After the dramatic collapse of cryptocurrency exchange FTX, a distrust of crypto exchanges arose. Realizing that this issue would have a serious impact on them, Binance CEO Changpeng Zhao tried to take reassuring steps. However, it seems that this has not been fully achieved. Because, in the days after the FTX crash, some altcoins were withdrawn by Binance users.

Bitcoin and these altcoins are withdrawn from Binance

As you follow on Kriptokoin.com, FTX collapsed, putting the entire market into a deep crisis. While Bitcoin and altcoins were preparing to rally after the US CPI, they faced hard selling. Now the effects of this collapse are spreading to the entire market. FTX closed customer withdrawals and eventually filed for bankruptcy protection. That’s why crypto’s net outflow has been industry-wide.

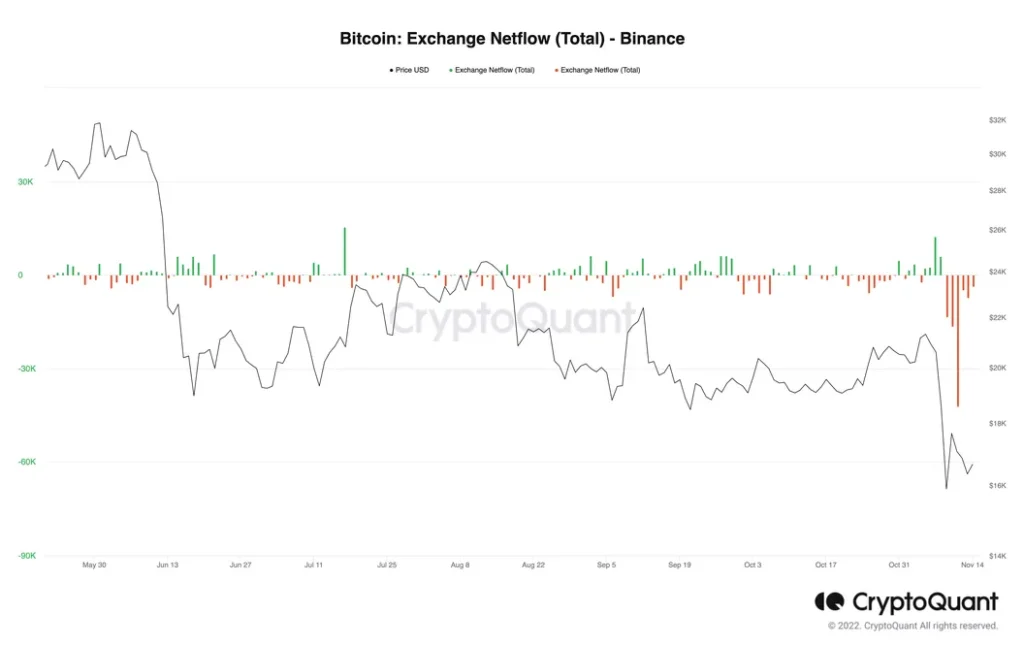

Bitcoin exits on Binance / Source: CryptoQuant

Bitcoin exits on Binance / Source: CryptoQuantThe world’s largest cryptocurrency exchange, Binance, witnessed record levels of Bitcoin, Ethereum and stablecoin withdrawals, along with the explosion of rival exchange FTX. According to data from CryptoQuant, a net outflow of $81,712 Bitcoin ($1.35 billion) has been received from Binance in the past six days. This means that more than 15% of the roughly 500,000 Bitcoins on its exchange were withdrawn from the platform. In addition, customers withdrew a net 125,026 Ethereum ($155 million) and $1.14 billion stablecoins from Binance in the same period.

Appearing on a Twitter space Monday morning, Binance CEO Changpeng Zhao called for calm. He said that a ‘slight’ increase in withdrawal speed is normal when crypto prices fall.

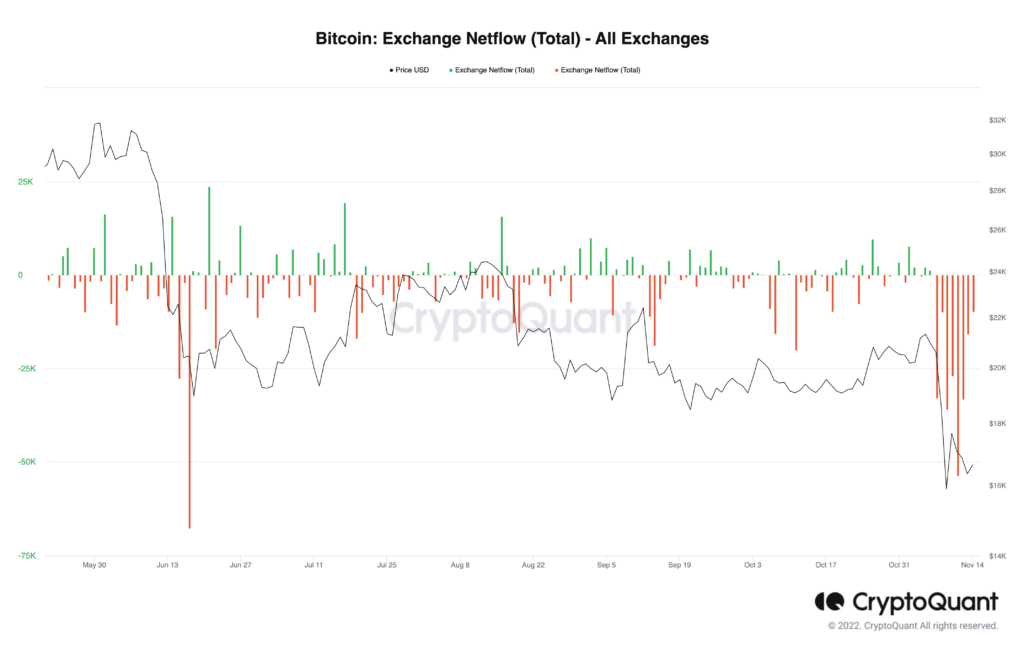

Bitcoin exits from all crypto exchanges / Source: CryptoQuant

Bitcoin exits from all crypto exchanges / Source: CryptoQuantThe collapse of FTX seriously affected other exchanges

Coinglass data shows that customers have withdrawn nearly 200,000 Bitcoins from exchanges in the past seven days. This reduced the level of Bitcoin held on exchanges to 1.88 million. With this percentage, withdrawals have become an industry-wide issue. Coinbase, Gemini, and Kraken are among the crypto exchanges that have seen similar percentage drops to Binance.

The rapid exits were caused by the explosion of one of the largest exchanges, FTX, before filing for bankruptcy last week. Speculation about the company’s finances has risen after a CoinDesk report found gaps in the balance sheet of FTX sister company Alameda Research. Customers struggled to quickly withdraw funds from FTX. Thus, this also caused a liquidity crunch.

Within days, FTX saw its Bitcoin balance drop from around 20,000 to just one. Binance made an attempt to buy FTX earlier last week. Accordingly, he signed a non-binding letter of intent. However, he backed out of this deal after 24 hours. Binance has not yet made a statement or comment on the subject.