US cryptocurrency miner Marathon Digital reported a roughly $192 million loss in its second-quarter report. The firm’s loss is largely due to the sharp drop in Bitcoin price. The miner says he can sell more to cover the costs.

Cryptocurrency miner reports $192 million net loss in Q2

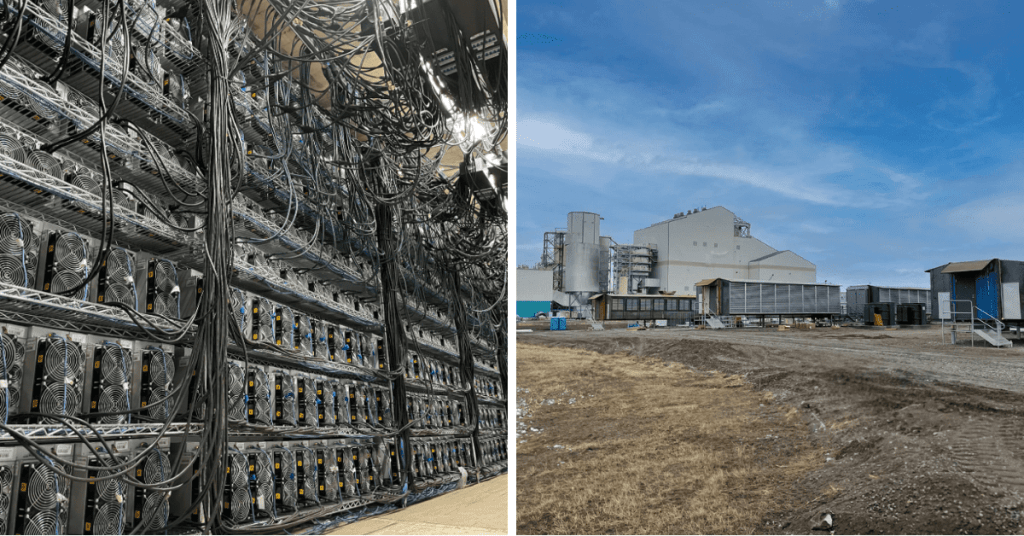

The company’s net loss in the second quarter of 2021 was $109 million. The Terra event in 2022 and the sales triggered by the subsequent bankruptcies put miners in a difficult position. In June, a heavy storm in Montana, USA, hindered Marathon Digital’s mining operations. The US miner was unable to operate more than 30,000 mining devices due to natural events.

Due to power supply delays in Texas and concerns about maintenance and weather affecting power generation facilities in Montana, Marathon generated 707 Bitcoins in the second quarter, down 44% from the previous quarter.

How bad is the situation?

On Monday’s company’s earnings call, Marathon Digital CEO Fred Thiel noted that “the second quarter has been tough for the industry in general and Marathon in particular.” Thiel also gave reassuring statements that the situation is temporary:

Bitcoin mining is a new industry and there is no established strategy. But looking at our progress, we are optimistic that we are on track to strengthen our position as the market leader.

Marathon may sell a portion of its monthly Bitcoin production

Marathon holds 10,127 Bitcoins (BTC) worth approximately $236 million as of July 31. From the beginning of 2022 to the end of July, it generated 2038 BTC. Due to more than 30 thousand idle mining equipment as a result of natural events, its production was only 707 BTC in the 2nd quarter of 2022. Marathon has 10,127 Bitcoins with a total value of $236.3 million as of July 31. According to the statements, “the marathon has the possibility to sell a portion of the monthly Bitcoin production”. Operational costs will be covered with the funds obtained from here.