Pendle is a yield management protocol that allows users to get more by dividing the yielding assets into different parts and allowing users to speculate about changes in the underlying return.

What is Pendle Protocol?

Pendle is an asset management protocol that, through a variety of strategies, allows users to gain greater control over their returns and unlock the ability to speculate about return fluctuations. The main features of Pendle are yield tokenization, AMM (Automatic Market Maker) and vote deposit tokenomics.

Pendle offers a wealth of features, all focused on yield fluctuations and how investors can profit from it. It represents part of a new group of more sophisticated DeFi protocols that increasingly reflect the more niche elements of TradFi.

This protocol operates in a fixed-rate environment that allows users to access more decisive returns and increases investors’ ability to hedge and speculate.

Pendle Features

Pendle offers permissionless yield management and the protocol has three key features.

1. Yield Tokenization

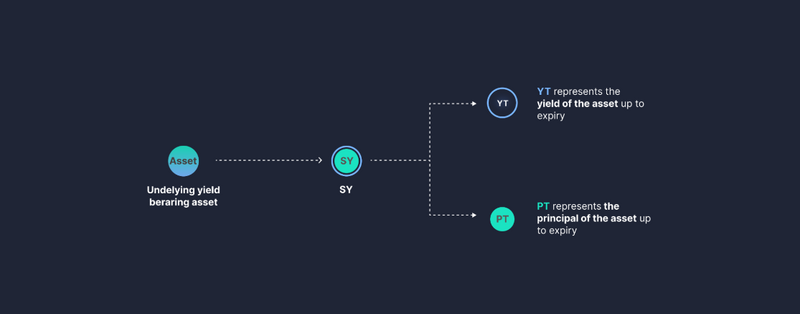

The protocol uses the SY (Standardized Return) token standard. SY tokens are bundled coins that can be used on Pendle and consist of two components: Base Tokens (PT) and Yield Tokens (YT).

Any yield-bearing asset can be wrapped in a SY token. The token standard provides a standardized API for these assets in smart contracts and allows formability across DeFi, and this standard could go beyond the protocol with the Pendle team recommending ERC-5115.

Delivering greater formability for yielding assets across DeFi will open up a new world of possibilities, and the launch of liquid staking derivatives (LSDs) has shown the first curtain of this performance.

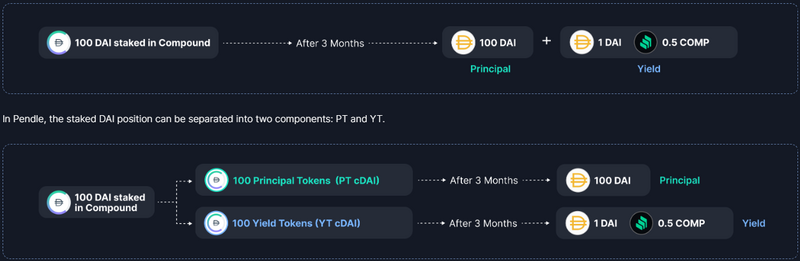

Yielding assets have become the norm in DeFi. Users take underlying assets, invest them in a yield resource, and receive a yielding asset in return. Following the example above, placing DAI in the Compound lending pool will result in the user owning the cDAI. The cDAI token denotes the amount of DAI provided and the return earned from the lending activity.

Pendle users will therefore have PT-DAI and YT-DAI, allowing them to freely trade both on Pendle’s unique AMM.

Principal tokens represent the principal of the asset and Yield tokens represent all the return generated by the asset. Instead of one token, investors now have two tokens. For ease of understanding, a user may have a stETH (Lido’s Liquid Staking Token). In the Pendle ecosystem this stETH would be SY-stETH, equivalent to PT-stETH + YT-stETH.

PT-sTETH is the initial amount of Ether staked and YT-sTETH is all staking rewards accrued by this stETH. Users can use the PT in Pendle for the underlying asset at maturity at a ratio of 1:1. YT entitles the beneficiary to all returns generated by the claimable asset in real time.

2. Pendle AMM

Effective trading of PTs and PTs requires a marketplace and Pendle AMM (Automatic Market Maker) is at the center of the entire ecosystem. The underlying mechanism of Pendle involves users betting on the return generated by the yielding assets.

Users who buy YT get efficiency for a long time. They bet that the yield (the Underlying APY) will trade above the Implied APY, which is a market-driven price in the future APY of the asset. In simple terms, they win if the yield is maintained or increased.

If users want to go long in wstETH yield, they can buy wstETH Yield tokens (YT-wstETH) on Pendle. As long as the return generated by these yield coins outweighs the purchase cost, the trade wins.

Theoretically, the counterparty to this trade would be a user who believes that the premium paid will outweigh the return generated. In practice, liquidity providers on Pendle act as counterparties to all transactions.

Pendle’s AMM maps PT to SY and leverages flash swaps to enable PT transactions through the same pool, meaning all transactions for a given asset route through a single pool of liquidity.

3. and PENDLE

The final piece of the Pendle puzzle is the vote deposit token: andPENDLE. This “last piece” is important because and PENDLE holders gain management rights and channel incentives on the platform.