Bitcoin price has reached an interesting point in its journey over the past three weeks. After breaking through a major resistance, BTC continued to rise but has pulled back over the past three days. Despite the recent decline, the uptrend is likely to continue, according to analyst Akash Girimath.

Bitcoin price prepares for two important levels

Bitcoin fell 10% between April 5 and 7 and retraced to $42,714. This decline poses no threat due to the support cluster that ranges from $42,000 to $40,000, according to the analyst. Therefore, the downside pressure is capped above the demand zone stretching from $40,900 to $42,316. As for the increase, Bitcoin price needs to retrace the yearly opening at $46,198 for any chance of a rise. If

exceeds $46,198, Bitcoin could see a buy move to retest the 200-day SMA at $48,249. Should it break through this hurdle, it will not be possible in a single move to overcome the psychological level of $50,000 as the area will be a strong resistance. However, a massive increase in buying pressure causing BTC to make a decisive close above this crucial level could pave the way for more gains. Investors can expect the $52,000 barrier to be the last and hard line of resistance for the bulls.

BTC on-chain analysis

IntoTheBlock’s GIOM model shows resistance rising from $45,235 to $50,491. Interestingly, this area contains the technically predicted 200-day SMA and $50,000.

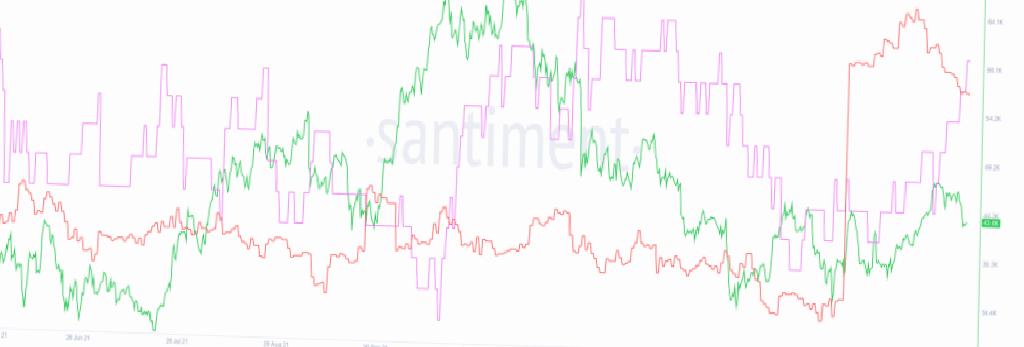

The supply distribution of whales holding 1,000 to 100,000 BTC shows a massive backlog since June 2021. More recently, wallets holding between 1,000 and 10,000 BTC have increased from 2,034 to 2,166.

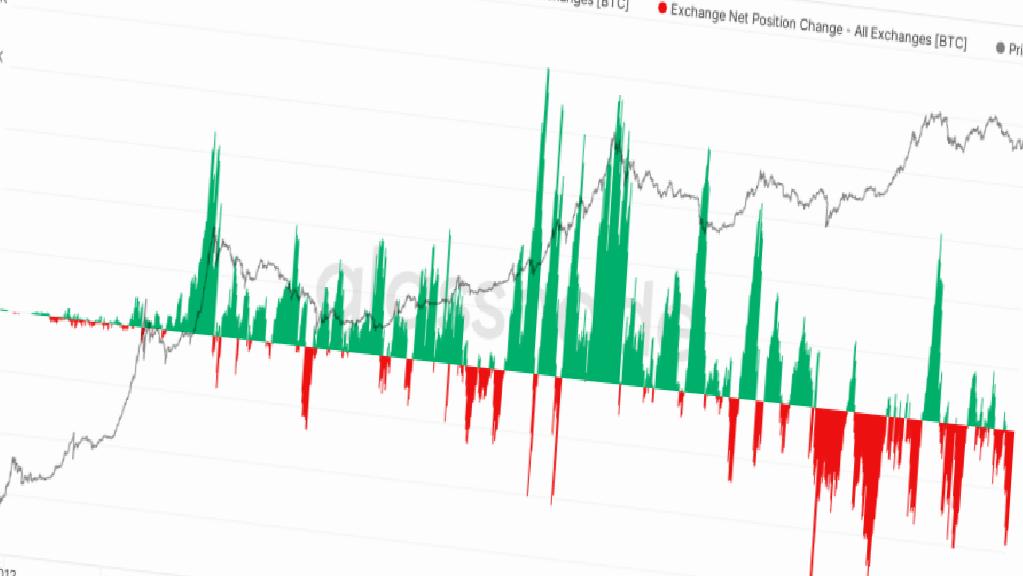

Finally, the amount of BTC released from centralized exchanges has reached nearly 100,000 BTC since March 7th. Such a massive outflow has occurred five times in BTC history, and the most recent is the sixth such transfer.

Result

According to Akash Girimath, whose analysis we shared as Kriptokoin.com, if Bitcoin produces a daily candlestick near $40,490, it will reflect the demand region and therefore the bullish thesis. will invalidate. Such a development could send the massive crypto crash to the next support level at $34,752. In the extremely bearish situation, breaking this foothold could cause the Bitcoin price to drop to $30,000.