The tough relief rally traders have been waiting for has arrived in BTC and ETH, but will the market sustain enough bullish momentum to catalyze a trend change? With a few analysts waiting for Bitcoin to bottom out, is it a good time to buy? Could crypto markets start to recover in the short term? To answer all these questions, crypto analyst Rakesh Upadhyay analyzes the charts of 10 cryptocurrencies, including SHIB. We have prepared the analyst’s evaluations for our readers.

Market overview

Bitcoin (BTC) is trying to make up for it by initiating a price recovery to end its streak of losses, after creating a dubious record of nine consecutive weeks of red closes. Analysts say that investors should not be afraid of a bear market, as it is basically one of the best times to invest in strong projects in preparation for the next bull phase.

CryptoQuant CEO Ki Young Ju emphasizes that unspent transaction outputs (UTXOs) older than six months reflect 62% of the realized cap, similar to the level seen during the March 2020 crash. Therefore, Ki says, Bitcoin could be close to forming a cyclical bottom.

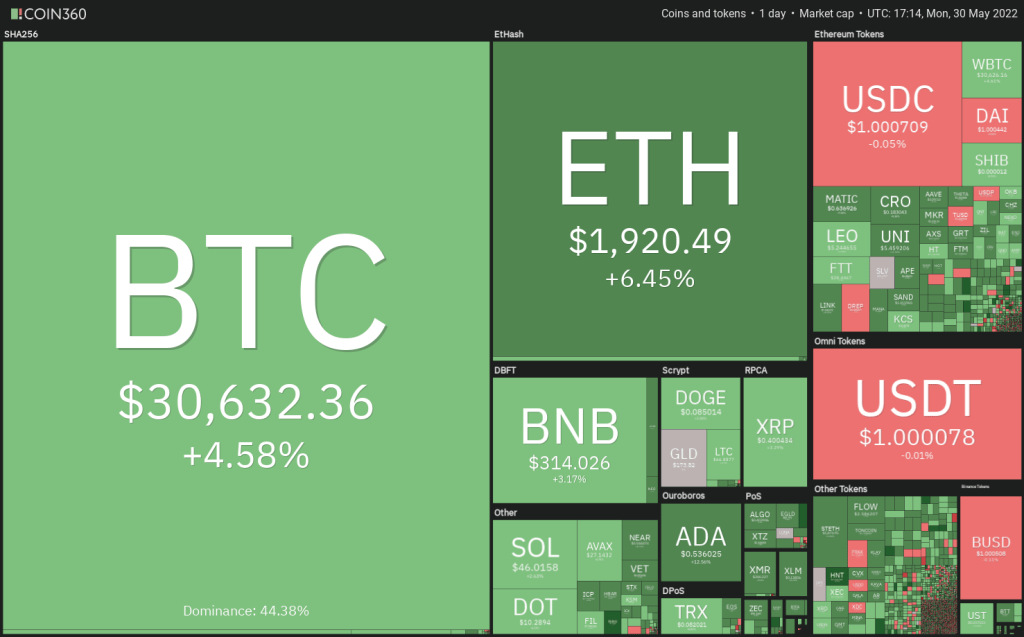

Daily cryptocurrency market performance / Source: Coin360

Daily cryptocurrency market performance / Source: Coin360 In the current bearish environment, a Bitcoin rally to $250,000 is hard to fathom, but billionaire investor Tim Draper is still bullish. As we covered in the cryptokoin.com news, Draper, speaking on a YouTube program on May 24, said that if more institutions start accepting Bitcoin, women’s participation will increase as they will buy something with Bitcoin. According to Draper, this could push the price of Bitcoin above the $250,000 target target.

BTC, ETH, BNB, XRP and ADA analysis

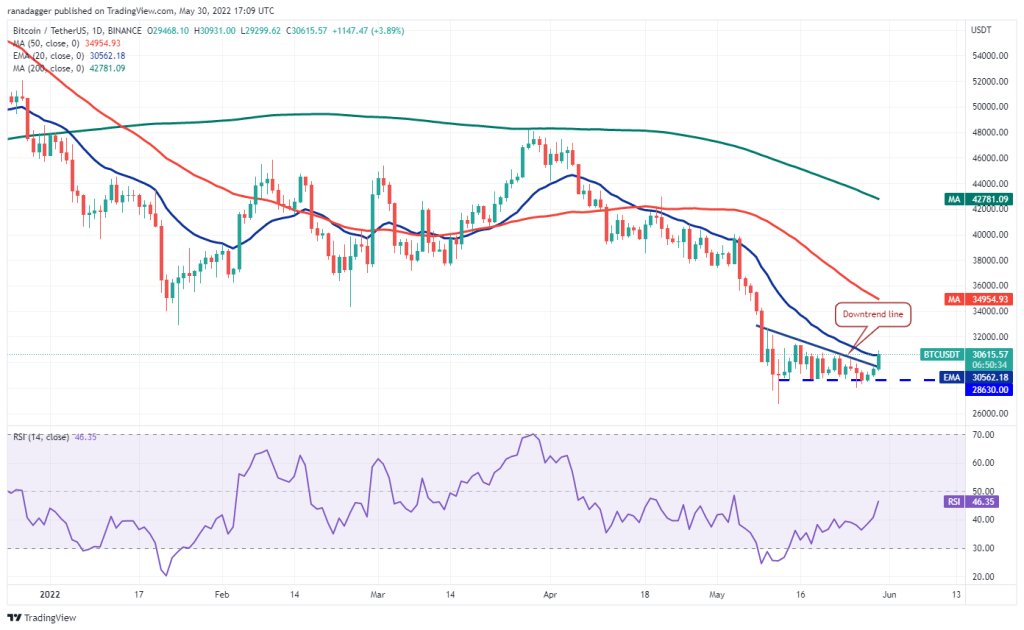

Bitcoin (BTC)

Bitcoin broke above the downtrend line on May 30th and the bulls are making the price 20-day exponential It is trying to hold above the moving average (EMA) ($30,562). If they are successful, it will be the first indication that the bears are losing control.

If price stays above the 20-day EMA, BTC could rally to $32,659 and then to the 50-day simple moving average (SMA) ($34,954). The 20-day EMA is flattening and the relative strength index (RSI) climbs above 46, indicating that the bulls are trying to bounce back.

Conversely, if the price drops from the 20-day EMA, it indicates that the sentiment remains negative and traders are selling in rallies. The bears will then make another attempt to push BTC below $28,630 and challenge the intraday low of May 12 at $26,700. A break below this support could signal a resumption of the downtrend.

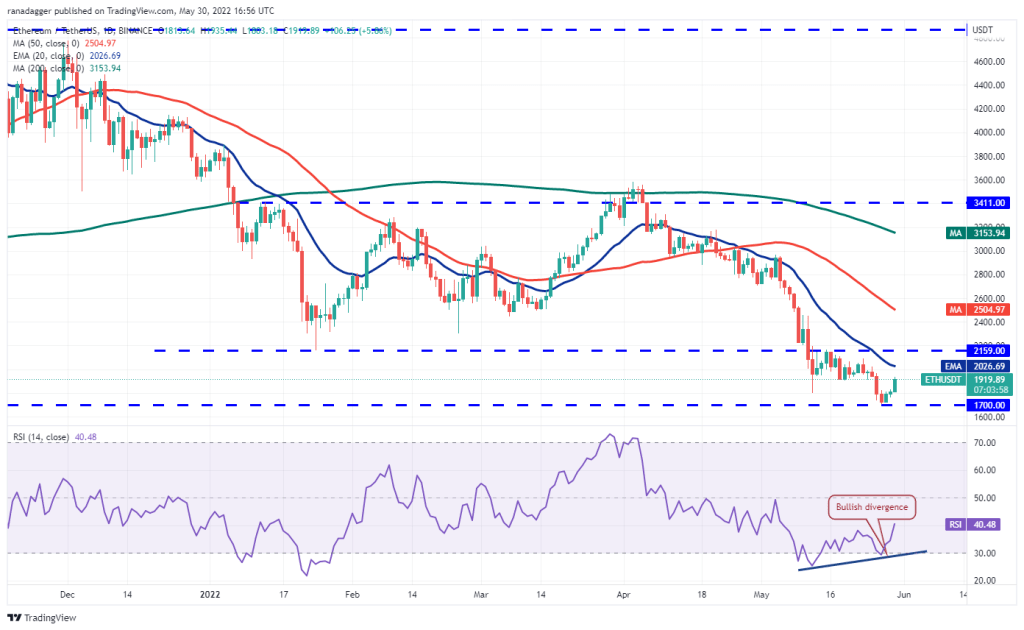

Ethereum (ETH)

Ethereum bounced off vital support $1,700 on May 28 and is heading towards the 20-day EMA ($2,026). This shows that the bulls are trying to start a sustained recovery.

RSI is showing a bullish divergence suggesting that selling pressure may decrease. Buyers will attempt to push the price above the 20-day EMA and challenge the $2,159 breakout level. If the bulls fail to break through this hurdle, ETH could slide down and consolidate between $1,700 and $2,159.

If the bulls push the price above $2,159, it would suggest a $1,700 bottom could be made in the near term. ETH could then rise to the 50-day SMA ($2,504). This bullish view could be invalidated if the price declines and drops below $1,700.

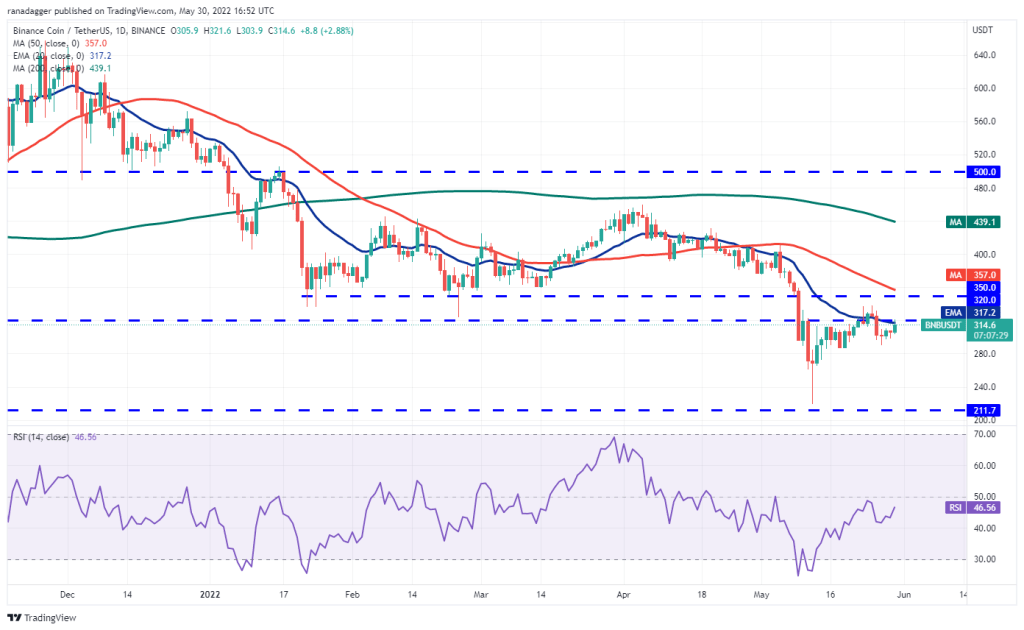

Binance Coin (BNB)

BNB hit support near the immediate support at $286 on May 27, suggesting that traders are buying the lows. The bulls will now again attempt to push the price above the overhead resistance at $320.

If they are successful, BNB could rise to $350. The longer the price stays above $320, the more likely it is to bottom out on May 12. If the bulls break the $350 barrier, the rally could reach $400.

On the other hand, if the price drops from the current level or $350, it means that the bears are selling in rallies. This could push the price back to immediate support at $286. If this support is broken, BNB could drop to $260.

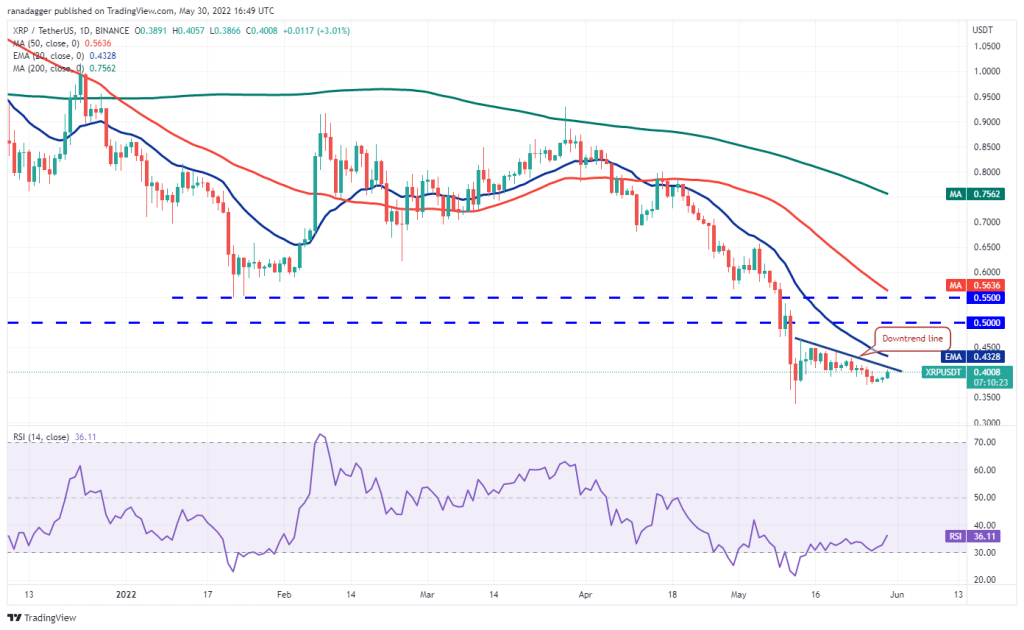

Ripple (XRP)

Ripple fell below $0.38 on May 26, but the bears failed to sustain the selling pressure. This started a recovery on May 28, reaching the downtrend line.

The bears repeatedly formed a strong defense along the downtrend line; so this is an important resistor to consider. If the price changes direction from the downtrend line, the bears will try to push XRP below $0.37 and challenge the critical support at $0.33.

On the contrary, if buyers hold and sustain the price above the 20-day EMA ($0.43), it suggests that sellers may be losing control. XRP could then rise to the psychological level at $0.50.

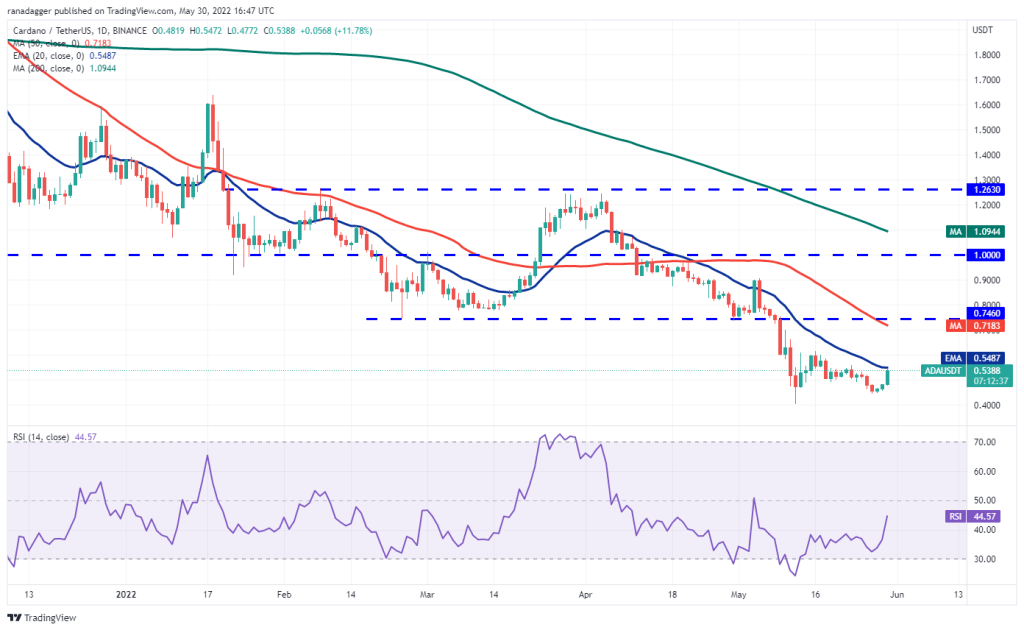

Cardano (ADA)

Cardano fell below the minor support at $0.46 on May 27, but the bears failed to build on the advantage. The bulls bought this dip and started a recovery on May 28.

The relief rally gained momentum on May 30 and the bulls are trying to push the price above the 20-day EMA ($0.54). If they succeed, it will indicate that ADA is trying to bottom out. ADA could then rise to $0.61 and then attempt a rally to the $0.74 breakout level.

This positive view could be rejected if the price drops from the 20-day EMA. If this happens, the bears will attempt to push ADA back below $0.40 and start the next leg of the downside move.

SOL, DOGE, DOT, AVAX and SHIB analysis

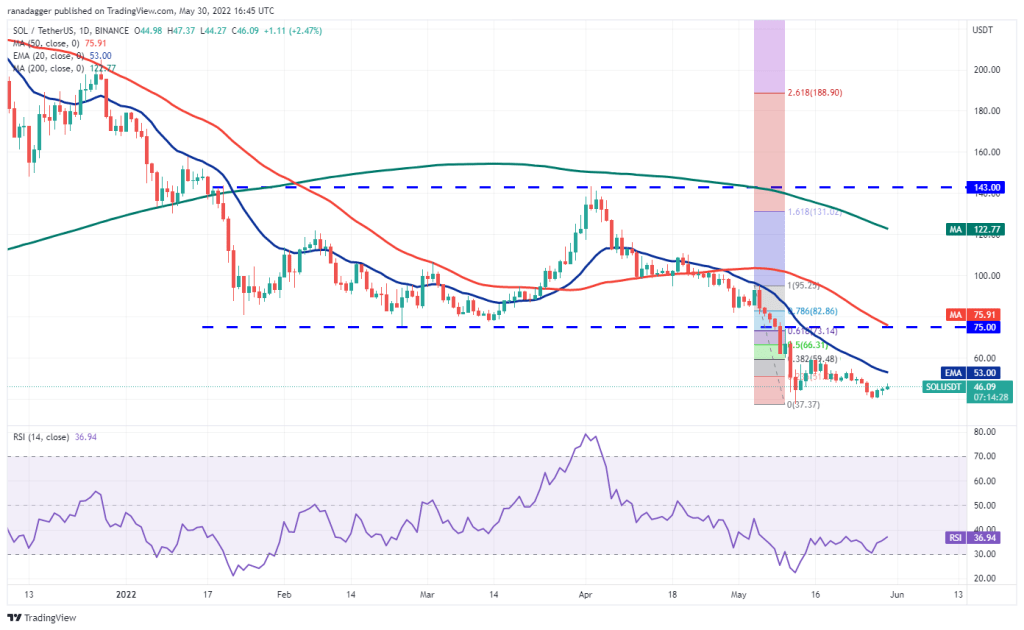

Solana (SOL)

Solana rebounded from $40 on May 28, which means lower levels are pulling bulls’ buys. It shows that it continues. Buyers will now try to push the price up to the 20-day EMA ($53).

If the bulls break above the 20-day EMA, the downtrend may weaken. The SOL could then climb higher to $60 and then to the 50% Fibonacci retracement level of $66.

On the contrary, if the price drops from the current level or the 20-day EMA, it will indicate that the bears continue to sell in the rallies. This could increase the possibility of a retest of $37.37. A break below this support could initiate the next leg of the downtrend.

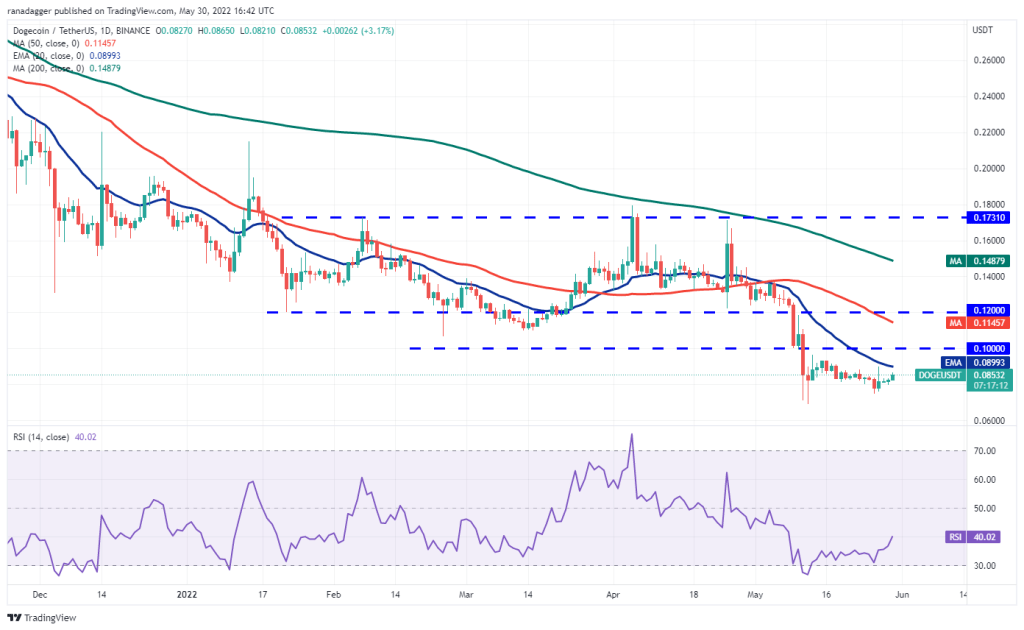

Dogecoin (DOGE)

Dogecoin dropped below $0.08 on May 26, but made a strong comeback on May 27. This indicates aggressive buying at the lower levels but the bears are not ready to give up their advantage as they continue to defend the 20-day EMA ($0.09).

The bulls will try to push the price above the 20-day EMA again. If they do, DOGE could rise to the psychological level at $0.10. This level could act as a resistance again but if the bulls break through this hurdle, DOGE could rally to $0.12.

Alternatively, if the price breaks from the 20-day EMA or $0.10, it indicates that the bears are active at higher levels. This could push DOGE to $0.08 and later to the intraday low of May 12 to $0.06.

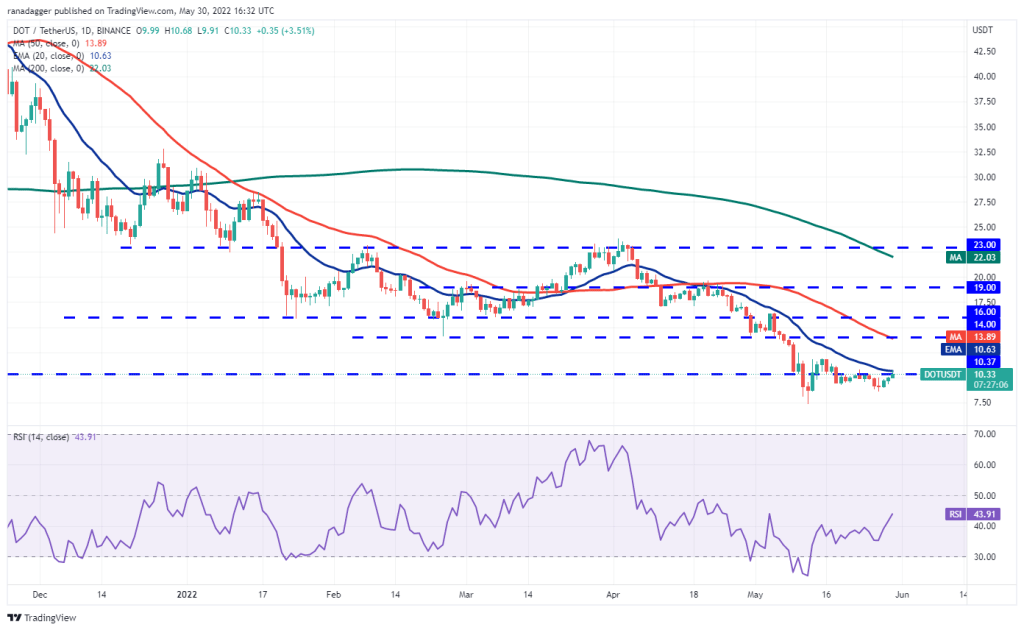

Polkadot (DOT)

Polkadot formed a Doji candlestick pattern on May 27, signaling indecision between the bulls and bears. This uncertainty resolved to the upside and the bulls pushed the price towards the overhead resistance at $10.37.

Buyers can open the doors for a possible rally to $12 if the price pushes above the overhead resistance. If the bulls break this hurdle, the next stop could be $14. A break and close above this resistance may indicate that DOT may have bottomed out.

This positive view may be invalidated if the price drops sharply from the current level and dips below $8.56. This could result in a drop to $7.30, the intraday low of May 12. The bears will have to push the price below this level to indicate the resumption of the downtrend.

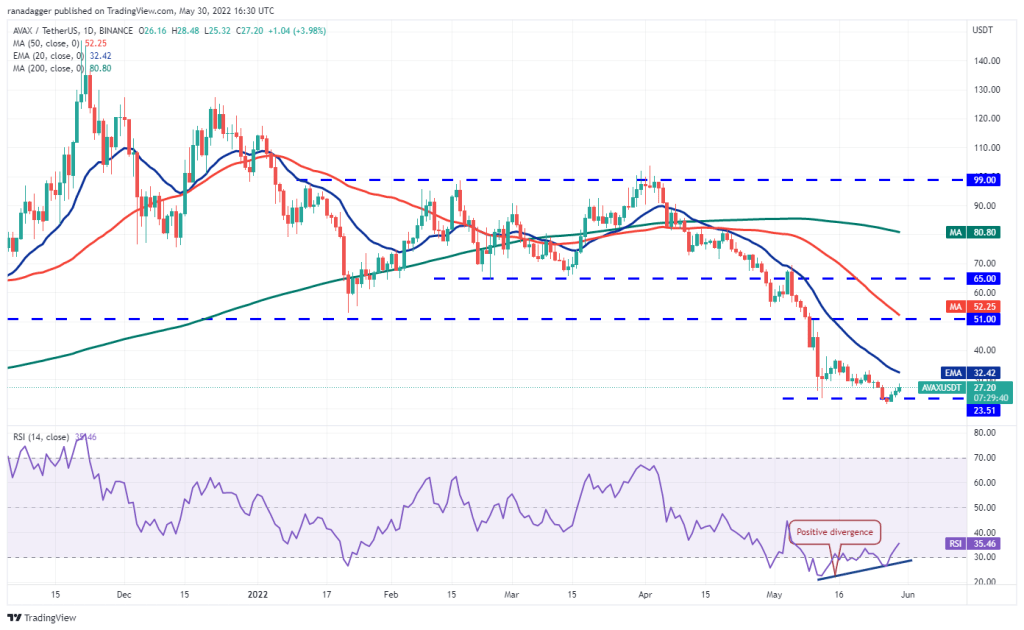

Avalanche (AVAX)

AVAX fell below strong support at $23.51 on May 26, but the bears failed to take advantage of it. The bulls bought the dip on May 27 and started to recover on May 28.

The bulls will try to push the price towards the 20-day EMA ($32.42), which is an important level to consider. If the price breaks down from this resistance, the bears will attempt to retest the May 27 intraday low of $21.35. If this support is broken, AVAX could slide to the psychological level at $20.

RSI is showing a positive divergence, indicating that selling pressure may drop. If the bulls push the price above the 20-day EMA, AVAX could rise to $38 and then attempt to reach $46.

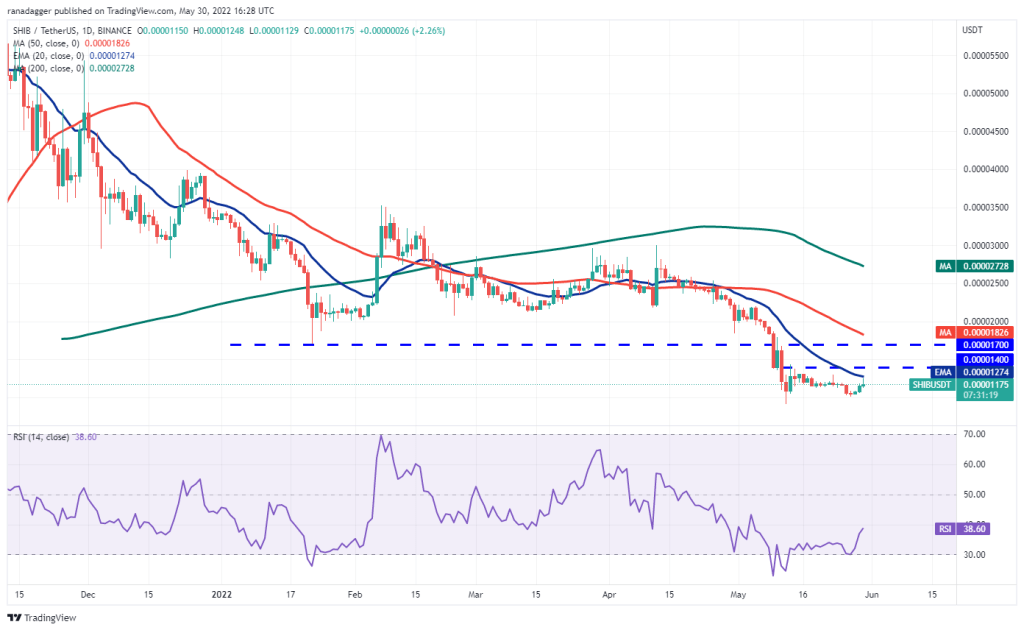

Shiba Inu (SHIB)

Bulls successfully defended support at $0.000010 on May 27, resulting in a recovery on May 28. SHIB continued to recover and reached the 20-day EMA ($0.0000012), which is likely to act as a strong resistance.

If the price drops from the 20-day EMA, the bears will again try to push the Shiba Inu (SHIB) below $0.000010. If this happens, SHIB could retest the critical support at $0.000009.

Alternatively, if the bulls push the price above the 20-day EMA, it suggests that the downtrend may weaken. SHIB could then attempt a rally to $0.000014 and then to the breakout level of $0.000017. The bulls will have to break through this overall hurdle to signal a potential change in trend.