Altcoin Uniswap (UNI) dropped to a yearly low of $3.7 on June 10. It has since witnessed a remarkable 40% price increase. The surge in development activities on the Uniswap network has caught the attention of whale investors. The highly anticipated “V4 Upgrade” aims to enhance the platform’s capabilities. It also promises to reduce transaction costs. UNI holders expect future earnings. So what’s the effect of upgrading here? Let’s look at the details.

Rise in Altcoin Uniswap (UNI) price and increase in development activity

Uniswap (UNI) has experienced an impressive 40% price recovery since hitting its 2023 low of $3.7 on June 10. This revival can be attributed to the increased development activity observed in the Uniswap network, which has attracted whale investors’ attention in recent weeks. The question on everyone’s mind is how the altcoin UNI price will react in the coming weeks.

On June 13, Uniswap announced the highly anticipated “V4 Upgrade,” a network enhancement designed to reduce transaction costs and introduce new features such as the automatic combination of on-chain limit orders and liquidity provider (LP) incentives. This significant development has caught the attention of institutional investors, especially as centralized exchanges grapple with regulatory challenges. When we look at Kriptokoin.com, the timing of the upgrade really couldn’t be more appropriate.

Increased development activity and positive signals from whales

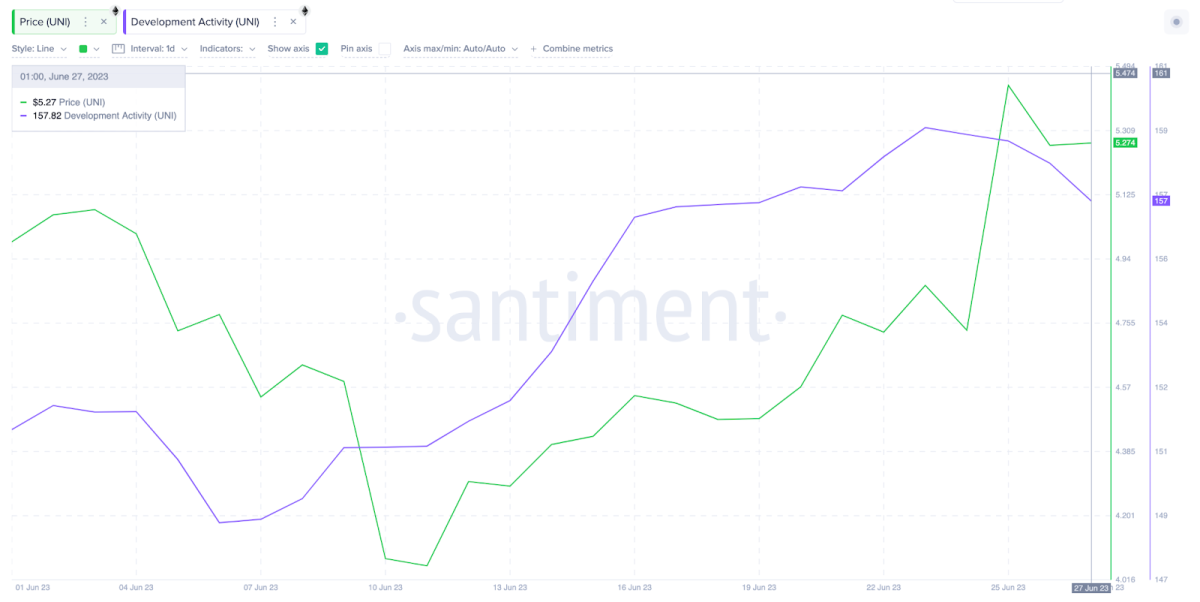

The on-chain data compiled by Santiment points to a significant improvement. Accordingly, this month reveals a significant increase in developer activity on the Uniswap network. Uniswap’s development activity increased by over 9% from June 6 to June 28. This increase indicates attention and resources to develop the network. It also instills confidence in investors in the long-term viability of the network.

On the other hand, historical data shows a close correlation between altcoin UNI price trends and development activity fluctuations. If this situation continues, UNI holders can expect more earnings in the coming weeks.

Institutional interest and UNI price outlook

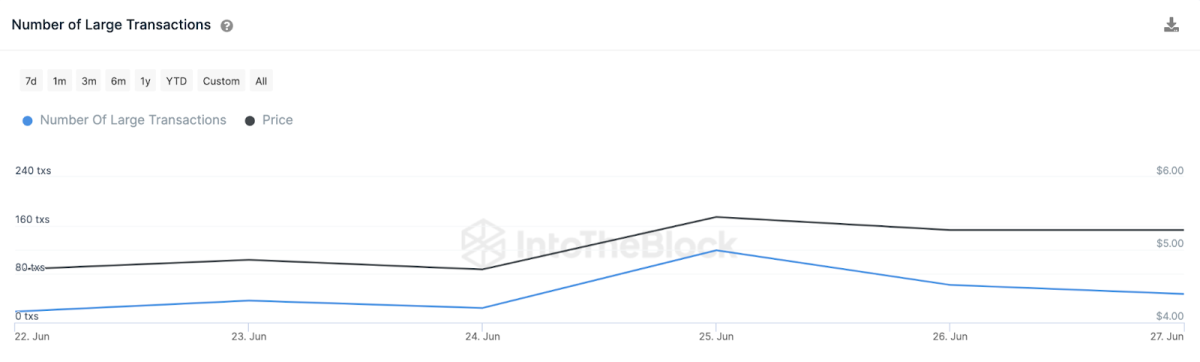

On June 25, Uniswap recorded over 119 whale transactions, the highest number in the last five months. This indicates that the new features introduced with the Uniswap ‘V4’ update are attracting the attention of major institutional investors. Also, according to Santiment’s chart, altcoin UNI Whale Transactions rose 160% from June 22-27.

The fact that whales show interest in an altcoin indicates increased confidence in the viability of the project. In addition, individual investors will follow this situation by taking long positions. The combination of increased development activity and bullish sentiment among altcoin UNI whale owners will potentially trigger further price spikes.

Altcoin UNI price prediction and resistance levels

Considering the factors mentioned above, bullish trends are targeting a price of $6 for the altcoin UNI. However, before reaching this milestone, the bulls need to surpass the $5.50 resistance zone. This area includes 26,080 investors who purchased 5.76 million UNI tokens for a minimum price of $5.53. Accordingly, if the bullish momentum continues, Uniswap’s price could rise towards the $6 target.

However, if UNI breaks below $4.5, the bears could reverse the bullish price prediction. In such a scenario, significant support is expected from 24,480 investors who purchased 2.81 million Uniswap tokens at an average price of $4.49. Accordingly, exceeding this support level may lead to a pullback of the altcoin UNI towards the dollar.