Altcoins, including Bitcoin (BTC) and DOGE, are seeing heavy selling. Crypto analyst Rakesh Upadhyay states that the big easing on June 13 may be the last capitulation before the market finally bottoms out. So what are the important levels that can stop the decline in Bitcoin and major altcoins? The analyst studies the charts of the top 10 cryptocurrencies to find out. We have prepared Rakesh Upadhyay’s analysis for our readers.

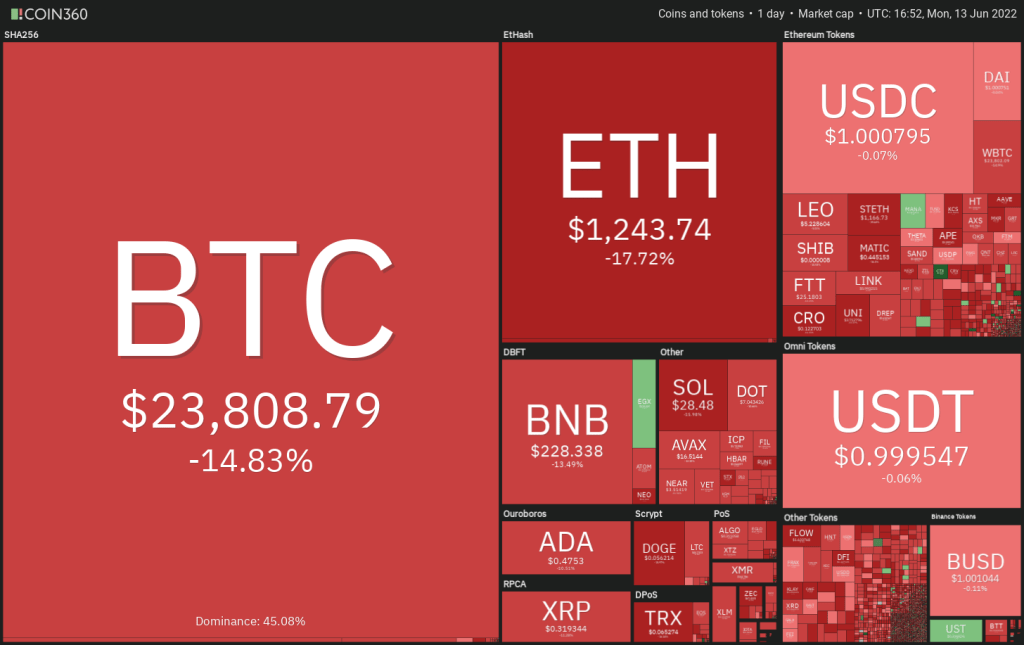

Crypto market overview

US stock markets extended their decline to start the week on June 13. S&P 500 hit new year low. It has plunged into bear market territory, dropping more than 20% from its ATH on Jan.

Cryptocurrency markets are following the decline of stock markets. Also, selling pressure intensified due to rumors of a liquidity crisis from major lending platform Celsius. The problem with Celsius is probably due to traders selling positions to meet margin calls. As you follow on Kriptokoin.com, this has brought the total crypto market cap under $1 trillion.

Daily cryptocurrency market performance. Source: Coin360

Daily cryptocurrency market performance. Source: Coin360Sharp drops have caused some analysts to predict extreme bearish targets. Anything is possible in the markets. Although it is difficult to say bottom, capitulations usually tend to initiate bottom formation. Traders can prepare their buy lists. He may also consider gradually accumulating once the price decline stops.

BTC, ETH, BNB, ADA and XRP analysis

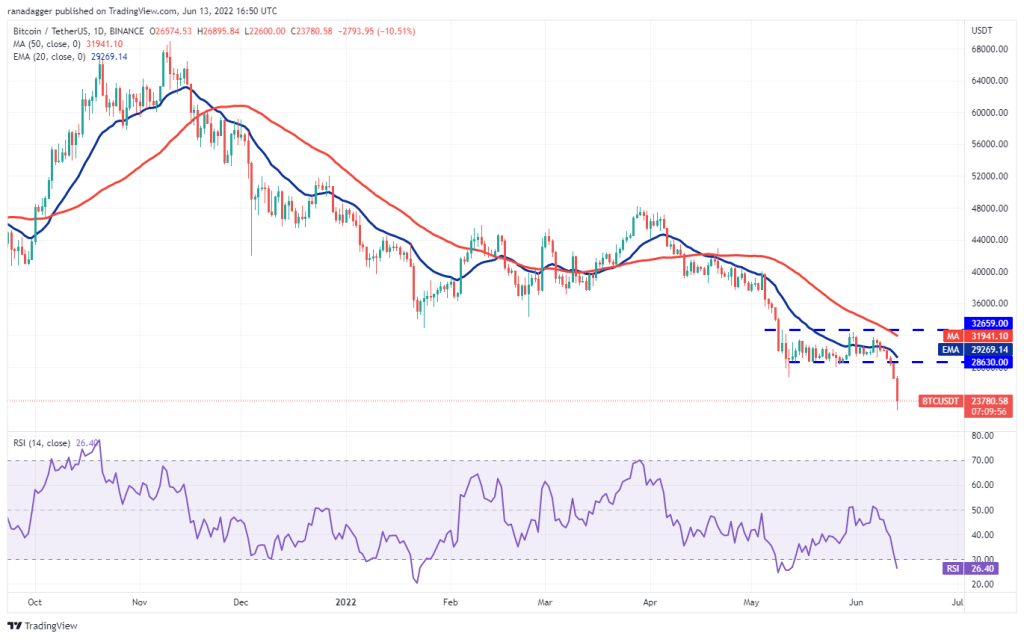

Bitcoin (BTC)

Bitcoin dropped below immediate support at $28,630 on June 11. This accelerated selling and the bears pushed the price below critical support at $26,700 on June 12. This indicated the resumption of the downtrend.

The bears continued the selling pressure on June 13 and BTC dropped to $22,600. The sharp decline over the past few days has pulled the relative strength index (RSI) into oversold territory. This indicates that a relief rally or consolidation is likely in the next few days.

Any recovery is likely to face selling in the region between $26,700 and $28,630. If bears turn this area into resistance, it indicates that the sentiment remains negative. Traders are likely to make another attempt to resume the downtrend later on.

A break below $22,600 is likely to bring BTC down to the psychological level of $20,000. The bulls will need to push and sustain the price above $28,630 to suggest that the bears may lose control.

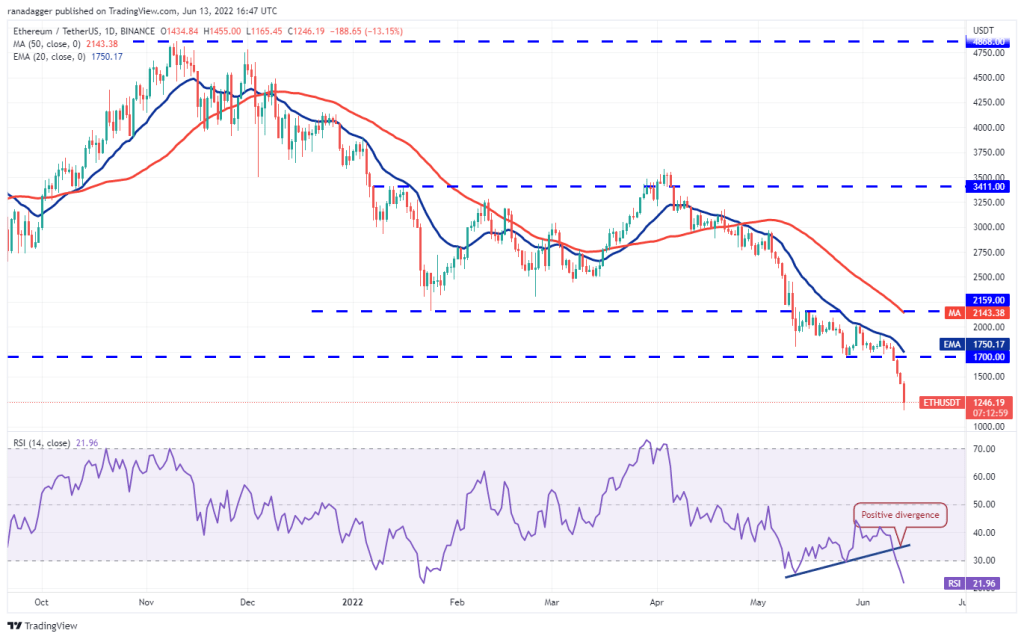

Ethereum (ETH)

Ethereum dropped below the vital support of $1,700 on June 10. This shows that the bears are under control. This marked the start of the next leg of the downtrend.

Sales gained momentum on 11 June. Then the bears dragged the price below the strong support at $1300. This shows that traders got scared and abandoned their positions.

Aggressive selling of the last three days pushed the RSI below 22. Historically, ETH starts a relief rally when the RSI drops below 21. This indicates that ETH may attempt a rally to the $1,700 breakout level. Alternatively, ETH is likely to drop to the psychological support at $1,000 if the bears continue the selling pressure.

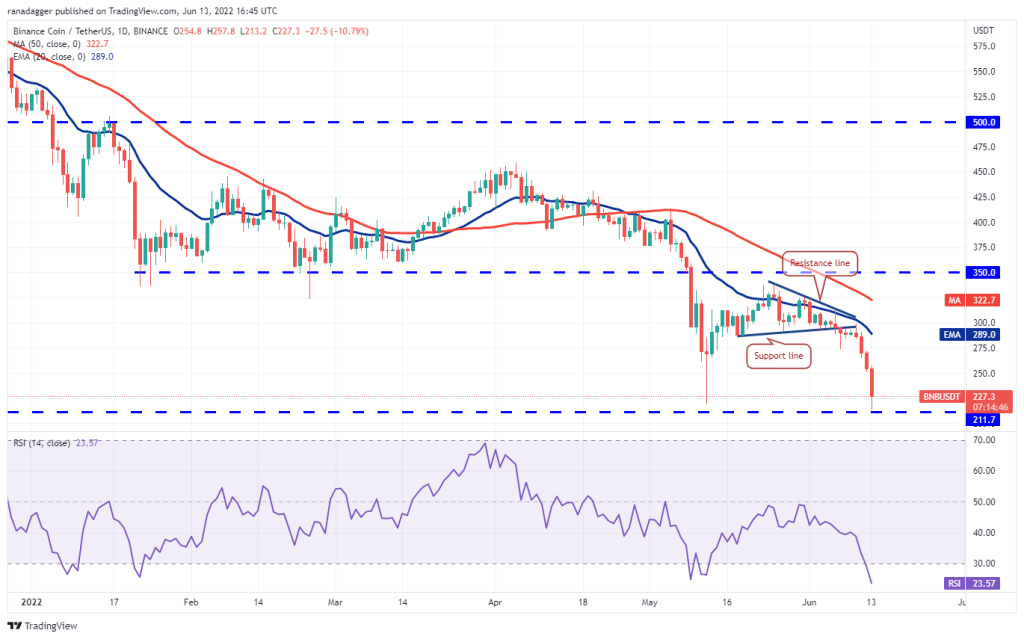

Binance Coin (BNB)

The failure of the bulls to push BNB back into the triangle may have attracted strong bears selling on June 11. Selling gained momentum and the price dropped near the strong support at $211.

If price rises above $211, it will suggest accumulation at lower levels. Buyers will then try to push the price above the 20-day exponential moving average ($289). If they are successful, it will show that BNB can stay range-bound between $211 and $350 for a few days.

Conversely, if the bears sink the price below $211, it will mark the start of the next leg of the downtrend. The psychological level of $200 is likely to offer minor support. However, if the level drops, the next support is likely at $186.

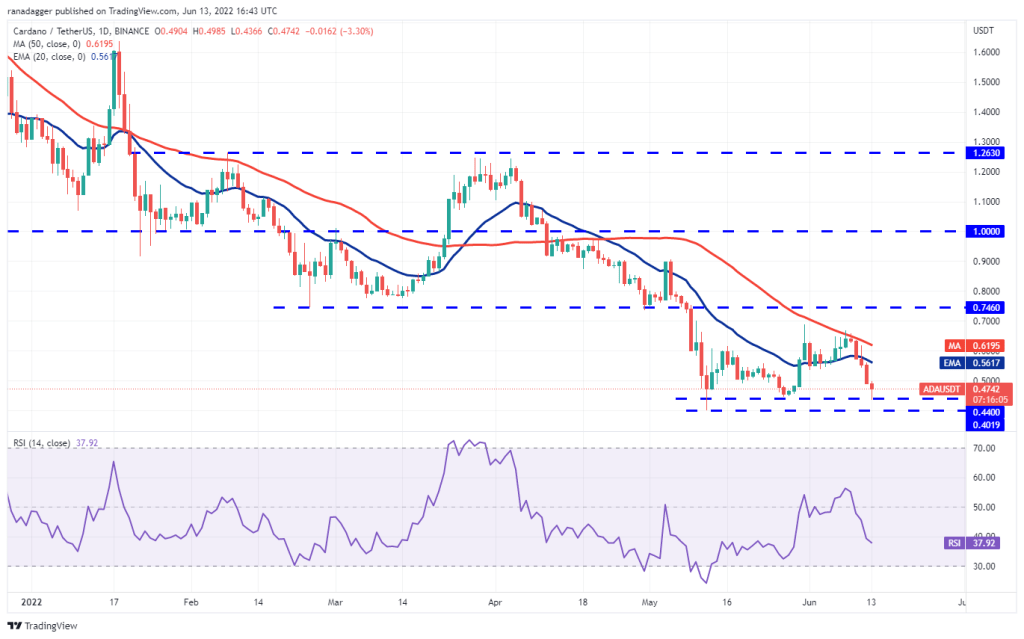

Cardano (ADA)

Cardano fell below the 20-day EMA ($0.56) on June 10. Also, attempts by the bulls to push the price above the level on June 11 faced strong selling at higher levels.

The bears pulled the price into the strong support zone of $0.44 to $0.40. This area is likely to attract strong buying by the bulls. Because a break below this could signal the resumption of the downtrend. ADA is likely to start its southward journey towards the next major support at $0.30 later.

Alternatively, if the price rebounds from the current level, the bulls will try to push the pair above the 50-day simple moving average ($0.61), and if that happens, ADA is likely to stay between $0.74 and $0.40 for a few days.

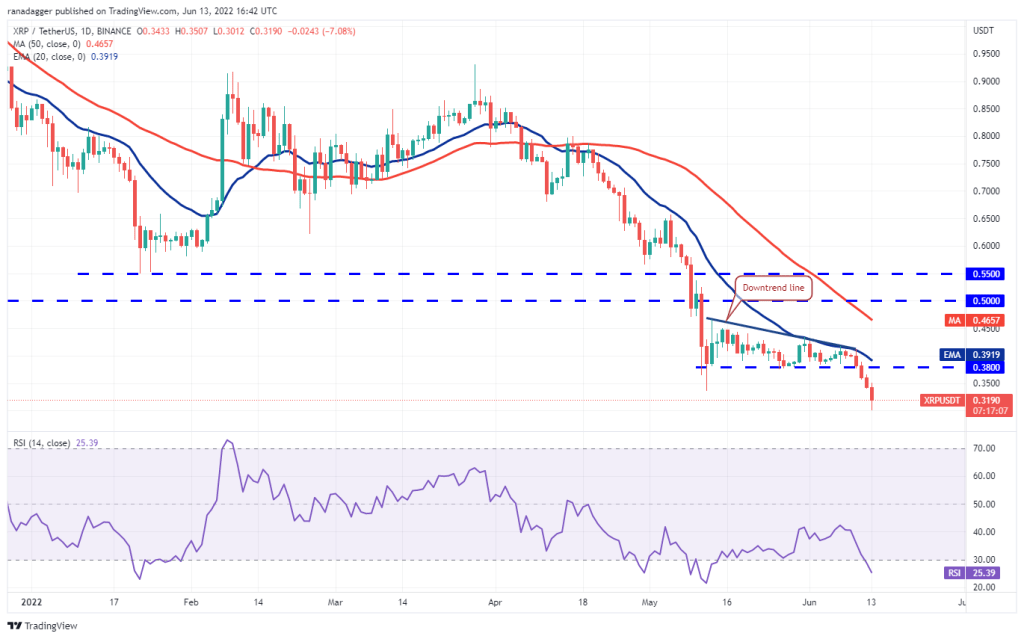

Ripple (XRP)

Ripple (XRP) broke support below $0.38 and closed on June 11.

Sales gained momentum and the bears pulled the price below the critical support at $0.33 on June 13. This marks the start of the next leg of the downtrend. Short-term bears are likely to take profits near the $0.30 pattern target.

If they do, XRP could start a relief rally that could reach the breakout level of $0.33 and then $0.38. Alternatively, if the bears sink the price below $0.30, XRP could hit the next strong support at $0.24.

LEFT, DOGE, DOT, LEO and AVAX analysis

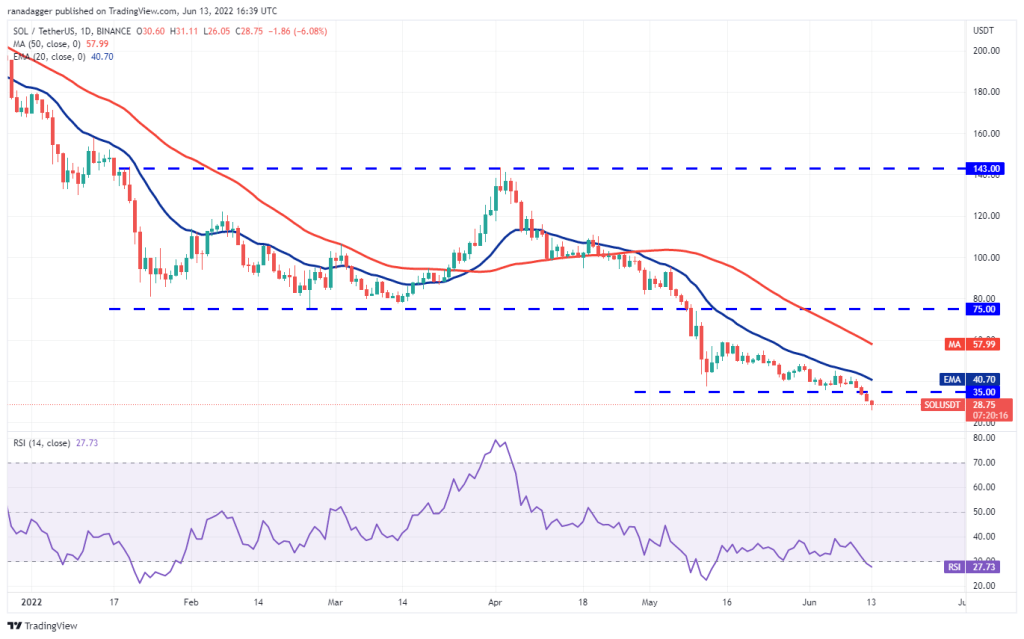

Solana (SOL)

Solana has been stuck between the 20-day EMA ($40) and $35 for several days. This uncertainty was resolved to the downside on June 11 as the bears pulled the price below support.

This then accelerated the sell-off and the bears pushed the price below the immediate support at $30. The next support on the downside is $22 and then $20.

The sharp selling over the past few days has sent the RSI into the oversold territory. This indicates that a relief rally or consolidation is likely in the near term. Also, the bulls will try to push the price above the $35 break level and the 20-day EMA. If they are successful, it will suggest that the current slump could be a bear trap.

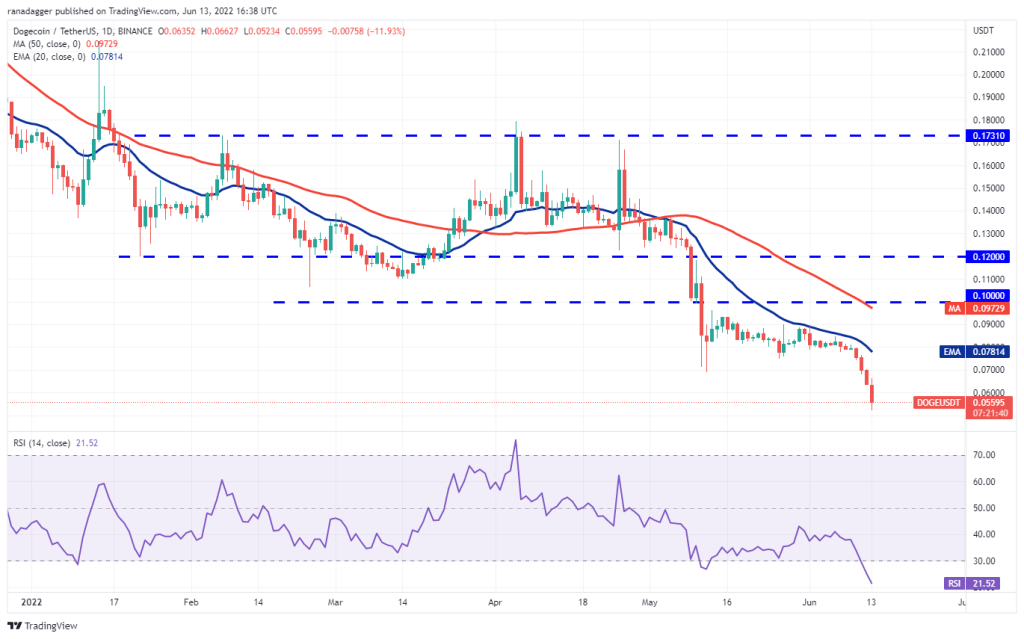

Dogecoin (DOGE)

The narrow gap trade of Dogecoin (DOGE) expanded downward on June 10. The bears pushed DOGE price below 0.07 June, the intraday low of 12 May. This indicated that the downtrend has resumed.

Selling gained further momentum and the bears pulled Dogecoin (DOGE) to the $0.05 psychological support. This level is likely to act as a short-term support. Because the oversold levels on the RSI indicate that a relief rally is possible.

On the upside, the bears will attempt to stop the recovery at the $0.07 breakout level. If DOGE price breaks down from this resistance, the bears will try to continue the downtrend and push DOGE down to $0.04. The first sign of strength in this regard will be a break and close above the 20-day EMA ($0.08).

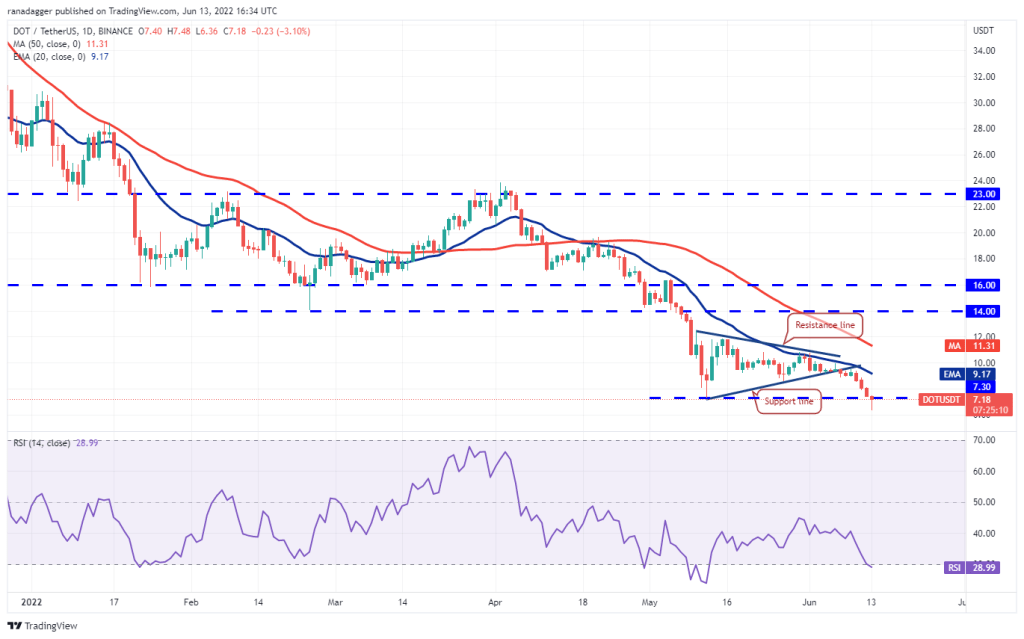

Polkadot (DOT)

The failure of the bulls to push Polkadot back into the symmetrical triangle attracted the bears’ aggressive selling on June 10. This started a downside move that dragged the price below the critical support at $7.30.

The bulls are attempting to push the price above the $7.30 breakout level. If they do, a break below $7.30 would suggest a bear trap. The DOT is likely to rise to the 20-day EMA ($9.17) later.

Alternatively, if the price fails to break above $7.30, it indicates that the bears have turned the level into resistance. This is likely to continue the downtrend with the next stop at the psychological level of $5 followed by the pattern target of $4.23.

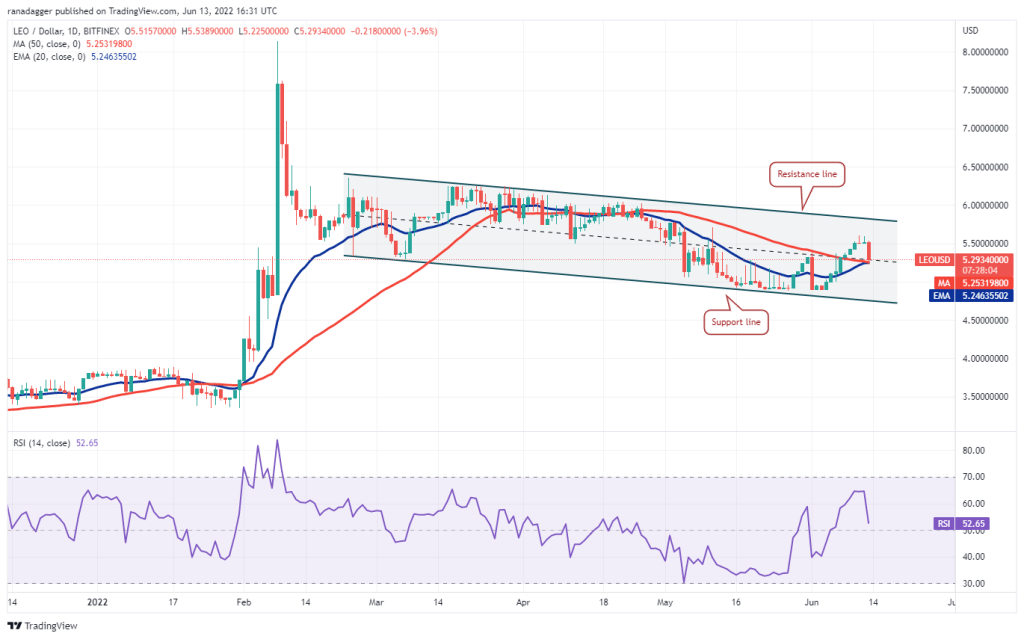

UNUS SED LEO (LEO)

LEO has been trading in a descending channel for the past few weeks. The bears pose a challenge around $5.60. However, they are struggling to push the price below the 20-day EMA ($5.24).

If the price bounces off the current level and rises above $5.60, LEO is likely to gradually rise to the resistance line of the channel. The bears are likely to defend this level aggressively.

If the price drops from the resistance line, the bears will try to push the LEO below the 20-day EMA. If this happens, LEO is likely to drop gradually towards the support line. In addition, such a move suggests that LEO may prolong the residence time in the channel for a while. The next trend move could start after the bulls push the price above the resistance line or the bears push the pair below the support line.

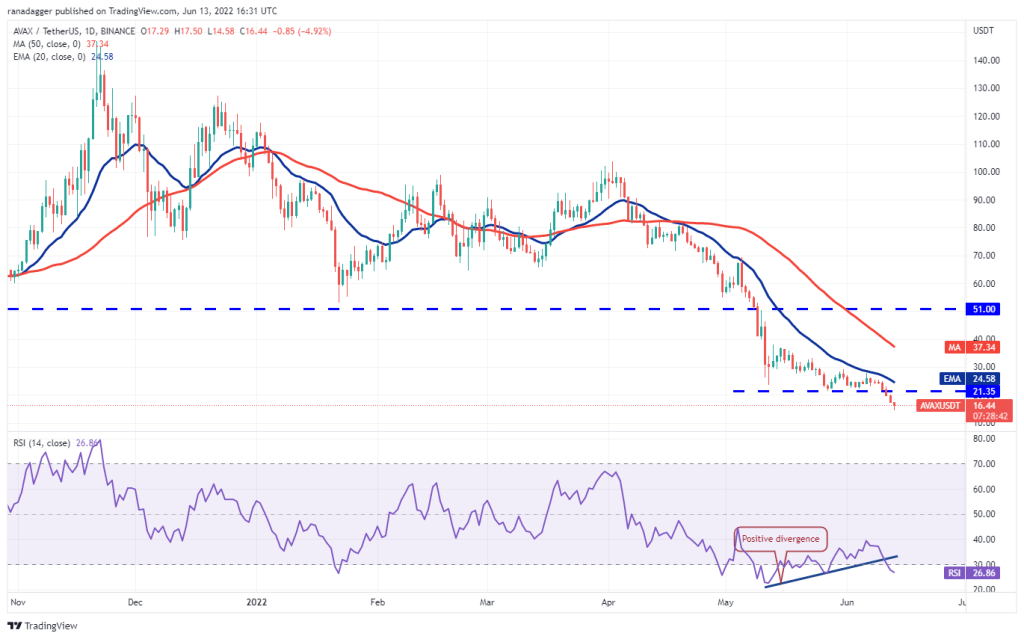

Avalanche (AVAX)

Avalanche’s narrow gap trade between 20-day EMA ($24) and critical support at $21 was resolved to the downside on June 11. This indicated the resumption of the downtrend.

Sales gained momentum and broke the $18 support on June 12. There is a small support at $15. However, if this level breaks, it is possible for AVAX to drop to the next strong support at $13.

While the falling moving averages show an advantage for sellers, the oversold levels on the RSI suggest that the selling may have been overkill in the near term. Therefore, it could result in a relief rally to the $21 breakdown level. The bulls will need to push the price above the 20-day EMA to indicate that the bears may lose control.