Chainlink (LINK) price gained 38% in September. Thus, it became one of the best-performing altcoin projects in the top 20 crypto rankings. Vital on-chain indicators show that Chainlink will continue its winning streak in October. Can the bulls reclaim the $10 zone in October? Crypto analyst Ibrahim Ajibade is looking for an answer to this question.

Despite altcoin price increases, network activity remains high!

As you follow from Kriptokoin.com, Chainlink performed quite well last month. Thus, it emerged as the top gainer in the top 20 crypto rankings. That’s why the altcoin has become the focus of all eyes. On-chain data shows that the rise in September was due to organic growth in Chainlink’s fundamentals rather than market speculation. Moreover, it is possible for the bulls to make further gains in October.

As you can see below, the first arc of the LINK price rally in mid-September coincided with a noticeable increase in LINK’s daily active users. But more importantly, the Chainlink network has consistently attracted at least 1,500 Active Addresses over the last three weeks leading up to September 11. The last time Chainlink consistently attracted this level of network usage was in January 2021. The altcoin price was around $20 at that time.

Chainlink (LINK) Daily Active Addresses and Price. Source: IntoTheBlock

Chainlink (LINK) Daily Active Addresses and Price. Source: IntoTheBlockThe Daily Active Addresses metric tracks the current user participation rate of a Blockchain ecosystem. When this metric is consistently at historical highs over a long period of time, as you see above, it indicates healthy and sustainable organic growth. This confirms the thesis that Chainlink has attracted significant attention thanks to the RWA wave. According to historical trends in 2022, it is possible for the altcoin price to rise up to $20. However, it is not yet clear whether this network activity will translate into tangible market demand and price increases.

LINK exchange supply drops to historical lows

In the markets, Chainlink holders appear to be preparing for further bullish action amid bustling network activity in October. A clear indication of this is that the LINK supply on exchanges has now fallen to historic lows. The CryptoQuant chart below shows that LINK Exchange Reserves dropped to 152 million tokens on October 3. This is the lowest level since Chainlink introduced its native staking roadmap in June 2022.

Chainlink (LINK) Foreign Exchange Reserves and Price. Source: CryptoQuant

Chainlink (LINK) Foreign Exchange Reserves and Price. Source: CryptoQuantExchange Reserves track the total deposits that cryptocurrency holders currently hold in major exchange wallets. Exchange Supply typically decreases during bull markets as optimistic holders shift tokens into long-term cold storage or their own custody. Historical data trends show that LINK price usually rises when exchange reserves decrease. It also reveals that the opposite is also true. We witnessed this phenomenon recently on July 20 and late September 2023, respectively. As a result, increased network activity increased the confidence of LINK holders. Based on past trends, the decline in Exchange Supply will likely trigger another altcoin price rally in October.

LINK price prediction: Altcoin is about to reach the $10 mark

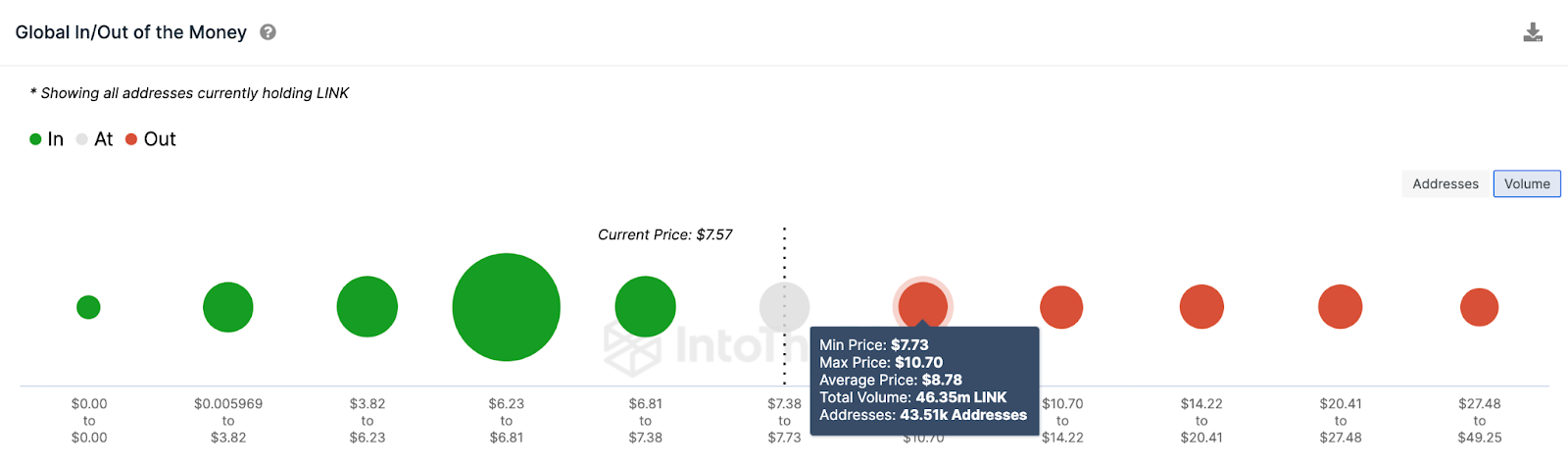

On-chain data shows Chainlink is in the best position to reclaim $10 in the coming weeks. Global In/Out of Money Around Price (GIOM) data, which shows the entry price distribution of current altcoin investors, also adds credibility to this prediction. If LINK bulls break the first sell wall at $8, it is possible for the LINK price rally to reach $10.

As you can see below, 43,510 addresses purchased 46.4 million LINK at an average price of $8.78. If they close their positions when the LINK price approaches this range, it is possible that they will accidentally trigger a pullback. However, if the decline in exchange reserves triggers a supply squeeze as predicted, the altcoin price could reach $10 in October.

Chainlink (LINK) Price Prediction. GIOM data. Source: IntoTheBlock

Chainlink (LINK) Price Prediction. GIOM data. Source: IntoTheBlockHowever, if the altcoin price falls below $5, it is possible that the bears will dash this bullish bet. However, the chart shows that 68,270 addresses purchased 535.8 million LINK at an average price of $6.50. This is the largest cluster of current Chainlink investors. Therefore, they will form a significant support buying wall. If LINK bulls fail to defend this vital support level, it could trigger an extended reversal towards $5.

Follow us on Twitter, Facebook and Instagram and join our Telegram and YouTube channels to be instantly informed about the latest developments!