Bitcoin (BTC), the largest cryptocurrency with its market value, has been going through a difficult process for the last 2-3 days. Bitcoin slumped to a two-month low on Friday and escaped from a tight price range as it has fluctuated between $22,500 and $22,200 since March 3. The coin was affected by many factors, notably the bankruptcy of Silicon Valley Bank (SVB). So, what do analysts expect for BTC? Here are the comments from different experts on the biggest crypto…

Pentoshi and two analysts warn of Bitcoin drop

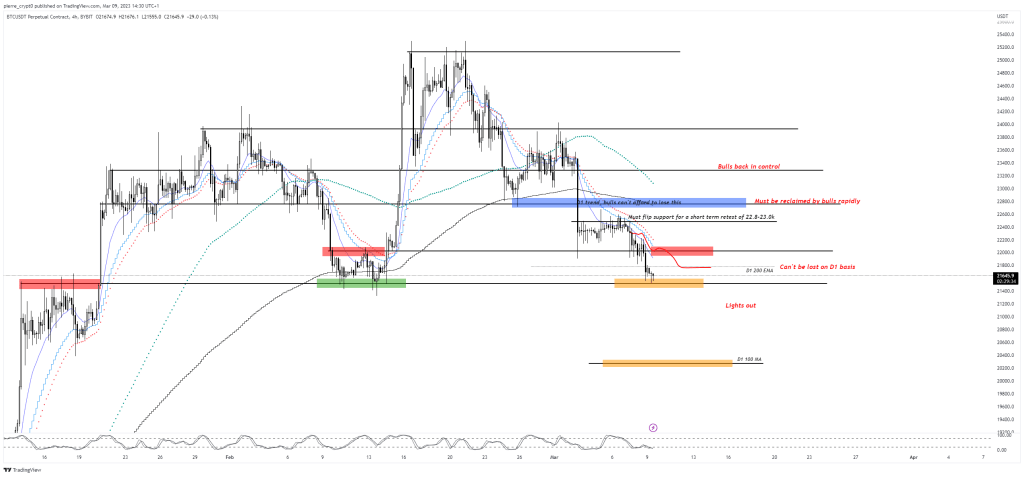

Bitcoin is changing hands at $ 20,400 with an increase of 1.4 percent in the last 24 hours. Analyst Pentoshi was among those who warned that support could come next. In an update on the Bitcoin forecast, the analyst stated that “between $19,700 and $20,500” things could “get ugly.” As we have also reported as Kriptokoin.com, BTC is currently trading in this range. A chart accompanying the analysis showed the importance of the current spot price zone within Bitcoin’s wider range.

On the other hand, trader and commentator Nunya Bizniz has flagged a similar bearish signal that is currently playing in the form of Bitcoin’s 200-day exponential moving average (EMA). He warned that, based on historical patterns, there was clear room for losses. The 200-day EMA is also on the roadmap of popular trader and commentator Pierre, who concluded that if a drop now occurs, the BTC/USD pair can very little prevent it from falling to the 100-day MA.

Nicholas Merten drew attention to the FED statements

DataDash host Nicholas Merten said in a new video update that the FED could once again wreak havoc in the crypto industry by continuing to raise interest rates as an inflation-fighting tool. As it is known, on March 8, the Chairman of the US Federal Reserve (FED) Jerome Powell spoke. Merten said that Powell’s speech would cause Bitcoin to drop below $20,000.

Due to Powell’s speech and other reasons, BTC fell to $ 19,000 for a short time. Merten also notes that the past few weeks have proven how interconnected the cryptocurrency is with traditional markets, and that Bitcoin bulls should be happy to keep BTC between $13,000 and $14,000 if it’s going to drop that low. Because, according to the analyst, these levels may be suitable for buying.

Jason Pizzino remains bullish for Bitcoin

Analyst Jason Pizzino told his 282,000 YouTube subscribers that while Bitcoin continues to rise in the long run, the leading crypto asset could drop by about 15 percent from current levels in the short term to below $19,000. Prices below $22,000 present a savings opportunity for Bitcoin, according to Pizzino. The crypto analyst also says that if the asset falls below $18,500, the bullish thesis for Bitcoin in the long run will be invalid. In general, the analyst considers the $18,000 to $22,000 range to be among the best buying opportunities.

Analyst pointed to $27,000

While BTC is currently on the decline, some analysts seem to have not lost hope. Analyst Captain Faibik predicted that BTC has the potential to reach $27,200 in case of a bounce back. The analyst supported a potential bounce situation if the bulls recapture and defend $22,000. Overall, the BTC chart shows that BTC is touching the lower Bollinger bands, so the market could correct prices and BTC could rise. If the market improves prices and BTC rises, it may be possible for BTC to surpass Faibik’s suggested levels.

Gareth Soloway: More falls are coming

Finally, another analyst warns that a bigger drop in BTC is imminent. As the Fed’s policies and industry turmoil continue to stir up risky assets, InTheMoneyStocks Chief Market Strategist Gareth Soloway warned there could be more downside for Bitcoin and other cryptocurrencies. Speaking to Kitco News, the analyst denied claims that Bitcoin has bottomed when asked if the continued consolidation signals a recovery. The analyst used the following statements:

The charts aren’t saying much right now, but the market has some big headwinds out there to digest. Investors should be very cautious after the Fed signaled that it would raise interest rates. We’ve been entering this bear market for about a year and a half. This recession means perhaps a year and a half of recession before Bitcoin rises to the moon again.

Gareth, who previously said that Bitcoin will drop to $20,000, stated that the asset will likely fall to an upper $13,000 target or a low $9,000 target. Referring to previous bear markets and considering the unique nature of current market drivers compared to previous bear markets, he also predicted that it would take longer for Bitcoin to transition into a bull market.