Altcoin BNB stays below $245 as key metrics gave mixed signals towards the weekend. Looking at Kriptokoin.com, the H-4 market structure was in a bearish trend at the time of writing. On the other hand, the futures market saw a large decline in Open Position.

New trajectory for altcoin BNB

In July, the crypto market mainly talked about the legal acquisition of Ripple Labs. Also, Bitcoin’s [BTC] price action was pioneering. Ripple Labs’ legal gain allowed Binance Coin [BNB] to surge above $250. However, recent BTC price movements are significant. Also, next week’s Fed decision is keeping the bulls from breaking the $245 barrier.

Meanwhile, BTC has yet to register a strong corrective recovery from its lows. It has struggled to close daily candlestick sessions above $30,000 in the past few days. This trend will reinforce the bearish trend in altcoin BNB’s H4 market structure by the end of the week.

Will the $245 resistance continue?

Chalked lower lows and lower highs following the price drop from $260 turned the H4 market structure trend bearish. The bulls can only start an uptrend if they surpass the recent low of $247.

However, the $245 resistance has blocked further rallies since Monday (July 17). If BTC loses the hold in the low range, there is a possibility of a drop. BNB will likely retest the $240 or $238 low range. In other words, the $245 roadblock is likely to continue if BTC fails to reverse its recent losses. Conversely, a close above $245 followed by a clearing of a lower high of $247 will lead BNB to target the $250 threshold again.

On the other hand, the RSI (Relative Strength Index) has fluctuated near the neutral point in the past few hours. It shows that prices can go both ways, as the buying and selling pressure is almost equal. In addition, the CMF (Chaikin Money Flow) recorded a decline, which indicates that capital inflows are declining.

Open Position ratio decreased

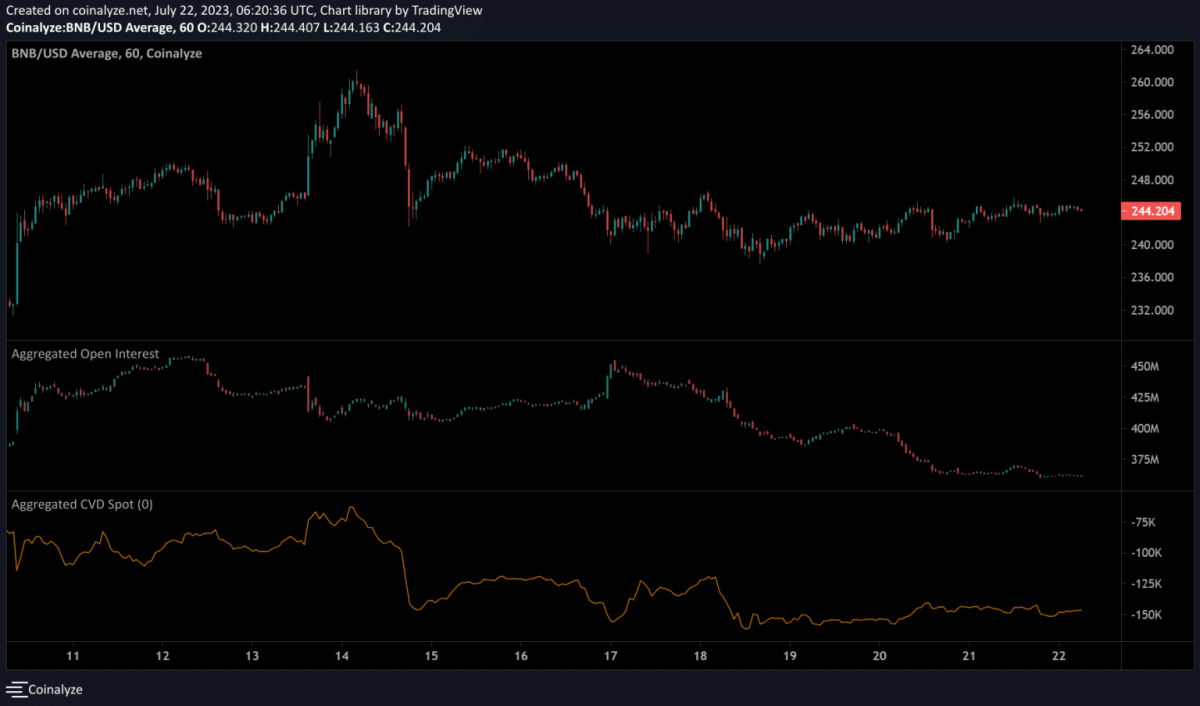

On the 1-hour chart of Coinalyze, Open Interest (OI) rates dropped from $450 million on July 17 to approximately $360 million at time of writing. The massive OI alongside the drop in CVD (Cumulative Volume Delta) marks a drop in demand in the futures market as BNB has been firmly consolidating between $240 – $245 since July 17. However, both OI and CVD were stable at the time of writing. This points to a possible price pivot at $245, which could mean a breakout or rejection.

However, altcoin BNB has recorded more short liquidation over the past 24 hours. According to Coinalyze, $39,000 worth of short positions were liquidated, versus $10,000 for long positions. Accordingly, this means a slight bullish feeling. The above measurements are giving mixed signals. Accordingly, it is necessary to be careful before making a move. It is also important to follow BTC price movements.