Bitcoin price started to decline after the statements of US Treasury Secretary Janet Yellen yesterday evening. With the recent sell-off, analysts say it is ‘vital’ for BTC bulls to hold short-term support levels.

Michael van de Poppe reports that ‘critical support’ has been broken in Bitcoin price

The popular crypto analyst recently shared the scenarios that he will follow for the next few days in Bitcoin price. His predictions came after Bitcoin was rejected from the critical $27,500 resistance.

Van de Poppe was saying that the $27,000 support level is critical. However, the outlook changed when BTC broke this level sharply last night. As a result, Van de Poppe shared 2 new scenarios for crypto over the next few days.

#BItcoin lost crucial levels after rejecting at $27.5K.

I wanted it to hold $27K, it didn't.

Scenarios I'm watching;

– Sweep $25.8K for bullish div long play (perhaps $24.9K)

– Reclaim $26.6K or preferably $27.5K = long play for me as then we'll accelerate towards highs. pic.twitter.com/Buan5lzLwf— Michaël van de Poppe (@CryptoMichNL) May 24, 2023

The first scenario was that there would be a sweep towards $25,800, possibly even $24,900. If this scenario doesn’t happen, Poppe predicted that BTC would recover $26.6k or go up to $27.5k. He stated that if the latter plays, it will continue for a long time in BTC, as its price will “accelerate towards highs”.

Bitcoin’s ‘Ichimoku Cloud’ suggests a deeper drop towards $24,000

Elsewhere, according to technical analysis from Valkyrie Investments, Bitcoin’s ‘Ichimoku Cloud’ suggests further declines. According to Valkyrie, we may see another drop in Bitcoin price towards $24,000.

The chart below shows a green Ichimoku cloud and shows a constructive, broader view. However, Bitcoin price has recently returned to the cloud. Also, Tenkan-Sen (blue line) crossed below Kijun-Sen (red line), confirming the downtrend.

Analysts at Valkyrie said, “This shows a sustained high timeframe bullish trend with a drop in bullish momentum and potential for near-term savings. A price close to cloud means loss of cloud support. It also triggers the possibility of moving to the opposite [bottom] edge of the cloud. In this case, an End-to-End trade brings prices around $24,000,” he says.

“Bitcoin price will be between $160,000-180,000 by December 2023”

This ambitious prediction came from the technical analyst known on Twitter as TechDev. TechDev predicts that the Bitcoin price will reach between $160,000 and $180,000 by December 2023.

TechDev’s analysis shows that Bitcoin price evolves in cycles and has followed this price development pattern over the past three cycles. Using a chart that plots the Bitcoin daily price against the set daily period, the analyst shows that the interval between cycles is a 10.2-day period.

Update: #Bitcoin on adjusted log time

Time = log(weeks)^3.44

Next period meets curve at 160-180K December 2023.

Observation based on a sample of 2. pic.twitter.com/GH3zjEsdti

— TechDev (@TechDev_52) May 23, 2023

TechDev used this constant to match the spikes on the Bitcoin chart and combine both indicators to find an intersection. The analyst, as mentioned earlier, deduced the next target between December 2023, the intersection of the indicators, and the Bitcoin price between $160,000 and $180,000.

According to TechDev’s observation, the expected peak of the upcoming cycle will occur before the Bitcoin halving. The next Bitcoin halving coincides with April and May of 2024.

Jason Pizzino says Bitcoin price could rise in double digits

According to another technical analyst, Bitcoin price is facing a major resistance between $28,000 and $32,000. According to Pizzino, BTC could rise about 80% from the current price once it breaks the main resistance zone. According to his analysis in a recent interview with David Lin Report:

Breaking between $28,500 and $32,000, an important level for Bitcoin, could mean bears decline and bulls increase. Once we pass this level, the comments from people saying we should see lower levels will decrease. Once you get past this level, there won’t be much left for the bears. Their next target will be $48,000. Of course, all-time highs should also be considered.

Going forward, the crypto analyst adds that Bitcoin will have a more sustainable rally if the price appreciates in small incremental steps rather than large spikes.

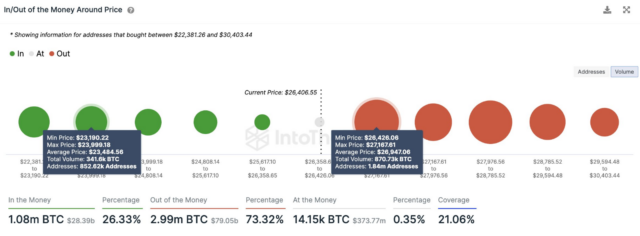

Ali Martinez says Bitcoin price is under siege

According to on-chain analyst Martinez, Bitcoin is currently experiencing a turbulent period. According to his analysis, Bitcoin points to a higher probability of a significant correction. It is also succumbing to bearish pressure from multiple key support levels.

https://twitter.com/ali_charts/status/1661373346527817729

Meanwhile, Bitcoin is facing an alarming situation, as stated in Martinez’s tweet. It looks like BTC is currently bearish in all major support areas.

Investors are pointing to a crucial demand wall with Bitcoin trajectory between $23,200 and $24,000. BTC will likely find support with new buyers from this level.

The analyst pointed out that within this critical region, 852,000 investors purchased approximately 341,000 BTC with an estimated value of $8.9 billion. This BTC accumulation on the demand wall signals significant interest and potential support. Thus making it a vital threshold to watch for market participants on the BTC chart.

This miner has collected all the block rewards in the last few hours single whale

In an interesting development, an anonymous BTC miner is collecting all the block rewards on its own. On the last day, the miner verified more than 10 Bitcoin blocks. Thus, it earned over 65 BTC worth over $1.7 million at spot rates.

The “anonymous” miner is speculated to be F2Pool. F2Pool is one of the oldest and largest mining pools in the world. Viewers show that F2Pool last mined late May 24.

As we reported as Kriptokoin.com, the introduction of the BRC-20 standard in the past weeks left the Bitcoin network in a difficult situation.