A top financial expert recommends buying this cryptocurrency in the midst of impending bank failures. What is behind this advice?

It is possible that this cryptocurrency could be a savior!

As you follow on Kriptokoin.com, the traditional banking system is facing great challenges. According to senior financial expert Bernstein, it is possible for Bitcoin (BTC) to be a savior. Bernstein analysts predict that the long-awaited mainstream adoption of Bitcoin could potentially be triggered by the US banking crisis.

Analysts also suggest that the current state of the banking system will fuel a “new crypto cycle” driven by the mass migration to self-custody wallets. In a note, Bernstein analysts Gautam Chhugani and Manas Agrawal write:

The safe-haven signal will lead to a new crypto cycle. This will make digital wallets stand out as on-chain savings accounts. The difference between treasury rates and bank deposit rates will continue to drain banks. In addition, weak balance sheets will lead to a new wave of mass migration to money markets.

According to Bernstein analysts, recent events are causing widespread financial uncertainty. However, investors are increasingly turning to alternative investment options like Bitcoin.

BTC continues to rise

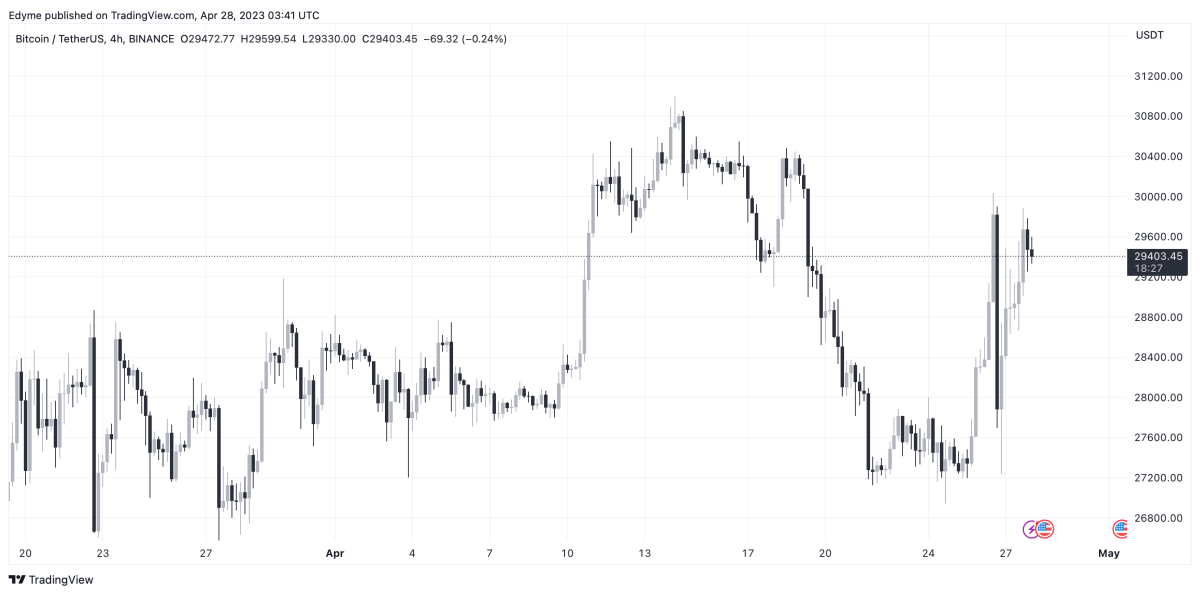

Despite the so-called buy signal, Bitcoin (BTC) has yet to make any significant moves. Instead, it only seems to have rebounded from the slowing uptrend in recent weeks. In the past 24 hours, the leading crypto has only increased 1.5% to $29,402 at the time of writing.

Bitcoin moves sideways on the 4-hour chart / Source: TradingView

Bitcoin moves sideways on the 4-hour chart / Source: TradingViewMeanwhile, crypto analyst Edyme analyzes the technical outlook for BTC as follows. This uptrend came after a notable drop from the $30,000 region over the past few weeks. So far, Bitcoin’s 24-hour range has ranged from a low of $28,748 to a high of $29,869. Besides its price, BTC market cap has also seen an uptrend. Trading volume points to buying pressure indicating a possible sustained uptrend.

Over the past week, Bitcoin’s market cap has soared from $527 billion on April 22 to $569 billion as of today. Transaction volume also increased from $19 billion daily to $23.3 billion in the same period.

The effects of the banking crisis on Bitcoin

According to Bernstein analysts, the growing banking crisis in the US will likely have significant effects on the future of Bitcoin. Analysts also predict that the crisis will cause the Fed to print another round of money and devalue the dollar. This will bring Bitcoin to the agenda once again as digital gold. Cryptocurrency has long been touted as a hedge against inflation. Also, its value is often regarded as an alternative to traditional safe-haven assets such as gold.

Many in particular have proclaimed Bitcoin as the future of finance ever since. With the current state of the banking system, its potential to be the future of finance is becoming more and more clear. Meanwhile, traditional banks are struggling with weak balance sheets and low interest rates. However, in such an environment, Bitcoin continues to gain value and recognition as a legitimate investment option. Its decentralized nature and distrust of traditional financial institutions make it an attractive option for investors looking to hedge their assets in times of economic uncertainty.

Bernstein analysts predict a new crypto cycle and advise investors to “buy Bitcoin”. Therefore, it is possible to say that crypto money will play an increasingly important role in the future of finance.