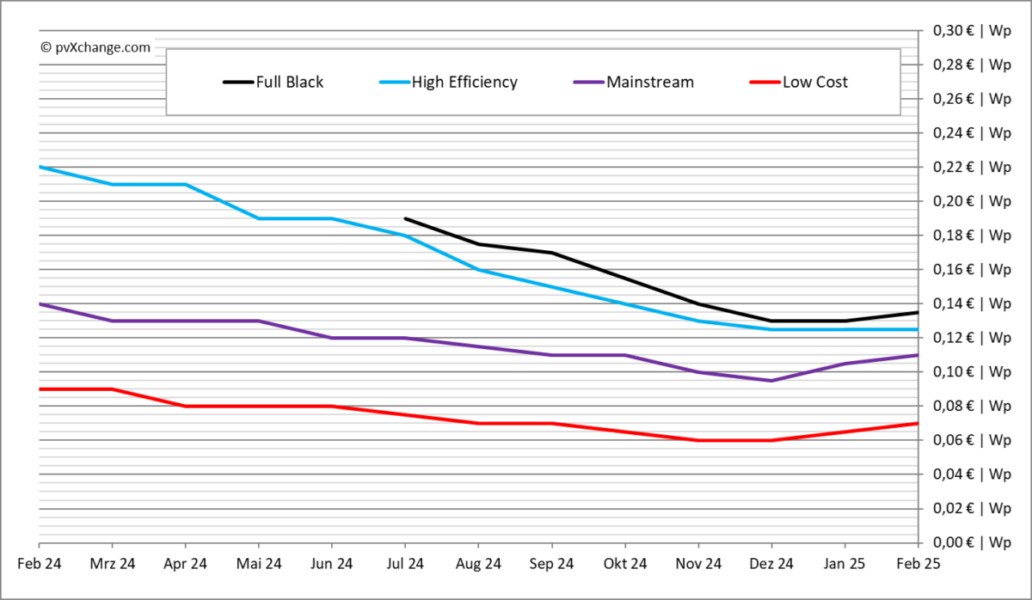

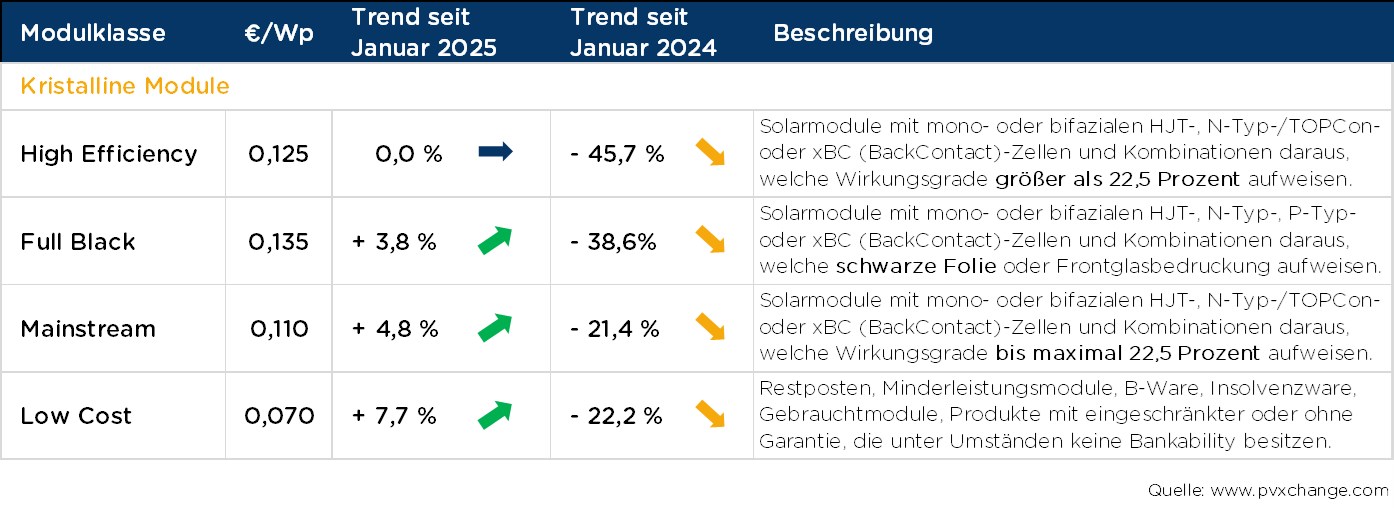

The solar panel prices have ended in a decline tendency for more than two years. At the beginning of the year, the prices watching the horizontal, recently started to rise again. In particular, the increasingly high -efficiency panels become less present, causing some distributors to stock up with the expectation of increase in price. Experts predict that prices will gradually increase until the beginning of the next quarter.

The solar panel prices have ended in a decline tendency for more than two years. At the beginning of the year, the prices watching the horizontal, recently started to rise again. In particular, the increasingly high -efficiency panels become less present, causing some distributors to stock up with the expectation of increase in price. Experts predict that prices will gradually increase until the beginning of the next quarter.Prices went to rise

According to the transfer, the panel stock, which is sold at discounted prices in the market, is rapidly running out. The main reason for this is the fact that production cuts create an artificial famine by lowering the supply. In addition, the supply of high -efficiency panels is not expected to improve in the short term. Many sellers, while stocking to assess the supply deficit, this can lead to prices to continue to rise steadily.

Large -scale solar projects are less affected by sudden price fluctuations due to long -term planning. However, the supply of new panels for medium -sized solar energy systems may be delayed until April or May.

Large -scale solar projects are less affected by sudden price fluctuations due to long -term planning. However, the supply of new panels for medium -sized solar energy systems may be delayed until April or May.On the other hand, the decrease in production throughout the sector affects all segments. Since the module manufacturers share the same supply chain, the decrease in production is reflected in all panel dimensions. Some Chinese manufacturers have not produced a single panel since the New Year, and China remains unclear when they will return to production after the New Year.

There is a serious supply surplus

Global module demand is expected to increase, the growth rate is estimated to fall from 25-30 percent to 8-12 percent band. The current production capacity is still a serious supply surplus, watching at 1,400 GW levels for 660-700 GW demand as of 2025.

Global module demand is expected to increase, the growth rate is estimated to fall from 25-30 percent to 8-12 percent band. The current production capacity is still a serious supply surplus, watching at 1,400 GW levels for 660-700 GW demand as of 2025.Especially in Europe, political uncertainties and new regulations suppress the demand for solar energy. Germany’s 15 GW capacity added in 2024 is expected to decrease by 10 percent this year. In 2025, energy storage and flexible consumption systems will come to the fore.

In the coming period, not only panel prices, but also the general economy of systems will gain more importance. The quality losses during the low price period have made the reliability of the modules questionable. However, with the rise of prices, it is expected that manufacturers will turn to better quality raw materials and increase performance reliability.