There were very active days in the cryptocurrency markets last week. The lawsuits filed against Binance by the CFTC and SEC in America have been troubling investors for a long time. On November 21, the US Department of Justice announced that it would hold a press conference. When the time reached 23.30, we all took our places in front of the screen with curiosity. Treasury Secretary Janet Yellen stated that Binance facilitated fund flows to terrorist organizations, Changpeng Zhao accepted the accusations and Binance was fined $4.3 billion. Then, Binance CEO announced that he was stepping down and would now continue his life as a consultant.

CZ also underlined that investor funds are safe and that they never manipulate the market. After the sentence is imposed, the question that comes to mind is what will happen next. Continuing where it left off with its new CEO Richard Teng, Binance is the cryptocurrency exchange with the largest market share. It is clear that the aim is to reduce Binance’s market share before a possible spot Bitcoin ETF approval. CZ for crypto development has taken a step back and the next big FUD is no longer on our agenda.

This week, on the macro side, our eyes will be on America and we will get the Core Personal Consumption Expenditures data, which is the inflation indicator followed by the Fed. Additionally, we will follow the speeches of many FOMC members and Fed Chairman Powell and examine their views on the December meeting, interest rate decision and inflation.

Wednesday, November 29

USA – Gross Domestic Product (GDP) (Quarterly) Expectation: 4.9 percent Previous: 2.1 percent – 16.30

Thursday, November 30

EUR Region – Consumer Price Index (CPI) (Annual) Expectation: 2.8 percent Previous: 2.9 percent – 13.00

USA – Applications for Unemployment Benefits Expectation: 218k Previous: 209k – 16.30

USA – Core Personal Consumption Expenditures Price Index (Annual) Expectation: 3.9 percent Previous: 3.7 percent – 16.30

Friday, December 1

USA – Fed Chairman Powell will make a speech – 19.00

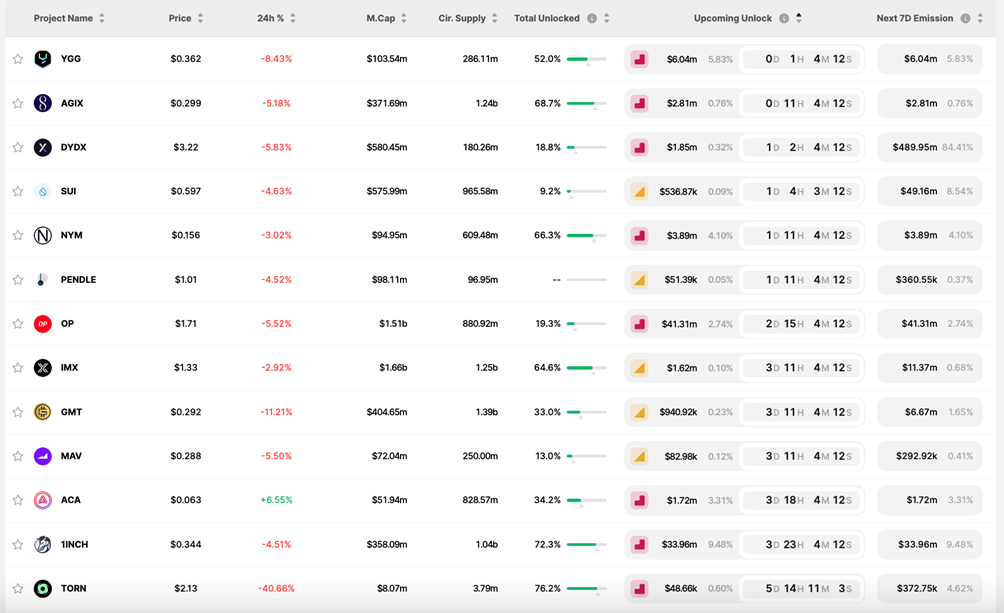

Unlocks According to Token Unlocks Data

Attention should be paid to DYDX, SUI, OP, 1INCH lock openings.