Stablecoin giant Circle announced a strategic investment in layer-1 Blockchain project Sei Netwok. Meanwhile, within the scope of the collaboration, Circle’s stablecoin is being launched in USDC Sei. Following this development, the altcoin price made a vertical rise.

The price of the altcoin that received investment from the stablecoin giant jumped!

As you follow from Kriptokoin.com, Layer-1 Blockchain Sei Network entered the market in August. The altcoin project, which gained rapid acceptance in the market in a short time, has now received a strategic investment. In this regard, Sei announced that it received a strategic investment from Circle, the issuer of USD Coin. He also shared that the popular stablecoin is natively integrated into the Blockchain. In this context, Sei made the following statement on his official X account:

Circle Ventures announced it is investing in Sei, the fastest Layer 1 Blockchain, to unlock new use cases in the ecosystem for Circle’s USDC. This strategic investment comes with Circle’s recommendation to go to market around stablecoin infrastructure. Circle Ventures’ unique approach to partnerships focuses on collaboration, ensuring both parties work hand-in-hand to create the next iteration of the internet.

https://twitter.com/SeiNetwork/status/1724794822341578891

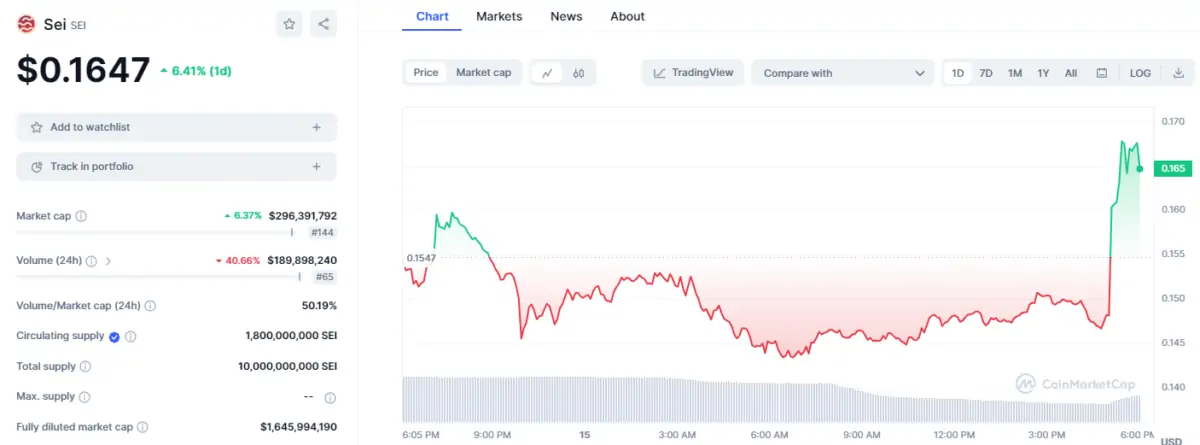

Following the news, SEI price made a vertical breakout. While SEI was at $0.1433 during the day, the investment news made its price jump to $0.167. The altcoin, which experienced a slight retracement at press time, is trading at $ 0.1647 with a 7.2% gain on a daily basis.

SEI daily price chart. Source: CoinMarketCap

SEI daily price chart. Source: CoinMarketCapWhat is the background of investment and cooperation?

This strategic investment comes with Circle’s market entry advice around stablecoin infrastructure. Circle Ventures’ unique approach to partnerships focuses on collaboration, ensuring both parties work hand-in-hand to create the next iteration of the internet. Its developers designed Sei specifically for exchanging digital assets, which is the primary use of cryptocurrencies. According to the description, this Blockchain is not only fast; It’s also the fastest. The altcoin project says it has a time to commit of 390 ms. Sei argues that it responds to the industry’s long-standing need for efficiency and scalability.

Through integration with Sei, USDC will offer developers and entrepreneurs around the world something they have never had before: the ability to build products and commerce globally, quickly and cheaply on an open platform with instant transaction settlement. USDC on Sei will unlock more efficient and accessible means for cross-border transactions. It will also improve the existing payment infrastructure. Moreover, it will significantly increase the liquidity of digital asset markets for users and developers on Sei.

Statements of the parties regarding strategic investment

Samy Karim, Sei Foundation Director, said: “The entire Sei team is excited to work strategically with Circle Ventures to create brand new use cases for USDC leveraging the infrastructure of the altcoin project. As crypto matures, stablecoins will become increasingly relevant to the overall growth of the industry. “Sei will provide the ideal scale infrastructure to meet this demand.” said.

“The Sei ecosystem aligns with our commitment to working with founders and teams dedicated to open access and programmable commerce,” said Circle Ventures Principal Wyatt Lonergan. “We look forward to working closely with the Sei team on integrating USDC for developers and users for high-speed and cost-effective transactions on the network.” said.