Axie Infinity (AXS) is one of the most popular metaverse coin projects on the market. According to analysts, AXS price is facing deeper losses despite a 90% drop. An AXS technical setup, on the other hand, predicts a 2,500% price rally for an indefinite period of time.

How does the system of the Metaverse coin project work?

Axie Infinity (AXS) is down nearly 90% after hitting $172 in November 2021. The sharp correction of AXS has made it one of the worst performers among the top-ranked cryptocurrencies. It could also see further declines in the coming months, according to a mix of technical and fundamental catalysts listed below.

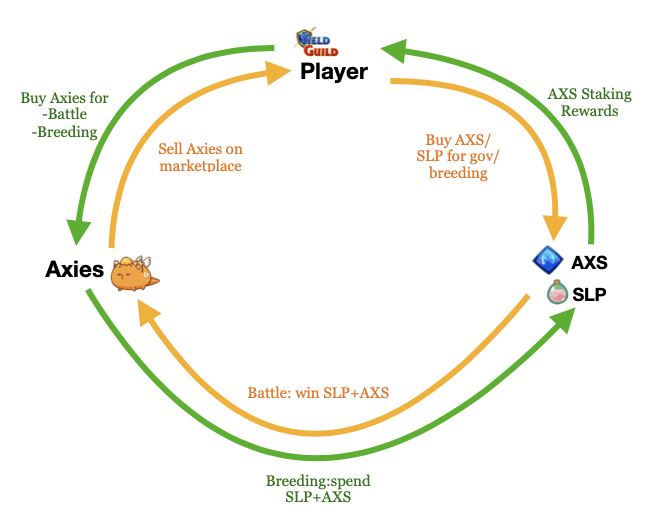

To summarize, AXS serves as a settlement token in Axie Infinity’s gaming ecosystem. It allows players to purchase NFT, a digital pet called ‘Axies’. It also serves as a business token that players can spend to create new ‘Axies’.

New users entering the Axie Infinity ecosystem need Axies to put them in a battle against other Axies. When they win, the platform rewards them with another native token called the Smooth Love Potion (SLP). In addition, larger tournaments give them AXS when they win.

Axie Infinity’s schematic / Source: Decentralised

Axie Infinity’s schematic / Source: Decentralised Low player count reduces AXS demand

As a result, former Axie Infinity players have been recruiting new ones to keep Axies demand. trusts. Otherwise, it is possible for former players to sell their SLP and AXS earnings in the markets, putting downward pressure on their rates.

However, when the values of Axie Infinity’s native tokens drop, the color of the job changes. Because it makes the game less attractive to new players who have to pay Axies to earn lower value SLP and AXS units.

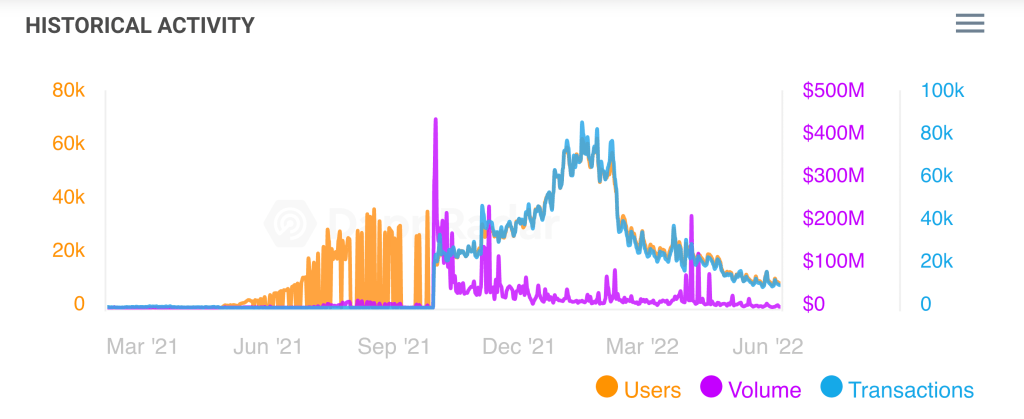

According to data provided by Dapp Radar, the Axie Infinity ecosystem went through phases in 2022, as mentioned above. In addition, the number of players dropped from 63,240 in January to 8,950 in June. According to data provided by Dapp Radar, there is an almost 85% drop. Interestingly, this coincides with the 80% price drop of AXS over the same period.

Axie Infinity stats since March 2021. Source: Dapp Radar

Axie Infinity stats since March 2021. Source: Dapp Radar At the same time, measured in-platform volume dropped after evaluating Axie Infinity’s Ronin Chain data. Volume was $300 million in September 2021, compared to just $2.12 million in June 2022.

At the same time, the senior managers of the project made some changes. In their August 2021 post from the new head of product, they quietly changed their ‘play-to-earn’-win’ mission statement to ‘play and earn’. He also said, “Axie Infinity should be a game first.”

Inflation is accelerating, risky assets are in danger!

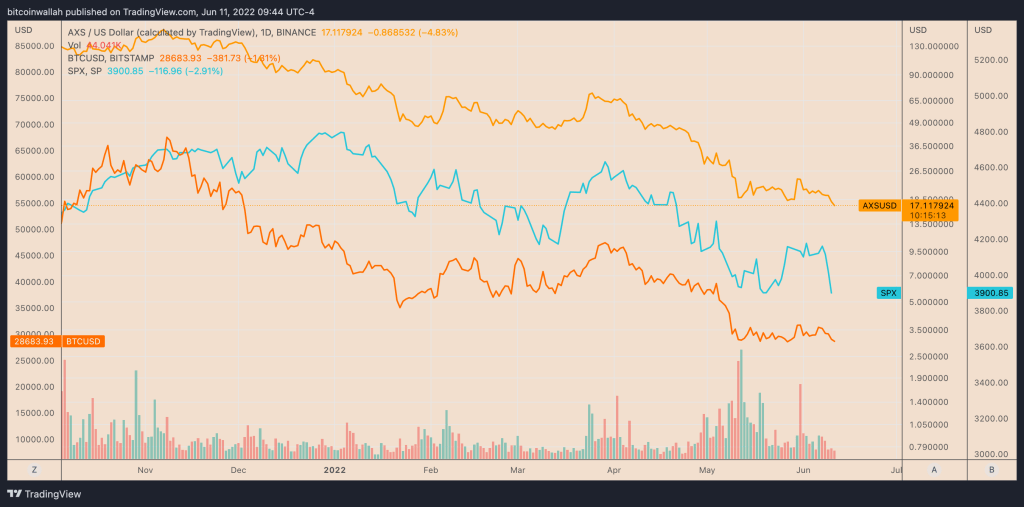

New inflation data further dampened bullish sentiments across top-ranked cryptocurrencies. This in one way or another strengthens the bearish bias of AXS. Notably, the US consumer price index (CPI) rose 8.6% year-on-year in May compared to 8.3% the previous month. Investors fear that the Federal Reserve will have to aggressively raise interest rates in the coming months. So This in turn will push the riskier assets down.

SPX daily price chart against AXS and BTC / Source: TradingView

SPX daily price chart against AXS and BTC / Source: TradingView Kriptokoin.com, AXS fell 7.5% after the report was published on June 10. Additionally, it fell another 7% on June 11 to a three-week low of $16.79. There is an expectation of lower cash liquidity, led by the Fed’s hawkish policies. According to experts, this means more losses for the AXS token.

“Metaverse coin price dropped below key support”

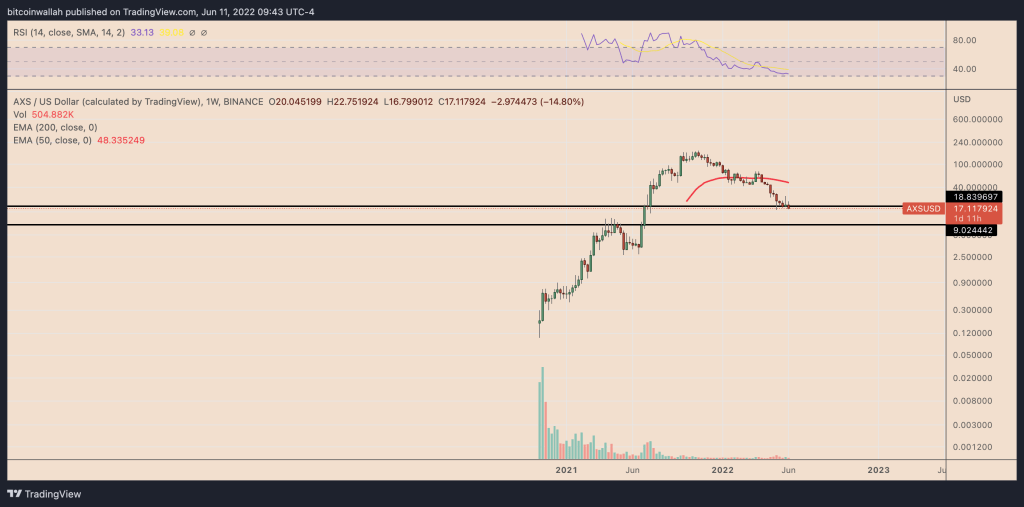

Crypto analyst Yashu Gola states that the multiplicity of negative fundamentals sent AXS below a key support level. Yashu Gola continues his analysis in the following direction.

This is also likely to lead to prolonged downward movements in the coming weeks. AXS broke below the $18-19 support range this week. This has been instrumental in limiting its downward attempts since the beginning of May. Also, support followed a bull run of around 800% from July 2021 to November 2021.

AXS weekly price chart / Source: TradingView

Now, the path of least resistance for AXS is approximately the next downside target through September 2022. 9 dollars. This means more than 50% reduction from its current price. Notably, the $9 level acted as resistance during the April-June 2021 session.

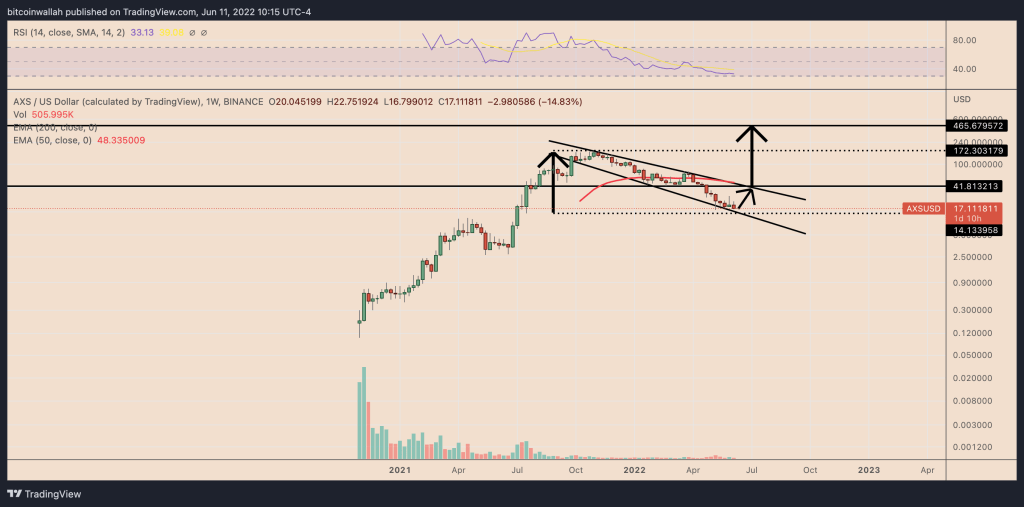

Conversely, a bullish sign comes from the potential ‘descending widening wedge’ (DBW) pattern on AXS’ weekly timeframe. This is confirmed by the coin’s fluctuation between two different, falling trend lines.

Traditional analysts look at DBW as a rule of thumb for technical analysis. According to analysts, the price unravels after breaking above the upper trendline of the structure. A bullish reversal pattern then occurs, rising by the pattern’s maximum height as shown in the chart below.

Weekly price chart with AXS ‘descending widening wedge’ setup. Source: TradingView

On the other hand, if the pattern is confirmed, AXS will rally towards $465 in an indefinite time frame. That’s a roughly 2,500% increase from today’s price.