Chainlink (LINK), which witnessed three big whale transactions in 11 minutes in the past days, is following the bearish trend in the altcoin market in terms of price. Bank bankruptcies and the upcoming “solid crypto straightenings” are putting the LINK price under pressure. Intense whale interest may historically be a sign of a comeback…

Altcoin market melts due to impending regulatory pressure

The altcoin market has tumbled yet again this week, amid Fed Chairman Jerome Powell’s latest statements at the hearing. As we have quoted as Kriptokoin.com, a part of the hearing was devoted to cryptocurrencies. Headlines focused on stablecoins, and Congress pointed to tougher and tighter cryptocurrency regulations.

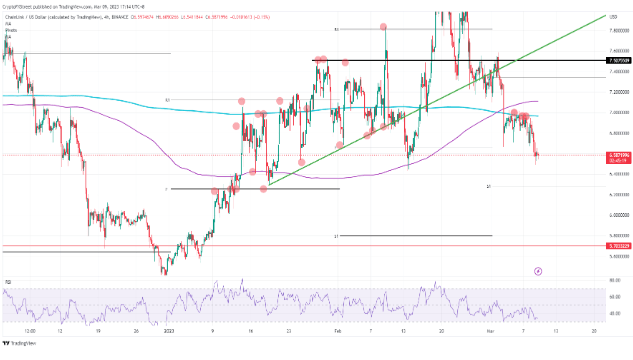

Technical analysis shows that LINK price could drop below $6 in this environment. Traders are now trading in more uncertain market conditions. Technical analyst Filip L. mentioned in his current analysis that we could see a 6% drop towards the monthly support level at $6.27. If crypto regulations in the US include decentralized altcoins, LINK’s drop could extend as far as $5.70.

On the bull side, in the market conditions that ease in the coming months, the first target of investors will be the $7 region. The RSI is a second reason why price action on LINK can climb higher as it is currently clinging to the oversold resistance. The third reason is the interest of institutional investors in Chainlink despite the price drop.

Chainlink (LINK) signals whale and corporate interest

Chainlink recently witnessed three major whale transactions that took place within 11 minutes in the final hours of Friday. On-chain analytics platform Santiment has reported whale transactions involving 11.6 million tokens worth approximately $79.7 million that have been moved to whale wallets.

Whale transactions could indicate increased institutional interest in Chainlink and potentially increase its value in the coming weeks. Such large-scale transactions are often seen as bullish signals, suggesting that notable investors are accumulating assets in anticipation of a rise in value.

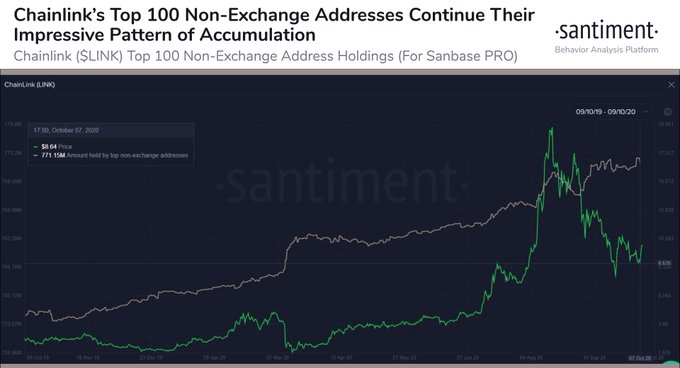

Historical data shows whales trigger price increases

Chainlink (LINK) was one of the top performing projects, with value increasing over 1,000% in 2020 alone. This impressive performance can be attributed to its unique value proposition and increased adoption among DeFi projects. But despite its revolutionary potential, LINK has been marred by whale manipulations.

One such event occurred in July 2020, when a huge whale with a wallet containing more than 700,000 LINK rocked the market by moving funds to various exchanges. This frenzy caused by whales drove LINK to over $8.5, resulting in a 50% price increase in just a few hours. Unfortunately, the whale later sold all of the LINKs in its wallet, causing a price drop that wiped out most of the gains made during the surge.