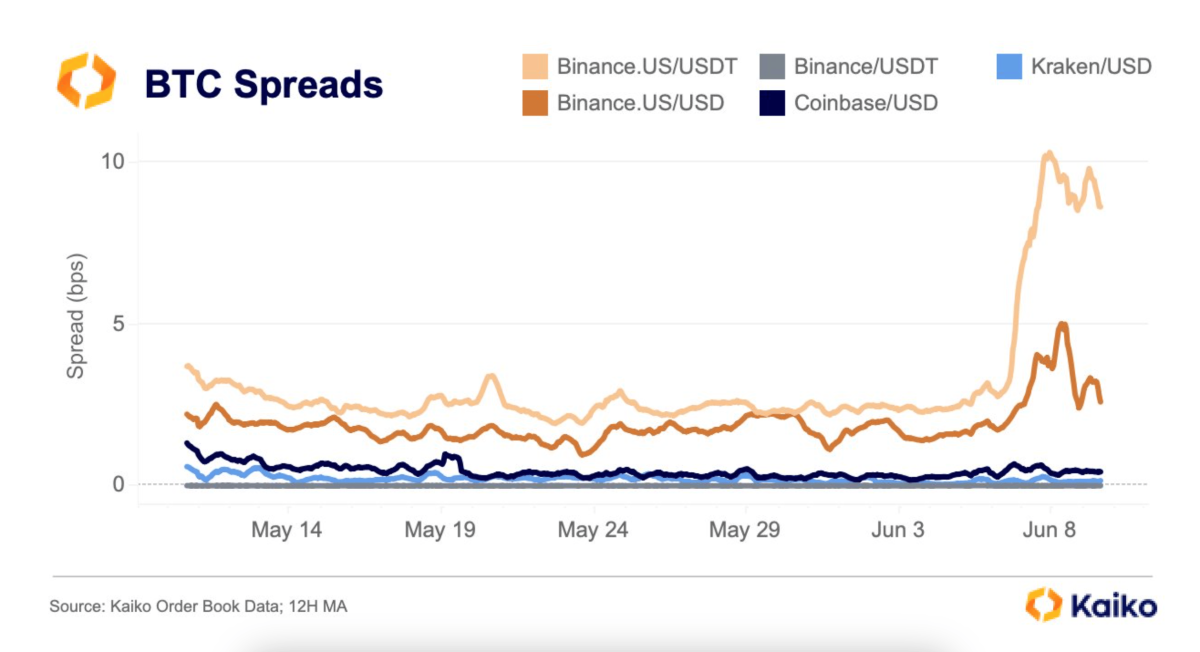

The trading price of Bitcoin (BTC) between different exchanges started to differ by up to 20x. According to reports, Binance.US is currently charging 20x more switch fees compared to its rivals Coinbase and Kraken over the past week.

Bitcoin scissors gap opens on BinanceUS

According to the report of on-chain analysis firm Kaiko, the Bitcoin spread in BinanceUS, the US arm of Binance, is increasing significantly compared to its competitors. Over the past week, BTC on BinanceUS has increased more than 20x against USDT and USD compared to other exchanges.

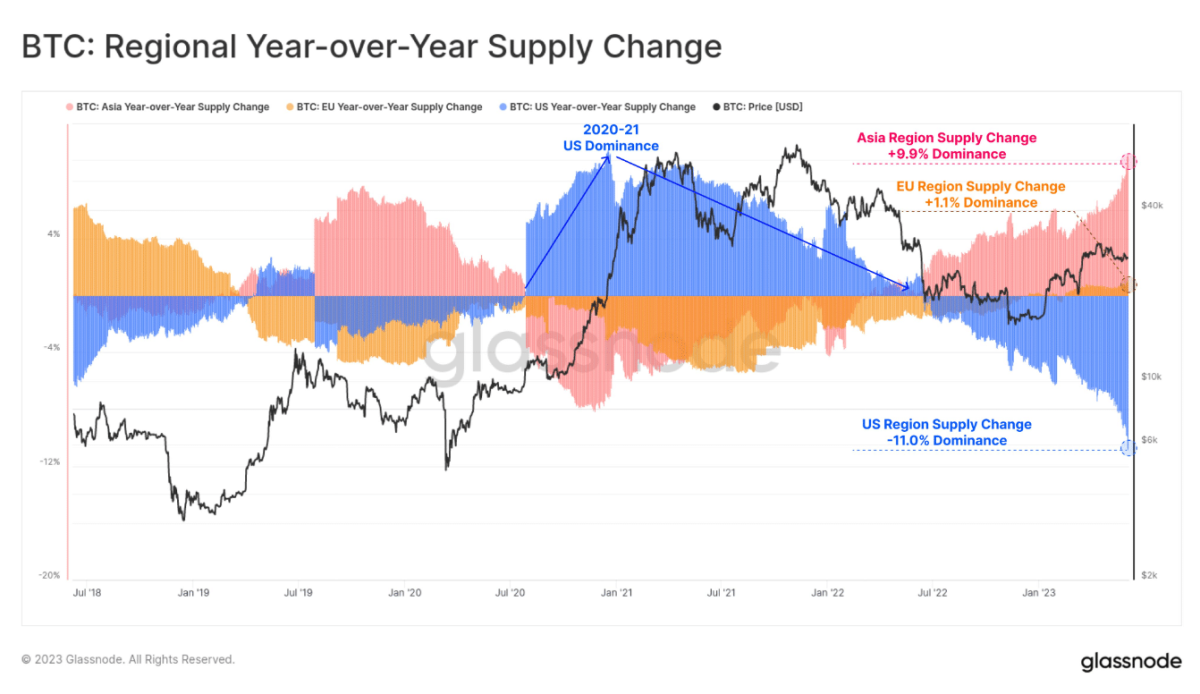

Bitcoin’s supply shrinks in the US

Recent data from Glassnode shows that the influence of the US market on Bitcoin is waning. The SEC lawsuit of the week, followed by Binance’s halting of US dollar trading, is drying up the liquidity flowing from the region. Comparison with other countries shows that European markets remained relatively neutral last year, while Asian markets were dominated by supply.

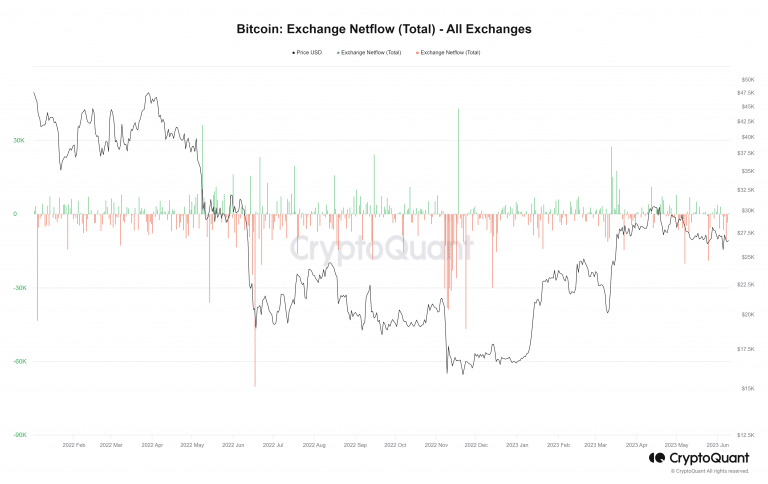

Also, according to a CryptoQuant chart, Bitcoin has recently experienced a significant outflow of funds. This shows that more BTC investors are withdrawing their holdings. The move is likely driven by increased fear, uncertainty, and suspicion (FUD). Specifically, on June 8, there was over 26,000 BTC of negative flow as withdrawals from exchanges increased. However, at the time of this writing, there was a positive flow of over 3,000 BTC.

Also, Bitcoin’s daily time chart has revealed minimal gains. At the time of writing, Bitcoin is trading around 25,500, down 4%. Also, the MACD indicator showed that the ongoing bearish trend has weakened due to this slight price increase.

What does technical analysis say about BTC?

Bitcoin (BTC) started the weekend with a dip below $26,000. The latest domino to drop was Robinhood, which took action to remove several altcoins from its platform, including SOL and ADA. BTC/USD slumped as low as $25.502 after the price peaked at $26,770.

You can take a look at the recent BTC report of JPMorgan analysts, which we quoted as Kriptokoin.com.

A look at the chart shows that the most recent decline came with the 14-day RSI falling to the bottom at 39.00. At the time of writing, the index hovers marginally above this point at 40.06. At the time of writing, the last 24-hour drop rates of the biggest cryptocurrencies by market cap are:

- Bitcoin (BTC): -3.85%

- Ethereum (ETH): -5.97%

- Binance Coin (BNB): -10.37%

- XRP (XRP): -8.38%

- Cardano (ADA): -22.49%

- Dogecoin (DOGE): -15.65%

- TRON (TRX): -13.60%

- Solana (LEFT): -23.79%