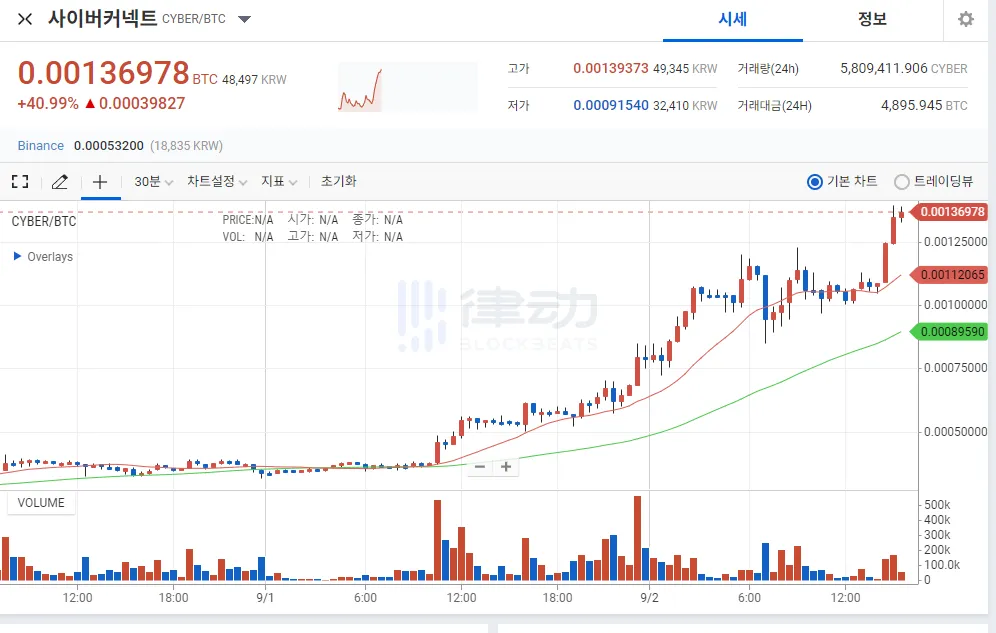

The CYBER altcoin ecosystem encountered a significant price difference between different trading platforms on September 2, 2023. According to data from South Korean cryptocurrency exchange Upbit, the CYBER price skyrocketed to 0.00136978 BTC, which equates to around 48,910 South Korean Won ($37.1) per CYBER token. This represented a staggering 167% premium rate. Meanwhile, on the Binance platform, CYBER was reportedly trading at $13.8, in stark contrast to the price on Upbit. Here are the details…

The liquidity problem led to the emergence of offers for the altcoin

The sudden price inequality caused concern within the CYBER community, prompting CyberConnect, the driving force behind CYBER, to take immediate action. In response, they released an urgent proposal, labeled CP-1, which aims to correct this liquidity imbalance in various networks, including Ethereum, Optimism, and Binance Smart Chain (BNB Chain). CyberConnect’s CP-1 proposal outlines a three-step strategy to address the liquidity issue:

- Deployment of CYBER Bridges: To facilitate liquidity between CYBER and various networks, CyberConnect plans to deploy CYBER-ETH, CYBER-BSC and CYBER-OP bridges powered by LayerZero’s ProxyOFT technology.

- Leveraging CYBER Assets: The offer includes using CYBER tokens unlocked by CyberDAO and its treasury to provide liquidity for bridges. A prudent approach is taken to minimize the risks associated with bridges. Initially, 25,000 CYBER-ETH, 25,000 CYBER-BSC and 25,000 CYBER-OP tokens will be bridged with the flexibility to adjust liquidity as needed. More importantly, this approach will not affect the total CYBER token supply.

- Balancing Liquidity: In case of liquidity imbalances between different networks, the foundation will intervene to restore balance by burning and issuing CYBER tokens. For example, if there is a surplus of CYBER-BSC and CYBER-OP and CYBER-ETH decreases, the foundation will destroy some CYBER-BSC and CYBER-OP tokens to print an equivalent amount of CYBER-ETH.

https://twitter.com/WuBlockchain/status/1697878580913652066

61,000 CYBERs used

The CP-1 proposal received rapid support from the CYBER community and around 61,000 CYBER tokens were used in favor, representing an astonishing 99.99% of the total votes. It is important to note that this proposal is a one-time exception to the usual DAO 7-day voting time policy due to the critical nature of the situation. Voting for the proposal has ended. As of the latest available data, the price of CYBER on the Binance platform was tentatively at $13 while on the Upbit platform it was reported as 0.00121892 BTC, indicating that the CP-1 offering may have already started to have an effect on stabilizing the price of CYBER on different trading platforms.

CYBER chart on Upbit

CYBER chart on UpbitUnexpectedly, CyberConnect later admitted to a bug in the CP-1 proposal snapshot, where the intended use of Community Treasure was mistakenly shown as a much larger figure than intended. The CYBER community will closely monitor the implementation of CP-1 and the impact of CYBER on the liquidity balance in the coming days as it tries to address the price discrepancies that have plagued the market recently.