Vitalik Buterin, co-founder of the Ethereum network, recently spoke about the Ethereum Merge upgrade. Buterin said the merger could happen as early as August 2022 if no further issues arise. In fact, Ethereum has delayed the upgrade several times in the past. Now, however, Beacon, running parallel to the Ethereum mainnet, is ready to merge with the ETH Blockchain by transitioning to proof-of-stake.

Will Ethereum Merge turn into a disaster?

The community is discussing the chances of successful completion of the Ethereum Merge upgrade. However, the Beacon chain witnessed a “block refactoring” event in the last week of May, where the fork continued for seven consecutive blocks. According to data from Beacon Scan, seven blocks 3,887,075 to 3,887,081 came out of the Beacon chain.

This occurs when a block in the Chain is “off chain” due to a rival block. This refactoring in the beacon may have occurred in response to an attack by a high-resource miner or a bug. The refactoring may also have resulted in an unintentional fork or duplication of the Blockchain. This is one of the worst consequences of disabling a block. This event is significant as it has occurred in recent years. However, it is also important because it causes a short-term crisis of trust in the community. Supporters are speculating on whether the merger will be a disastrous event for the Ethereum Blockchain. Accordingly, legacy node clients were identified as the cause of the block restructuring experienced in Beacon last year.

Kraken optimistic that the merger will be successful

Kraken CEO Jesse Powell said that Ethereum developers and community are working consistently to complete the merger. He also added that he is not worried about delays. Advocates criticize the delays. Additionally, he sees them as a sign that the developer community is not up to the task. However, there are also those who argue that Ethereum transaction fees will only drop with the Merge upgrade.

As it is known, Rising transaction fees are causing institutional capital and projects to go to Blockchains like Solana, Cardano and Avalanche. This means that the Ethereum consolidation is a major event for those who believe in DeFi, Web3, and the Proof-of-Stake mechanism. Powell doesn’t mind the numerous delays in the Ethereum consolidation process. Instead, he argues that because of the importance of upgrading, success is more important than speed.

Ethereum Merge merger will lower transaction fees?

Ethereum aims to address high gas fee concerns in the community with its Merge upgrade. Merger will be an important impetus in this direction. This is because the network is moving from a very energy-consuming Proof-of-Work mechanism to an energy-efficient Proof-of-Stake mechanism. Experts, merger; The Ethereum Blockchain sees it as a primary step in reducing gas fees on layer-2 and sidechain networks. Ethereum layer-2 solutions such as Polygon, Optimism, Boba Network, Arbitrum One may be affected by the reduction in gas fees.

Layer-2 protocols are projects that process transactions independently. These complete more transactions per second with a lower gas fee and are then added to the Ethereum Blockchain. As Cryptokoin.com reported, the transition to Proof-of-Stake will reduce the need for Tier-2 projects. It will also enable the Ether Blockchain to process higher volume transactions at low cost.

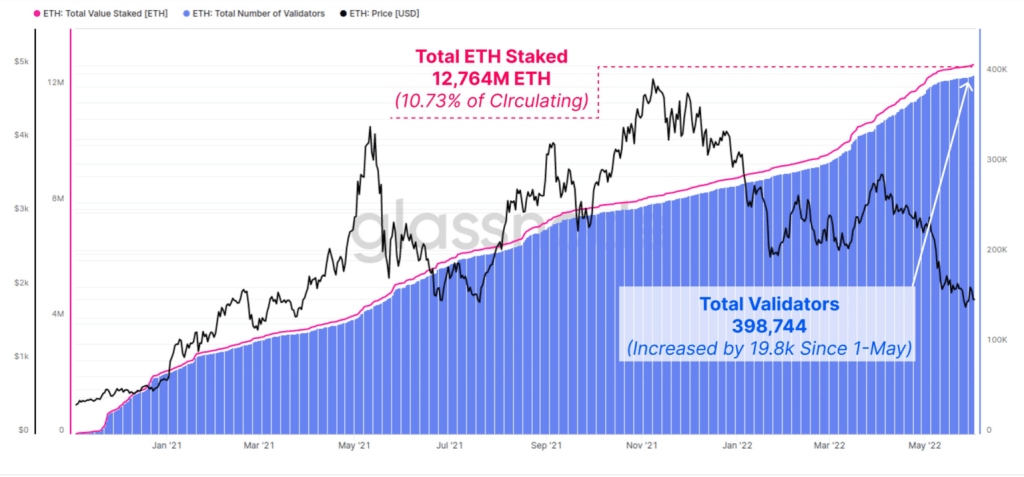

The amount of ETH staked in the ETH2 contract made ATH

10.73% of the circulating supply of ETH is in the ETH2 deposit contract. 398,000 individual validators staked an all-time high of 12.76 million ETH. Thus, the amount of Ethereum staked on the Beacon chain has reached another important milestone. This shows the enthusiasm of investors and market participants about Ethereum Merge.

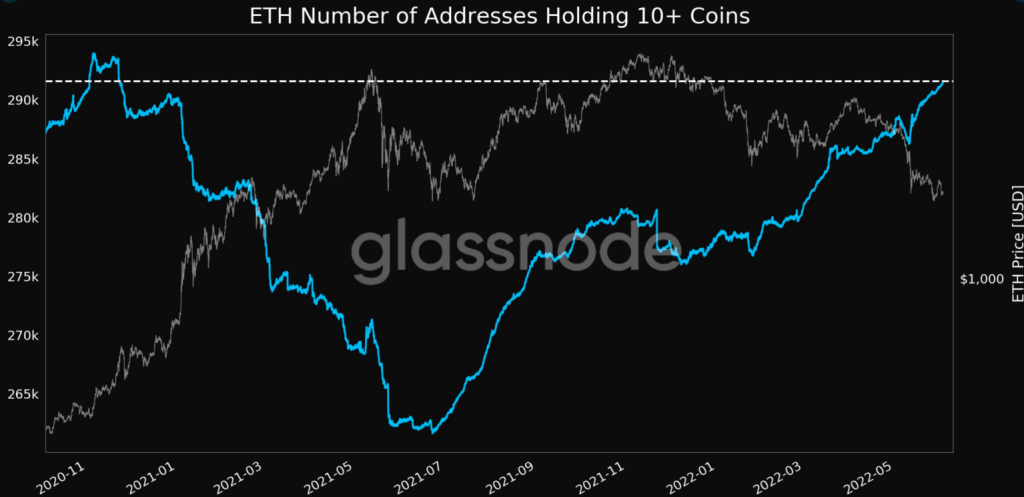

Ethereum holders continue to accumulate

Ethereum holders continued to accumulate ETH, the largest altcoin prior to the merger. According to crypto data platform Glassnode, the number of addresses holding at least 10 ETH has reached an 18-month high. Accordingly, the amount of ETH these addresses hold is around 291,608 in total. The fact that ETH holders continue to accumulate shows that they did not give up despite the downward trend in the market. 54% of ETH holders have witnessed massive gains in the past, which is seen as the main reason for hoarding the altcoin.

What will happen after Ethereum Merge upgrade?

Puff, a contributor to Iron Bank, a lending platform within the Ether Blockchain, spoke about the implications of the merger. Puff is among those who think that the upgrade will increase capacity in ETH:

“It would get us one step closer to the chains. Once the merger takes place, scalability in Ethereum will increase and the costs of capacity will decrease. We also anticipate that the upgrade will increase the availability of decentralized applications.”

Experts predict that Ethereum Merge upgrade will have effects such as higher usage of decentralized applications (dApps), high scalability and fast transaction processing. They also expect users to have a greater degree of control over their own assets, and they think that greater decentralization will increase participation in the Ethereum network. Layer-2 protocols, on the other hand, instead of losing their importance, will be a real catalyst for the potential of the Ethereum Blockchain. Tyler Perkins, zkSync’s CMO, argues that the merge will have no impact on layer-2 solutions:

Layer-2s will be the group most affected by the planned fragmentation after the merge. This is because the upgrade will increase the amount of data storage available to aggregates.

What do analysts predict about ETH price?

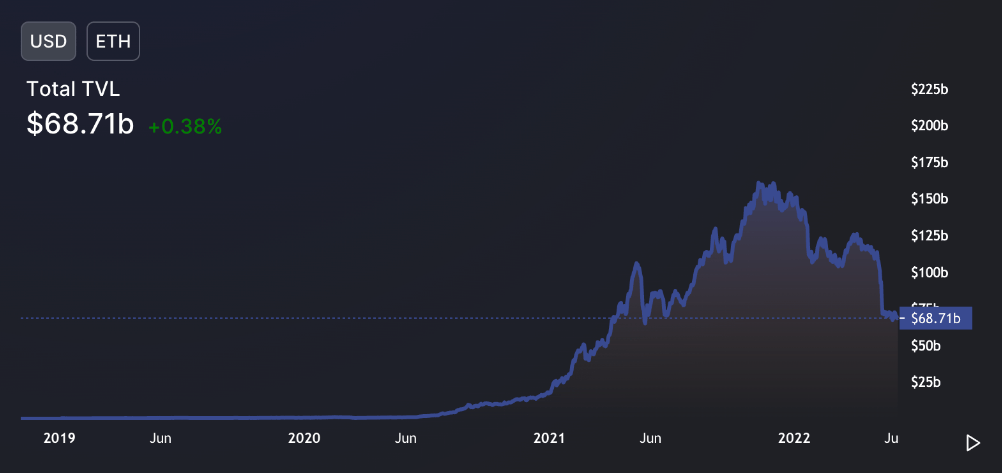

Based on on-chain activity and technical factors, it is possible for Ethereum to drop further in June. However, two key factors stand out that are likely to drive the altcoin’s price down. Experts say that Ethereum has lost most of the capital in the dApp ecosystem. Additionally, they predict that a burst in DeFi could push the Ethereum price higher. On June 5, the locked total value (TVL) in Ethereum hovers around $68.71 million, which is 65% of DeFi TVL.

The massive collapse of Terraform Lab’s tokens LUNA Classic and UST caused a massive pullback in Ethereum’s TVL. Before Terra’s collapse, Ethereum’s TVL was around $100 billion. Analysts say TVL may continue to decline in June.

The second important factor is the bearish indicators derived from the analysis of the Ethereum price chart. Ethereum price is inside a range defined by horizontal support and descending resistance line. The pattern denotes a descending triangle and analysts predict it indicates a bearish trend in price. Therefore, it is possible for ETH to continue falling.

The descending triangle pattern may cause the altcoin to drop below the support line. Then the pattern can be resolved after the price drops by the maximum height of the triangle. It is also possible for Ethereum price to drop below the lower trendline of the descending triangle. In this case, the altcoin seems to reach $1,350, losing 25% from the current levels in June.

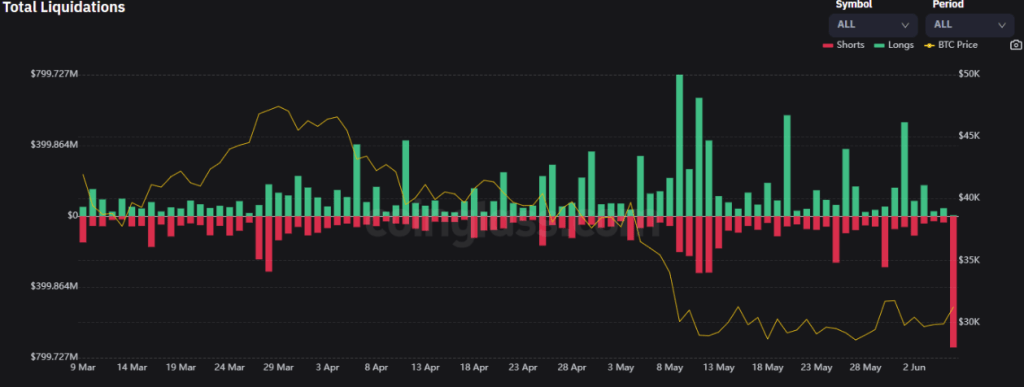

The altcoin has witnessed one of the biggest liquidations in the past few months. Accordingly, $800 million of assets left the Ethereum network. Therefore, ETH price is trending upwards in the short term. Such a large volume of liquidation caused a squeeze. Then, Ethereum price bounced from the $1,715 support to the $1,900 level. The total liquidation rate on Ethereum reveals that the bulls are controlling the market as 90% of orders placed are open positions.