While the supply of this altcoin on the stock markets has reached the lowest level in five years, it is said that investors are moving away from the sale.

Altcoin price in check

Ethereum price controlled the behavior of investors and traders. Based on where it started, the world’s largest altcoin has managed to change the course of its supply distribution.

But in the last few months, external factors have played a bigger role in determining investor behavior, so much so that ETH holders are now literally taking matters into their own hands.

Ethereum holders control the supply

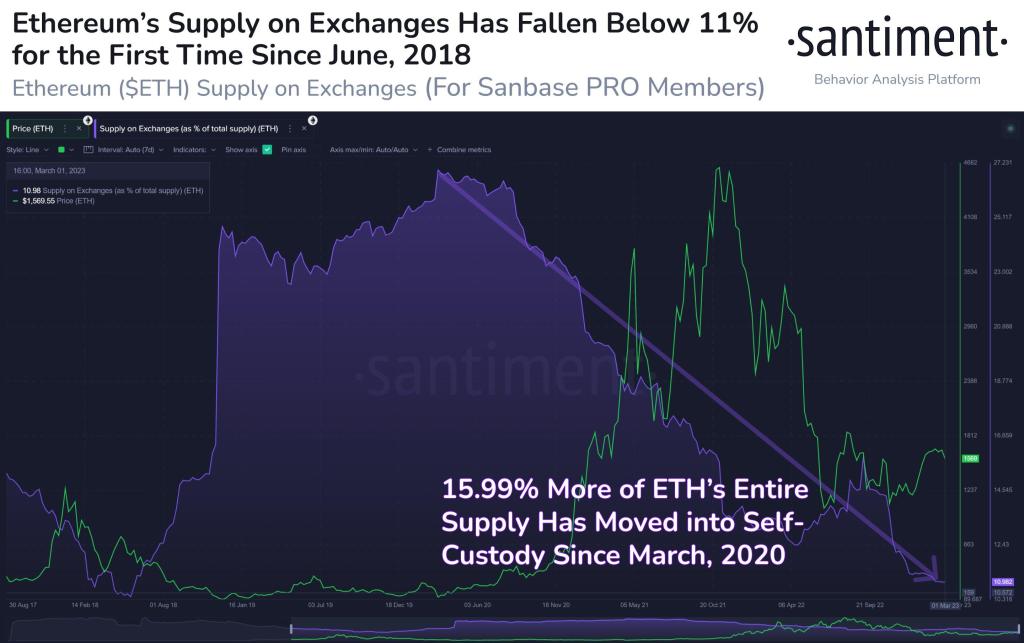

After the FTX crash, Ethereum holders seem to have become quite skeptical about the security of their holdings on other exchanges. As a result, more and more supplies have moved from exchanges and ETH holders to their own custody or cold wallets. In the three years since the Covid-19 crash in March 2020, supply on cryptocurrency exchanges has been falling. As a result, around 16% of the total ETH supply has been moved to such wallets to date. For the first time in five and a half years, the total supply of ETH on exchanges fell below 11%.

Another aspect that can be considered as the reason for the decrease in the foreign exchange supply is the possibility of accumulation. The first sign of accumulation can be counted around May 2020, just a few months after that, the bull run has started that pushed the price of ETH above $3,500. Thus, this accumulation continued until the crash in May 2022, when investors saw some selling.

The accumulation that started right after can be attributed to small investors, not whales. This is because the supply distribution in wallets holding 10,000 to 10 million coins has dropped significantly. Most of this supply was taken by small wallet holders holding between 1 and 10,000 tokens.

This suggests that whales and other major assets aren’t looking forward to a price hike anytime soon, but the move of ETH from exchanges to cold wallets also suggests that future sales are less likely.

Ethereum price remains consolidated

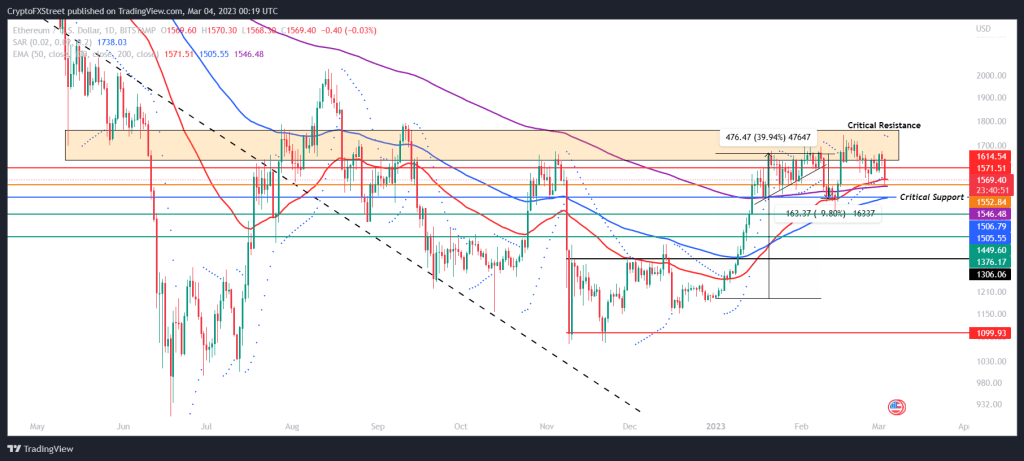

For almost a month and a half, Ethereum price has been consolidating between the critical resistance at $1,762 and the $1,552 support level. Since the altcoin has not yet crossed the six-month mark of $1,800, the fluctuations observed over the past few days have had no effect on the price.

After a 4.75% drop, Ethereum price is trading around $1,570, according to cryptokoin.com data. If the cryptocurrency doesn’t face any sell-off anytime soon, a recovery can be expected in the hands of the bulls. However, to mark a sustainable rally, ETH would need a daily candlestick above the critical resistance of $1,762 to start a rise above $1,800.

On the other hand, if the price declines further, it could test the critical support at $1,506. Losing this support would invalidate the bullish thesis and drop Ethereum price by more than 10% below $1,400.