Bitcoin price is showing indecision as it trades at roughly $28,000. On-chain metrics reveal why horizontal movement dominates. It also indicates that a sharp move in BTC is likely to occur soon, according to crypto analyst Akash Girimath.

Bitcoin price action collects all profits and losses

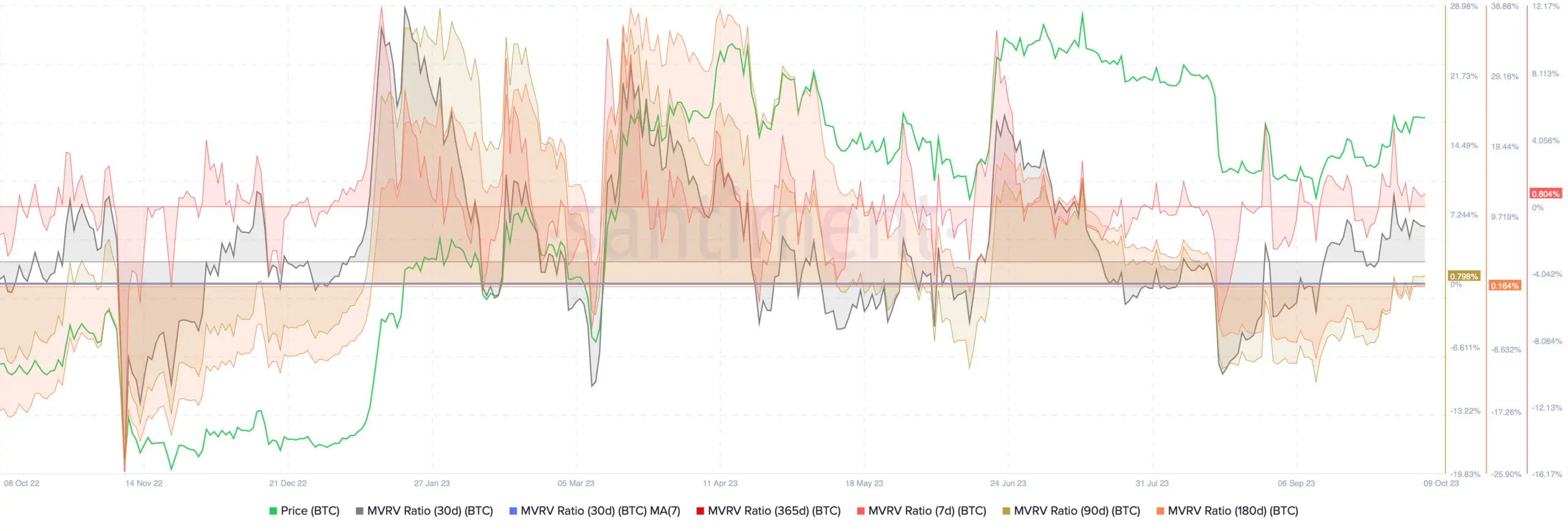

As you follow on Kriptokoin.com, BTC price increased by 12% last month. BTC is currently trending sideways at $28,000. However, Santiment’s Market Value to Realized Value (MVRV) index shows that owners are neither at a profit nor at a loss. This index measures the average profit/loss of investors who purchased BTC over a certain period of time. The 7-day MVRV provides results for holders who purchased BTC over the past week. Currently, the 7-day, 30-day, 90-day, and 180-day MVRV are all trending near 0. This means BTC holders are effectively in a no-profit, no-loss situation.

If there were many investors in profit, the market could form a top as these investors took profits. Conversely, if there were a lot of unrealized losses in the market, long-term holders could potentially buy the dip, triggering a rally. Since neither is true, the directional trend for Bitcoin is unclear.

BTC 7, 30, 90, 180 day MVRV

BTC 7, 30, 90, 180 day MVRVA closer look at BTC’s directional trend

Bitcoin investors should not ignore the macro outlook, especially after the October 6 employment report. This event showed that 336,000 jobs were added in September, much higher than the forecast of 170,000. Therefore, this significant macroeconomic event took the market by surprise. It also caused the US Dollar to rise. These developments triggered a short-term decline in risky markets.

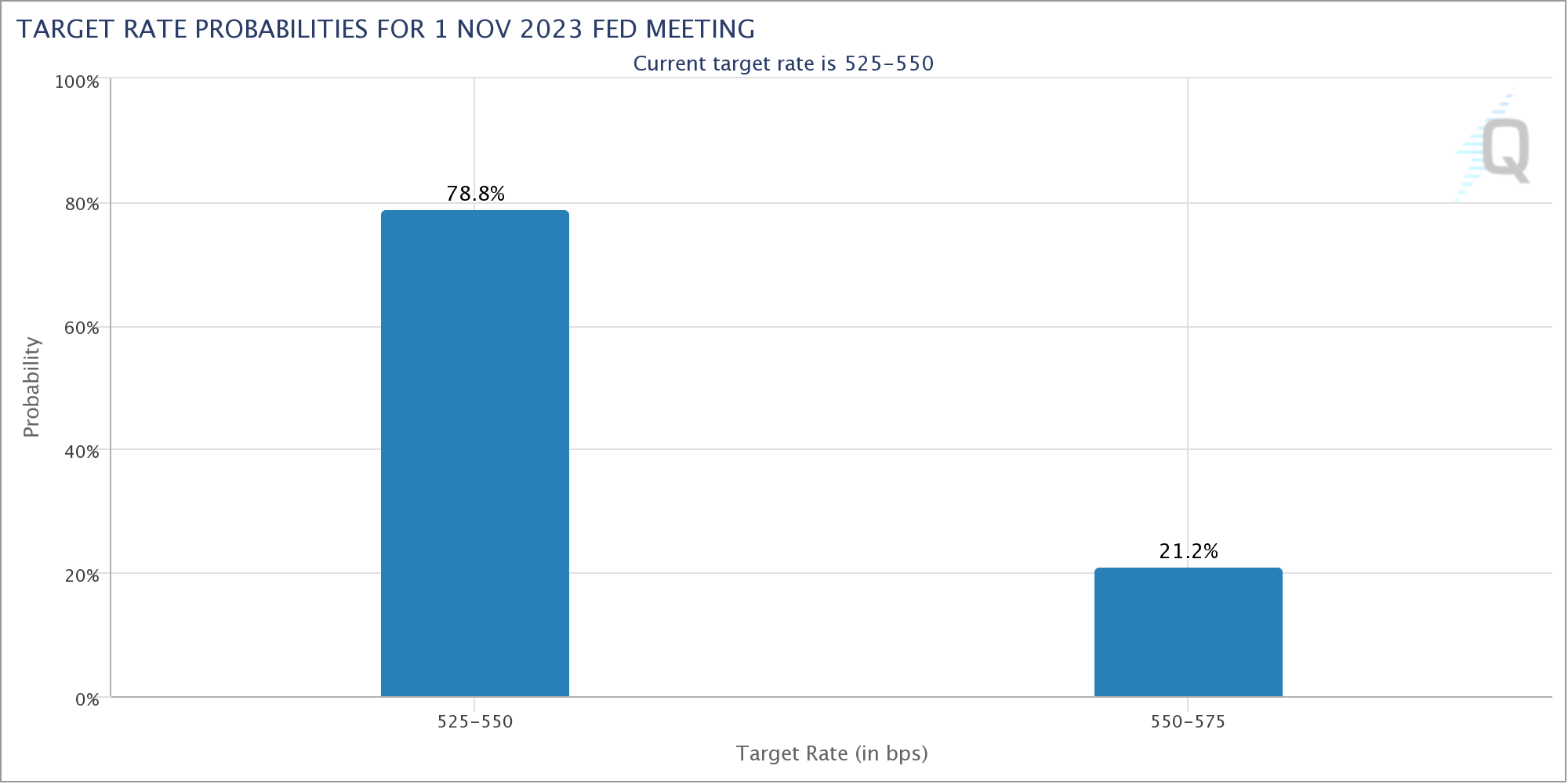

As a result, the release of Federal Open Market Committee (FOMC) minutes on Wednesday is key as it could further reinforce Federal Reserve Chairman Jerome Powell’s idea of another interest rate hike in November. Earlier this week, the CME FedWatch Tool was showing a 30.9% probability of a 25 bps rate hike. After the last employment report, this rate dropped to 21.2%. The majority still predict that the Fed will keep its policy rate between 5.25% and 5.50%.

CME FedWatch Tool

CME FedWatch ToolIn Jackson Hole, the Fed hinted that another interest rate increase could be made in 2023 if the data warrants. Considering the latest jobs report, it’s possible Powell could strengthen this idea. This is likely to provide further windfall to risky assets. Meanwhile, although NFP numbers are important, inflation figures and the Core PCE Price Index to be announced on October 11 and October 27 will play an important role in the Fed’s interest rate decision on November 1.

Bitcoin technical data is hesitant but…

BTC price is trading below $28,352, the midpoint of the 21% collapse that occurred between July 13 and September 11. Both the Relative Strength Index (RSI) and the Awesome Oscillator (AO) are yet to show signs of decline. In this case, a move north is more likely for Bitcoin price. The target for bulls in this direction will be buy-side liquidity, which stands above the higher swings that occurred between July 20 and August 8. This move will mean an increase of approximately 9% in total.

The SEC’s approval of a spot Bitcoin ETF remains a wild card scenario. It is possible that this could send the Bitcoin price well above $30,000 and potentially to $35,000 or $40,000. As we stated above, such a scenario is unlikely. However, the chances of it happening are never zero. On the other hand, if the Fed approves a rate hike at the FOMC, the short-term impact of this news could push the Bitcoin price lower to gather buy-side liquidity, which is sitting around $24,900.

BTC 1 day chart

BTC 1 day chartFollow us on Twitter, Facebook and Instagram and join our Telegram and YouTube channels to be instantly informed about the latest developments!