Bitcoin (BTC) price is quietly climbing $30,000 as traders complain of market inactivity and uncertainty. The price predictions of 6 analysts for the coming weeks are as follows…

Michaël van de Poppe pinpoints $30,500 for Bitcoin price in the short term

The popular Twitter analyst with 655,700 followers said in his latest analysis that the market is in an overall recovery. Poppe says he is ready for moves where the leading crypto will exceed $30,000:

Bitcoin is constantly flipping levels and returning to the range. I’d rather see $28,900 held here, which continues towards $30,500.

Jason Pizzino says Bitcoin can’t stop right now: Target $32-42,000

Elsewhere, trader Jason Pizzino says that Bitcoin and the stock market ignore bad economic news. According to Pizzino, Bitcoin held its head above the waters despite the threat of recession and banking crashes.

In their latest analysis, “For about two months, Bitcoin has been trading above $25,000. With all the bad news we’ve seen in the markets, nothing is stopping Bitcoin from hitting $30,000, $40,000 and maybe even $50,000 this year…”

According to Pizzino, investors who expect to receive Bitcoin at a discounted price will likely not be able to do so. The analyst says that BTC surviving with multiple bearish signals earlier this year means it could soon find itself in the $32,000 to $42,000 range.

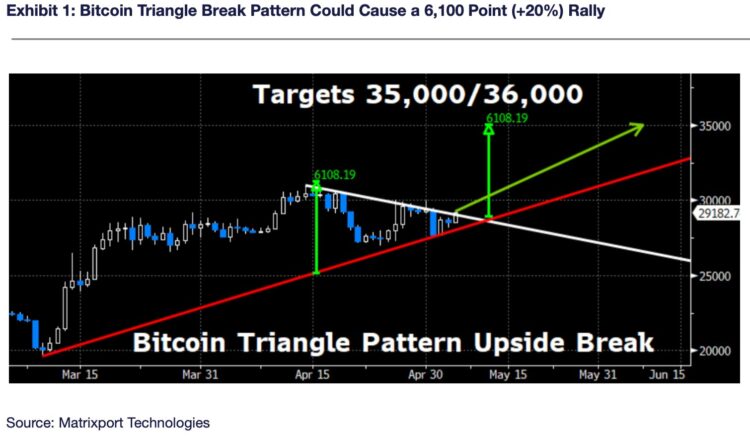

Matrixport analysts target $36,000 for Bitcoin price

According to Matrixport experts, Bitcoin is ready for a strong move for the coming weeks. The company projected a $36,000 target for Bitcoin based on a technical breakout that marked a strong rally amid a positive market outlook fueled by stock buybacks and meme coins.

Matrixport’s analysis shows that Bitcoin is currently trading within an upward contracting triangle. This move potentially suggests a move higher by about 6,100 points. This will push the price of Bitcoin to the projected $36,000 target.

Also, according to Matrixport, Bitcoin could see a significant price increase of up to 20% from current levels. This will set a target of $35,000 to $36,000 for Bitcoin due to the potential breakout in the market.

“BTC’s MVRV rate exceeds key threshold”

According to a recent analysis by CryptoQuant researcher “Onchained”, Bitcoin’s market cap-to-realization (MVRV) ratio in January 2023 shows a significant increase in its price, breaking level 1 on the upside.

Also, according to his analysis, MVRV is experiencing a trend change when it breaks the 365-day SMA. If the ratio breaks this moving average on an uptrend, the MVRV ratio typically changes direction to reach levels 2 to 3.75 or higher, indicating the start of a bull market.

Conversely, if the MVRV rate breaks the 365DSMA in a downtrend, the rate changes direction to reach lows of 1 or lower, indicating the start of a bear market. These patterns can be seen in the chart.

Onchained’s analysis revealed that when the MVRV ratio broke the 1.5 level, 365DSMA flattened out before changing direction. Currently, BTC appears to be experiencing this trend as the MVRV rate fluctuates in the range of 1.5 values. If Bitcoin breaks the $30,000 level, a rapid change in the MVRV rate is expected. We’ll probably see this shift to a range of values between 1.8 and 2.

Aurelien Ohayon (TAnalyst) predicted BTC will reach $200,000

Recent analyst TAnalyst updated his latest Bitcoin (BTC) observations on Twitter. The analyst predicts that BTC is heading towards a bull run. He is betting on the upcoming Bitcoin halving in April 2024.

According to the infographic shown in the tweet, he predicted that if BTC followed the same pattern in linear regression, it was likely to reach $200k by 2024.

#BTC BULL RUN STARTS. pic.twitter.com/V6R1M6bxf4

— AO (@AO_btc_analyst) May 4, 2023

Meanwhile, CoinShares executive Meltem Demirors says the Bitcoin price will depend on two main catalysts. We, as Kriptokoin.com, have included their recent statements this summer.