The price of the popular altcoin Cardano is hovering well above the recent drop marking the potential bottom. According to one analyst, this recovery, while impressive, is likely to be limited due to multiple hurdles and on-chain drop metrics. Here is analyst Akash Girimath’s analysis of Cardano (ADA)…

Cardano price needs to prove its worth

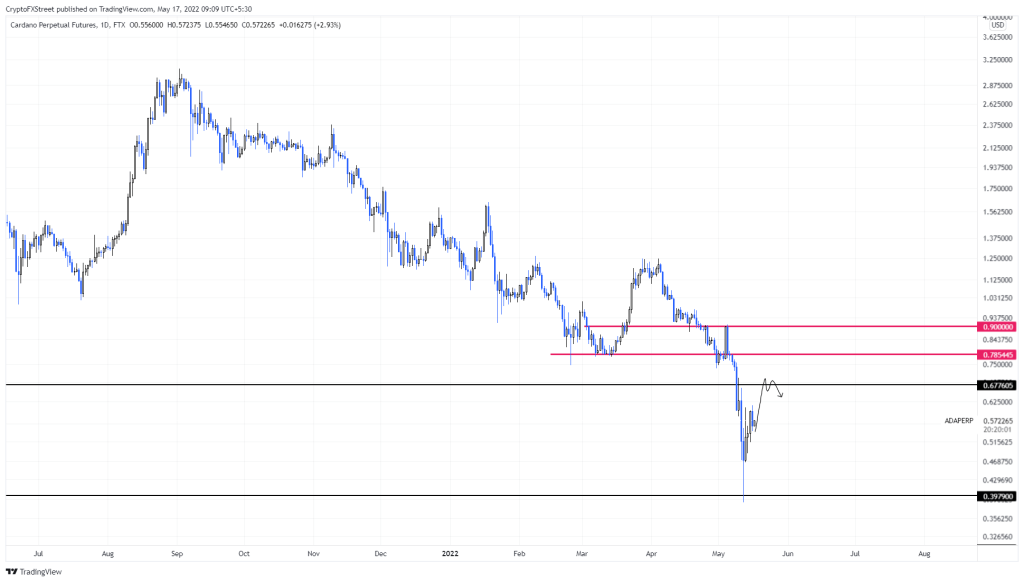

Cardano price has dropped 57 percent from May 6 and 87 percent from its all-time high of $3.11 . The last leg of this massive decline was caused by the UST-LUNA debacle that crashed the market. The recent bearish move seems to stabilize after tagging the $0.397 bottom as support. Since then, Cardano price has rallied 47 percent to the point where it is currently trading – surging to $0.55. While this move is impressive, further uptrends are unlikely due to the hurdles ahead, according to one analyst.

The immediate resistance barrier at $0.677 could be the local high for Cardano price and is where the upside border could be closed according to Girimath. Beyond this barrier, $0.785 and $0.900 are cited as two key hurdles that could stall the bullish momentum.

Whale behavior raises concerns for altcoin

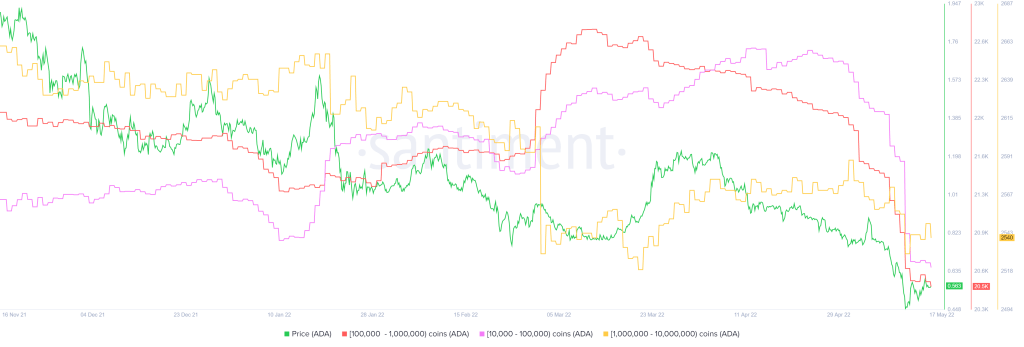

Further supporting the Cardano price downtrend is the behavior of whales as seen in the supply distribution chart. The group of investors with assets between 10,000 and 100,000 ADA has been dumping their holdings since April 10. This category fell from about 22,500 to 20,500, marking an 8.8 percent decline. The same trend was observed in whales holding between 100,000 and 1,000,000 ADA tokens. These investors jumped from 127,600 to 121,500, representing a 4.7 percent drop.

The number of massive investors holding between 1 million and 10 million ADA tokens has dropped from 2,589 to 2,540 over the past two weeks. Regardless of the number of tokens they hold, whales have been on sale for some time now. A daily candlestick near $0.397 will likely produce a lower low, invalidating the already unsound bullish argument. “In such a case, ADA could drop another 22 percent to $0.307,” Girimath says.