What about technical analysis for Bitcoin (BTC), which exhibits volatile price movements and cannot clearly determine its direction?

With the announcement of MicroStrategy that it bought BTC, the leader of cryptocurrencies, which shot $ 30,000, was finally rejected at the $ 29,500 resistance. BTC, which started to lose value with the dominance of sales-oriented transactions, is currently trading at $29,060. In addition, the fact that BTC exhibits volatile movements and cannot decide on its route not only spoils the technical outlook, but also greatly affects the liquidation data.

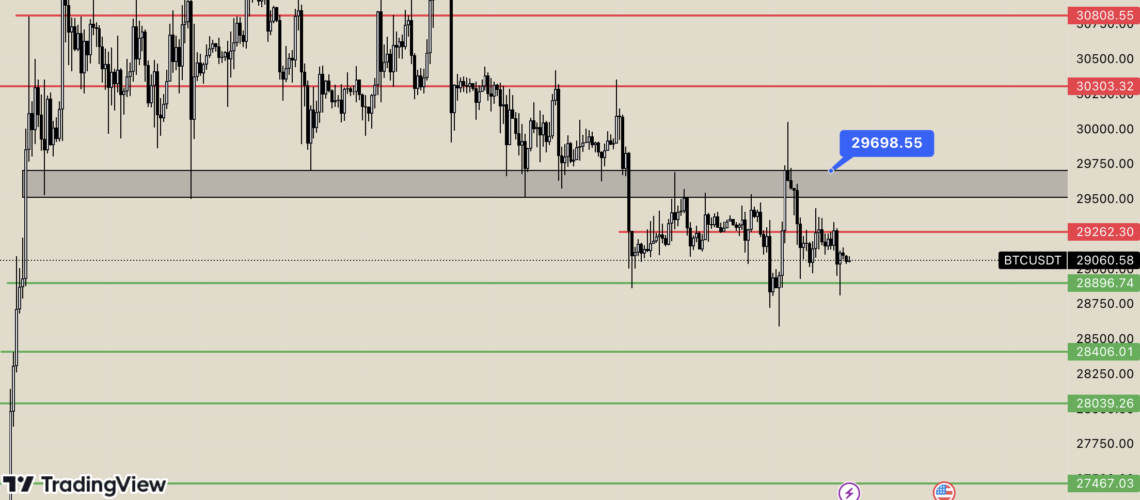

Bitcoin (BTC) chart rating

With the news of MicroStrategy, BTC, which was shot at $ 30,000 and withdrawn, came up to $ 29,060. In fact, the market leader, which hung up to $ 28,800 yesterday evening, created fear in investors. Although it has thrown it over the support again, it cannot be said that the risks on the BTC side are over.

Except for volatile and hard movements, BTC, which is traded in the range of $ 29,500 – $ 29,000, has not determined its route. The resistance levels that can be followed in the upward movements are 29,262 – 29.735 – 30,303 and 30,808 dollars, respectively. In particular, the persistence of over $30,000 could bring a spring mood to the market in terms of fundamental and technical analysis. In bearish situations, the levels where buyers are expected to play an active role are $28,896 – $28,406 – $28,039 and $27,467, respectively.