The hottest agenda in the cryptocurrency world right now is the SEC’s lawsuit against Binance. Obviously, this issue is the reason for the decline in Bitcoin price. So, what will happen next? What are the expectations for BTC price? Let’s focus on our article.

Is the lawsuit a danger to Bitcoin?

Jeff Dorman, CEO of digital asset investment firm Arca, has positive thoughts. He thinks that the closing of the stock market will not affect the price much as a result of the Binance operations in the USA. Also, according to him, non-criminal accusations from the past did not affect Binance’s current international situation. Arca’s CEO is also looking at the market while expressing positive views for the crypto community CZ and Binance. Accordingly, a negative atmosphere prevails in the Bitcoin and crypto money market.

https://twitter.com/jdorman81/status/1665754975350435841

SEC accusations against Binance have little effect in the medium term. However, there are other factors as well, even if they have no effect at all. Uncertainties from Digital Currency Group (DCG), which filed for bankruptcy on January 19, and its subsidiary Genesis Capital, are creating a negative mood in the market. DCG CEO Barry Silbert pulled $1 billion from personal assets when cryptocurrency hedge fund Three Arrows Capital went into default, according to Jon Reiter, CEO of Data Finnovation and ChainArgos. It’s a coincidence. But it certainly draws more attention to intercompany loans and deals within DCG. Bitcoin will test the $25,000 resistance, a level not seen since March 17. We are at a stage where the US debt ceiling crisis is averted. Also, the probability of a surprise Bitcoin price rally seems even lower in the short term. Investors should be especially cautious if Bitcoin futures contract premiums turn negative or the costs of hedging increase using BTC options.

Bitcoin derivatives markets show mixed reaction

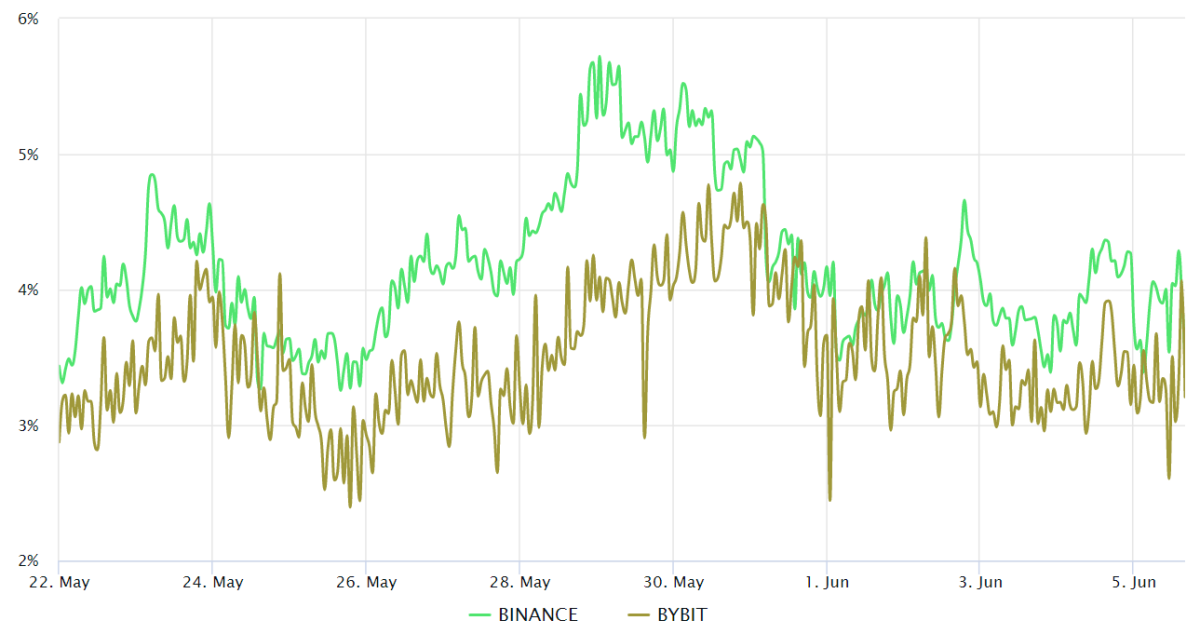

Bitcoin quarterly futures are popular with whales and arbitrage tables. However, these fixed monthly contracts often trade at a slight premium compared to the spot markets. Accordingly, this indicates that sellers are asking for more money to delay settlement. As a result, BTC futures contracts in healthy markets should trade at a premium of 5 to 10% per year. This is not unique to crypto markets.

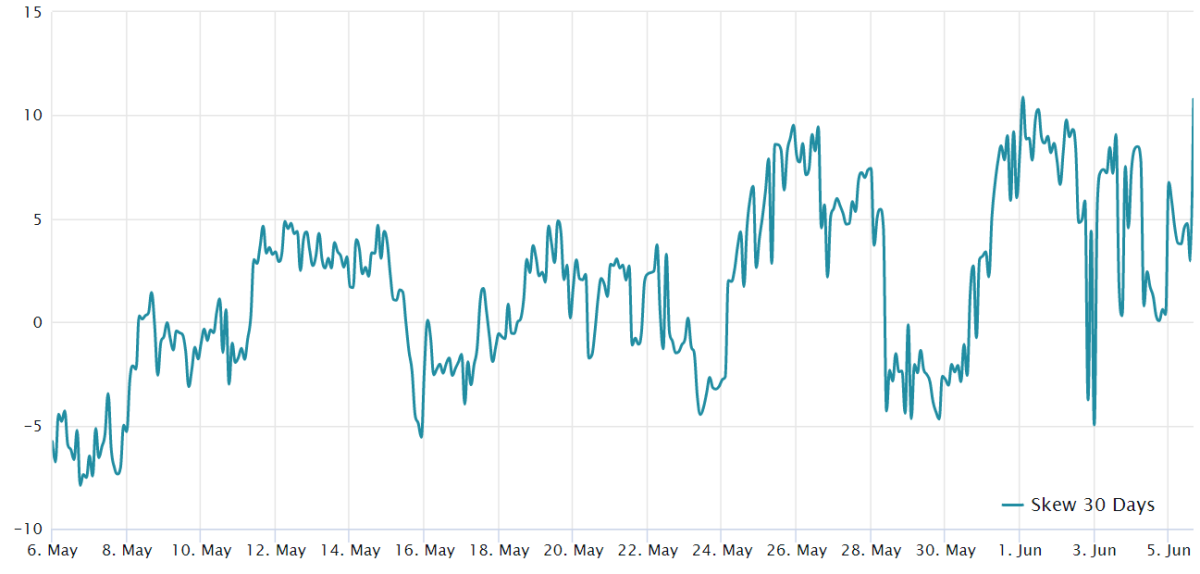

Bitcoin investors have been quite cautious since June 1, as the futures premium remains below 4%. On the other hand, the indicator remained at 3.5% after the SEC accusations against Binance surfaced on June 5th. Investors should also analyze the options markets to see if the recent correction has caused investors to be more optimistic. A delta skew of 25 is a sign of times when arbitrage tables and market makers charge excessive fees for upside or downside protection. In short, if investors are expecting a drop in Bitcoin price, the skewness metric will rise above 7%. Excitement stages tend to have a negative 7% skewness.

As shown above, traders abruptly fell as the indicator rose to 11% on June 5, relative to the 25% delta skewness of BTC options. This level is the highest in the last three months. It also points to the discomfort of investors.

Bearish trend continues as FUD reigns

In essence, the Bitcoin options and futures markets show that the bearish trend that started after the failed test of $31,000 on April 14 is continuing, but there has been no significant decline in the overall market structure. Still, it may be too soon to interpret the possible consequences of the SEC’s actions. It also takes months, if not years, for court decisions to be finalized. As a result, those betting on the Bitcoin bull run should adjust their expectations. Because investors hate uncertainty.

Until there is greater clarity on DCG-Genesis’ status and Binance’s operational capability in the more challenging US regulatory environment, there is less incentive for long-term buyers to step in and defend the crucial $25,000 support.

Whales are buying bottoms for Bitcoin

Whales are buying the bottom return strategy, as in the bull market and bank loan turmoil at the beginning of the year. Popular analyst Credible Crypto said that the SEC’s Binance lawsuit helped the BTC price hit the first target. He predicts that the Bitcoin price could only drop during forced liquidations, but if Bitcoin reclaims $27.5k we will continue on our way to all-time highs. Bitcoin will witness a squeeze and bullish reversal. However, there will be a bonus for buying more bearish dips. Started buying spot BTC as it hit target lows at $25.8k. The downside is limited to $20,000 and Bitcoin is not going any lower than that. Whales will try to buy at $25,000, and some have already started buying as the price hasn’t dropped below $25,000.

On the other hand, the pseudonymous analyst of InvestAnswers has a positive opinion in his comments. He says Bitcoin (BTC) and crypto markets could get a boost from the resumption of monetary easing. When we look at Kriptokoin.com, it emphasizes that global liquidity or the amount of money circulating in the system has historically been one of the best indicators for the movements of crypto markets. The analyst emphasizes that this trend may reverse as liquidity has dropped slightly over the past year. He also says he can support Bitcoin in the process. Finally, crypto analyst Ali Martinex said that Bitcoin has “the most important support level” between $26,360 and $27,160. According to Martinez’s observations, more than 2.36 million unique Bitcoin addresses have purchased more than 1 million Bitcoins in this price range. This data shows that a significant number of Bitcoin holders are buying their Bitcoins in this price range. It also shows that the price may be encouraged to avoid falling below this range.