Litecoin holders are ecstatic as the halving event unfolds. Investors have been accumulating the crypto industry’s so-called “silver Bitcoin” over the past month. Litecoin’s official Twitter account tweeted that the halving is less than 2000 blocks away as of July 30. The highly anticipated event will reduce the block rewards from 12.5 LTC to 6.25 LTC. Here are the details…

Whales buy from “Silver Bitcoin” asset

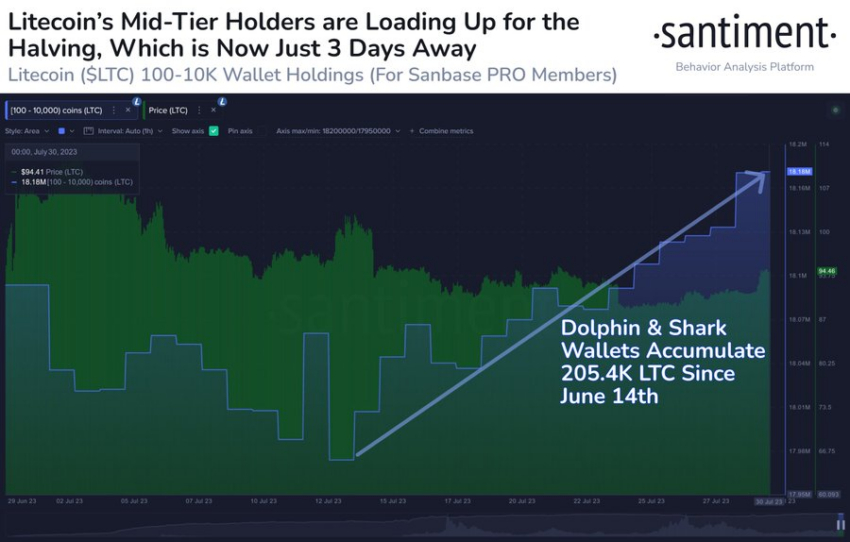

Santiment’s on-chain data has revealed the moves of medium-sized Litecoin whales. Addresses holding 100 to 10,000 LTC according to the data platform have purchased 205,400 LTC since June 14. The firm attributed the “aggressive accumulation” of this community to the halving event. As of writing, the total assets of these wallets have reached 18.18 million LTC, worth approximately $1.7 billion. According to Santiment, crypto investors tend to perceive most coin halvings as bullish events for the market.

Meanwhile, a previous report confirms the above data. According to the report, Litecoin miners stock their reserves by adding 400,000 LTC between July 1 and July 28. The current positive sentiment surrounding Litecoin has also boosted its price. LTC has gained 4.34 percent in the last 24 hours, trading at $95 at the time of writing. This is a clear departure from its early-July performance, when it dropped over $100. Litecoin surged in June when it was listed by EDX Market as one of the four cryptocurrencies its platform supports. However, its price started to decline in early July after reaching $113.

Halving is approaching: What’s next?

With the halving approaching, the price of LTC has soared by 3.2 percent over the past five days to its current price from the low of $89 recorded on July 25. Additionally, the trading volume of LTC also increased significantly over the period. According to the data, crypto-asset trading volume has increased by nearly 150 percent in the last 24 hours, reaching over $1 billion. That’s well above the $395 million recorded on July 29.