Whales sell Bitcoin as the market returns, parking these coins in 4 altcoin projects. Current data provided by Santiment reveal an interesting trend in the HODL behavior of whales.

Bitcoin selling whales are collecting these altcoins

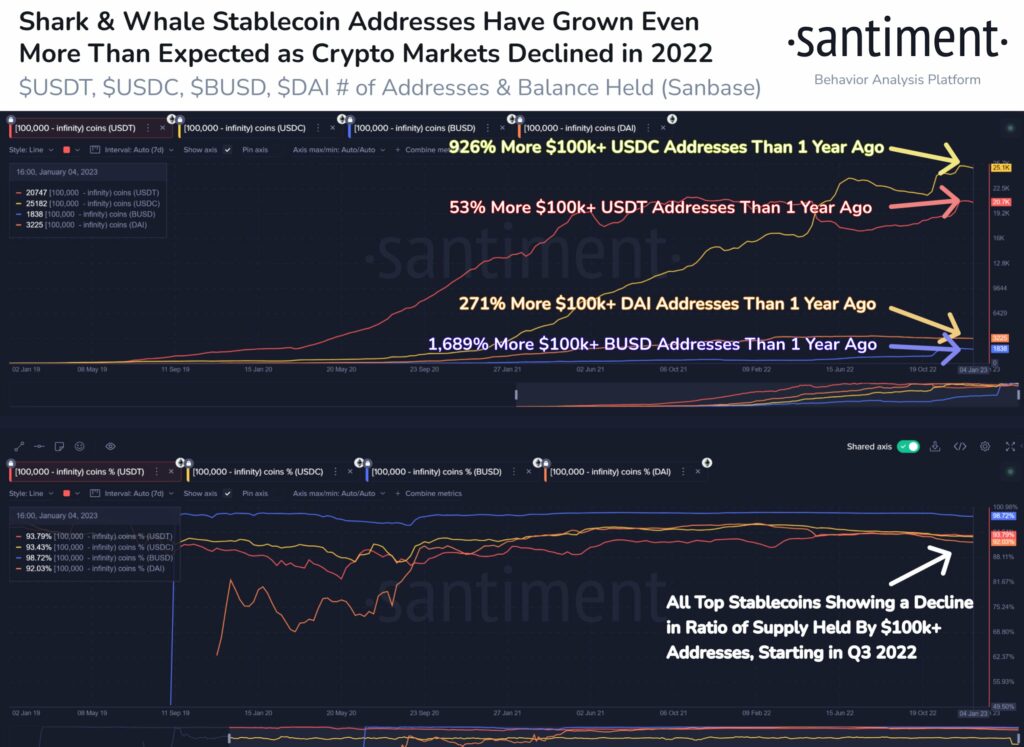

Crypto analytics platform Santiment has revealed that Bitcoin (BTC) whales’ gains in last year’s bull run have not been converted to fiat currencies. As the 2021 bull market ended, Bitcoin whales had turned their earnings into stablecoins, according to Santiment. Its analytics platform is now seeing a 53% year-over-year increase in the number of whales holding more than $100,000 in dollar-pegged cryptocurrencies. Santiment analysts summarize current whale behavior as follows:

It was no secret that Bitcoin whales were sold as the crypto markets retreated in 2022. But the 2021 profits are sitting in stablecoin wallets rather than being converted to fiat. As in the chart, USDT, USDC, DAI and BUSD exploded with new major addresses.

According to Santiment, the number of major Tether (USDT) addresses has increased by 53% in a year, while the number of Dai (DAI), USD Coin (USDC) and Binance USD (BUSD) addresses has increased by 53%. These stablecoins are up 271%, 926%, and 1.689% on the overall chart.

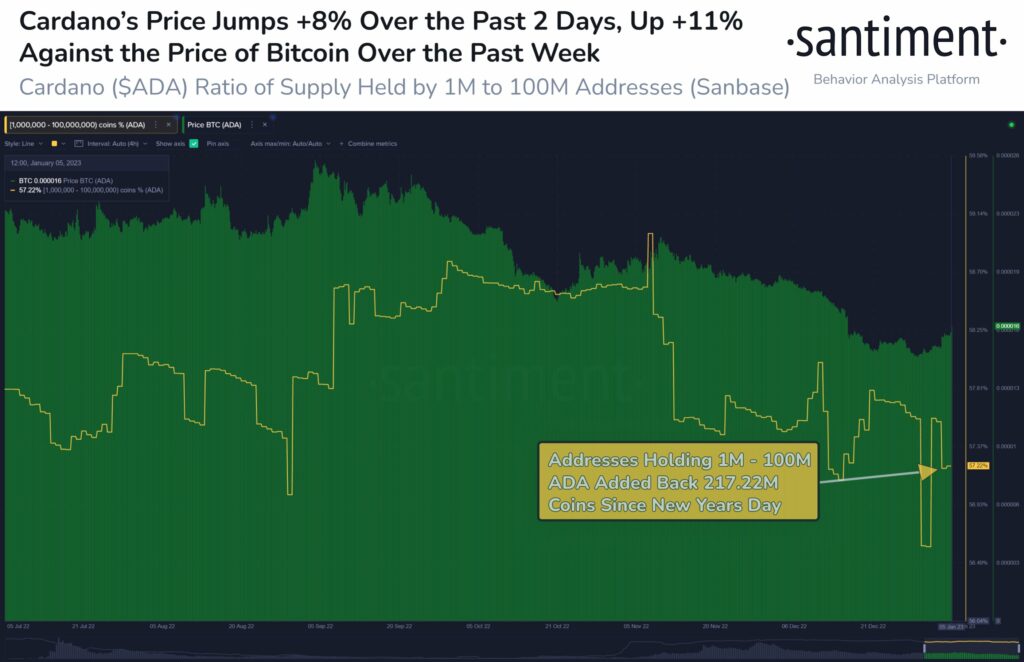

Cardano (ADA) among altcoins seeing heavy whale accumulation

Santiment reveals that Cardano (ADA) whales have purchased more than $60 million in ADA after they started selling them late last year:

Cardano is enjoying a small volatility at this hour, and addresses holding one million to 100 million ADA could be the main validator to watch for a price boom. After throwing 568.4 million tokens in the last two months of 2022, they added 217.2 million ADA to kick off 2023.

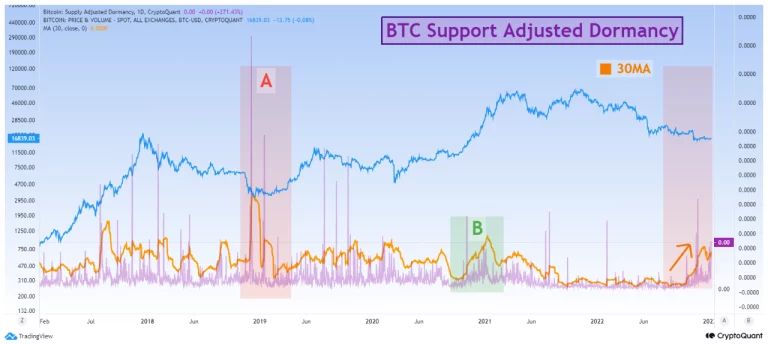

On-chain data points to dark days for Bitcoin investors

An assessment of two on-chain metrics revealed that Bitcoin investors may be facing a tough year. CryptoQuant analyst Gigisulivan says BTC marks a Stock-to-Flow Return below $16,700. The on-chain analyst had predicted that after the positive CPI data was released next week, BTC could try to move into the $20,000 to $22,000 range. However, the analyst concluded his words by stating that this shows that BTC investors should not expect much:

It’s just a thought given that 2023 could be worse than 2022 once we know what kind of recession we’re going through.

Another CryptoQuant analyst, Yonsei_dent, found that negative sentiment continues to rise as Bitcoin intensifies long-term investor distributions. Yonsei_dent evaluated BTC’s Support Adjusted Recession indicator and found that it has been in an uptrend since mid-December.

Commenting on the impact of the continued increase in BTC’s idle state in terms of market trend, Yonsei_dent evaluated the historical clues from BTC’s performance in the 2018 bear market and found that it indicates an increase in sales to hedge against further losses in investments.

As you follow on Kriptokoin.com, Bitcoin (BTC) is about to exceed $ 17,000 again after a series of attempts since December 14. Some analysts think it can break through from this level.