Recently, three different market experts announced that they expect bullishness for various altcoins. Here are the explanations of Mac Brennan, Arthur Hayes and Taiki Maeda…

Mac Brennan points to popular altcoin Solana

In a recent social media post, Mac Brennan, founder of the mrgn group, which manages a substantial $150 million fund, discussed the possibility of a bull run for Solana (SOL). According to Brennan, Solana’s total value locked in decentralized apps (dApps) may experience significant growth in the near future. In its current form, SOL’s TVL is only 3 percent of its value invested in validators. This rate is in stark contrast with Ethereum’s TVL being 60 percent of the invested value. Brennan attributed this disparity in part to the lack of liquid stake tokens (LSTs) in the Solana ecosystem.

But Brennan’s optimism stems from his prediction that the popularity of LSTs in Solana will increase, leading to an increase in TVL. He estimates that SOL’s TVL could reach around $3 billion if the ratio of SOL’s TVL to staked value reaches half that of Ethereum. If it matches Ethereum’s rate, SOL’s TVL will achieve the second highest position in the cryptocurrency world after Ethereum. The founder also further fueled Solana’s TVL and overall ecosystem growth by launching its own native tokens of upcoming dApps in SOL, particularly in the areas of decentralized finance (DeFi), non-fungible tokens (NFTs), and data oracles. highlighted the potential to increase

Hayes talked about the relationship between Ethereum and artificial intelligence

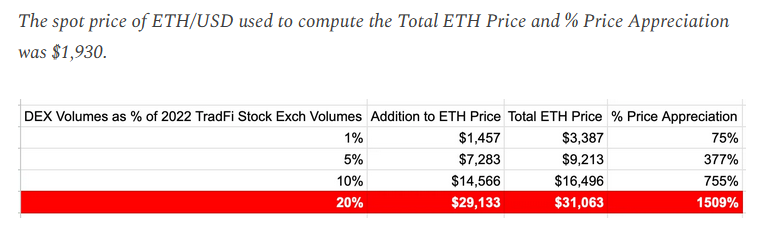

Arthur Hayes, the co-founder of BitMEX, claimed in another prediction that Ethereum (ETH) will benefit greatly from artificial intelligence (AI) technology. According to Hayes, AI applications could lead to decentralized autonomous organizations (DAOs) running smart contracts, and Ethereum as the most widely used decentralized virtual machine is a natural basis for such scenarios. Hayes predicts that tokens issued by AI-powered DAOs will predominantly be traded on decentralized exchanges (DEXs), many of which are built on Ethereum. Hayes predicts that if this vision is realized, the price of Ethereum could rise by a staggering 1.556 percent to reach $31,063, given the significant DEX trading volumes.

Maeda points to DeFi rise

On the other hand, facing a bear market due to the disparity between traditional finance returns and on-chain returns, the DeFi sector may be on the verge of a new bull market, according to another analyst. Taiki Maeda, founder of HFAresearch, a cryptocurrency analytics firm, claimed that the launch of real-world assets (RWAs) on the blockchain could bring about this resurgence. When traditional finance returns were low in 2020, capital poured into DeFi in search of higher returns, driving TVL to over $200 billion in less than two years. However, this trend reversed with the Fed raising interest rates in 2022, causing investors to shift their funds back to traditional finance.

Maeda argued that for a sustainable DeFi bull market, on-chain returns must exceed the risk-free rate in traditional finance, which is currently over 5%. He claimed that this could be achieved through RWAs that tokenize real-world assets on the Blockchain. For example, DeFi protocols like MakerDAO, Aave, and Compound buy US Treasury bonds off-chain. It creates a profitable business model by transferring its returns to the participants on the chain. This type of yield farming, which relies on government interest payments rather than inflation or the Ponzi scheme, can create economic value and attract more capital and liquidity to the DeFi sector.