There are decisions that will come from the USA again on the agenda of the markets.

– FED interest rate decision will be announced at 21:00

– FED Chairman Powell will make statements at 21:30

As we all know, the Fed’s interest rate policies directly affect the markets. So, let’s look at the direction of the interest rate decision expectations.

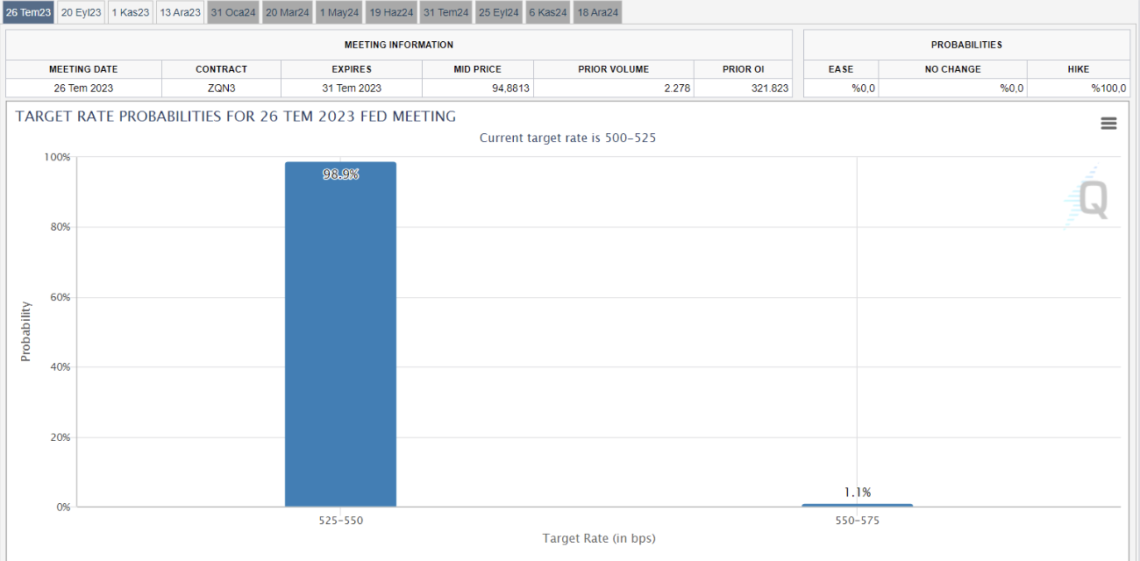

– Expected FED to Raise Rates by 25 Basis Points: 99.2%

– Expectation of FED to Raise Rate by 50 Base Points: 1.1%

As can be seen, there is an expectation that the FED will increase the interest rate by 25 basis points. In addition, since this is the expectation since last month, if the FED raises the interest rate by 25 basis points, the most important thing for us will be the statements Powell will make after the decision.

So what does Powell want?

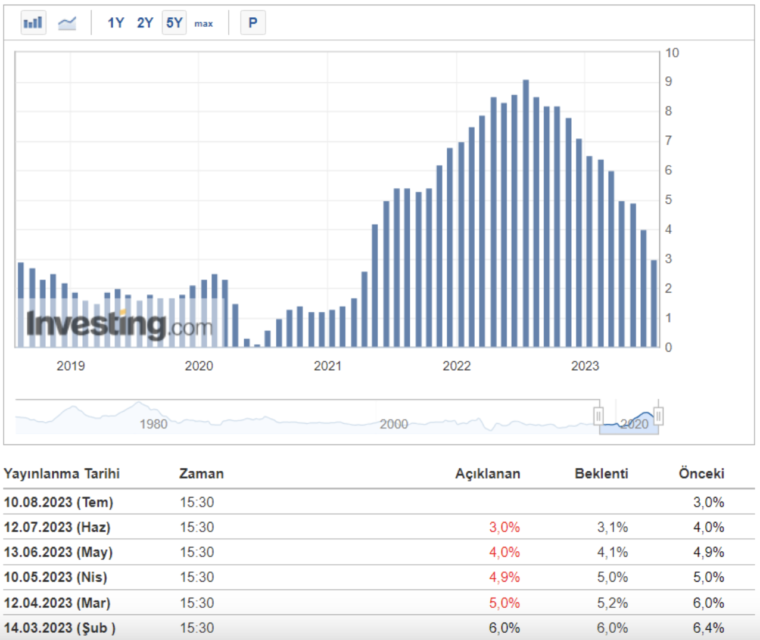

We know that Powell said that the US inflation should fall to the level of 2% and that they can take all kinds of measures until they see this rate.

The Consumer Price Index data, which was announced on 12.07.2023 and shows the state of inflation, was announced as 3%. We see that there are serious decreases in inflation especially in the last two months compared to other months.

In addition, as a result of the Core Inflation data, which is the main focus of the FED, and some economic data showing that the US economy has cooled, we can say that everything is going as Powell wanted. For this reason, we can expect him to speak a little more moderately at the press conference he will hold after the interest rate decision.

Let’s get to the crucial point. What will happen to Bitcoin, how should we act?

Bitcoin is currently in a downtrend. It is not good for BTC to be at these levels. We have to be cautious as it is in the risk zone. Therefore, it is healthier to be careful and act by considering both aspects compared to support and resistance.

BTC current price: $29,184. We have an intermediate support at $29,068 just around the corner. If it goes below this price or closes under 1 hour, it is possible to pull back to the next support ($28805).

The key area is $28,805. This is our key support price. If Bitcoin hangs below the intermediate support price and pushes this important support price, if the 2-hour candle closes below this price, I think that further declines will follow.

Key Resistance in Bitcoin: $29,605 and $29749. These prices are the area with heavy sellers. If there is a 4-hour close above the last price of $29,749, the declines may end for a short time. At the same time, BTC would be freed from the risk zone.

Bitcoin Search Support: $29068 STOP!

Bitcoin Major Support: $28805

Here are some things to consider when taking action:

As long as the support prices remain above, we can continue with a stop or try long.

We can try a stop or short if it hangs below the support or according to the closings.

The Fed rate decision will be announced at 21:00 in the evening. Please do not open a stop-free transaction despite the possibility that Bitcoin volatility may increase after the interest rate decision is announced.

In fact, especially those who open futures trades, be careful not to open trades before and after the interest rate decision, because we can see sharp movements up and down for liquidity.