One of the most dramatic collapses in the crypto industry has occurred regarding FTX and Alameda. This has affected the entire cryptocurrency market. In particular, trading companies entered a liquidity crisis with the increase in withdrawals on the platforms. There is a growing narrative that the private stocks of these companies could be in limbo. Here are the details…

FTX impacts the entire cryptocurrency space

As we reported on cryptokoin.com, Sam Bankman-Fried’s fortune fell from an estimated $16 billion to virtually zero overnight. His fortune reached $26 billion in March of this year. But everything collapsed after the FTX group filed for Chapter 11 bankruptcy last week. Bloomberg Billionaires Index, Bankman-Fried’s value; The US arm of FTX, which it owns about 70 percent, is now valued at $1 billion due to a possible trade from $8 billion in a fundraising round in January.

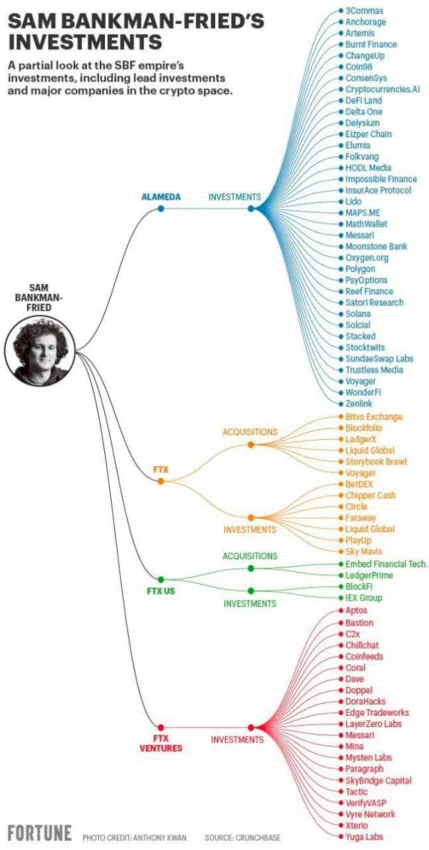

SBF has successfully raised billions to fund FTX. However, it should be noted that SBF’s reach in the crypto world is far beyond just FTX, Alameda and FTX.US. Given this fact, the spread of the crisis to the market in general is already expected. Given their exposure to FTX and Alameda, the firms listed below are at high risk. You can see the investments of SBF and its companies as follows:

Bloomberg: Echoes of FTX collapse continue to spread

Data from Crunchbase sheds some light on the different investments made by SBF and related companies. Overall, Alameda Research was responsible for 184 investments, FTX Ventures for 48 investments and the FTX exchange for 21 investments. A quick glance at such investments or even acquisitions may give readers some insight to be wary of exposed firms. FTX’s most recent investment was made on August 29 in blockchain gaming company Limit Break. The firm has raised $200 million from FTX and other investors such as Coinbase Ventures, Anthos Capital, SV Angel, and Shervin Pishevar. Limit Break is known for its DigiDaigaku NFT collection.

“Echoes of the collapse of the Sam Bankman-Fried empire continue to spread across financial markets,” Bloomberg wrote. “It threatens the future of crypto lenders like BlockFi.” Crypto lending platform BlockFi admitted to exposure to FTX on Nov.

There is a signal of potential financial distress

FTX and its venture capital arm, including trading firm Alameda Research, had made extensive investments. The Information reported on November 10 that SBF has invested more than $500 million in funds managed by Sequoia and other venture capital firms. But if these assets were held through Alameda, there is a fear of possible deletion. LayerZero Labs, the company behind interoperability protocol LayerZero, bought back its stake in FTX and Alameda just a day before filing for bankruptcy.

Mysten Labs, the firm behind the Sui Blockchain, raised ~$300 million led by FTX Ventures. Meanwhile, Aptos, a layer-1 blockchain platform, has closed $150 million in funding from FTX Ventures and Jump Crypto. One of the highlights here is Circle. In an interview last year, Circle raised $440 million by including FTX as an investor. However, Circle’s co-founder and CEO, Jeremy Allaire, denied all the allegations.

On the other hand, Paolo Ardoino, Chief Technology Officer (CTO) at crypto exchange Bitfinex and stablecoin issuer Tether, said that when asked by Blockchain journalist Colin Wu about Tether’s affiliation with FTX, they also made no disclosures. Overall, the extent of the collapse from the end of FTX/Alameda seems huge. FTX had only $900 million in liquid assets and $9 billion in debt the day before it went bankrupt.