The altcoin market has gained strong momentum over the past month with prices rising more than 35%. All losses caused by the FTX bankruptcy have been recovered prior to the final correction. Now the real question is which altcoins or tokens can stand out in the company of falling BTC.D. 2 crypto analysts make the following choices in this regard…

5 altcoins that promise high profits according to Altcoin Sherpa

According to crypto analyst Altcoin Sherpa, Chainlink (LINK), Arbitrum (ARB), Aptos (APT), Binance Coin (BNB) and Injective Protocol (INJ) make up the best altcoins to watch for profitable trading. Sherpa’s review is based on the price behavior of altcoins, supported by technical indicators based on the historical behavior of altcoins.

Chainlink (LINK)

Using the weekly chart, Sherpa showed that LINK has been in a horizontal range for almost a year. It has been in this range since May 2022, attracting a large trading volume. The recent behavior of LINK is similar to when it was trading around $2.

It then remained in a tight range for almost a year before starting a significant rally that took the price to the ATH level of $52. Sherpa anticipates a repeat of such a rally as soon as LINK rises above the current range.

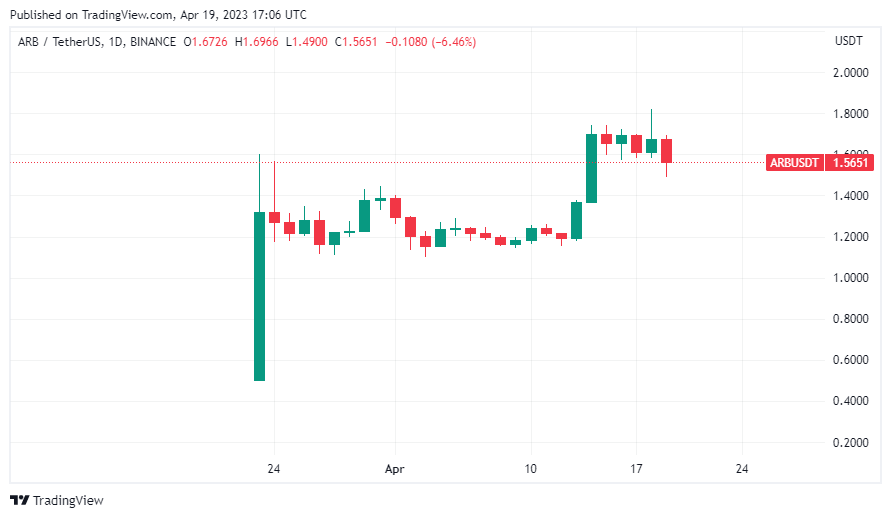

Arbitrum (ARB)

According to Sherpa, Arbitrum is trading on ideal ground for potential profit. Despite the popular altcoin already in an established uptrend, Sherpa thinks it would be a good decision to buy from a Fibonacci support around the $1.45 price zone.

This area will represent a significant pullback and price consolidation, coinciding with a volume profile supporting another leg in the price rally.

aptos (APT)

Sherpa’s view on APT is that it would be a good decision to buy around the $11.72 price zone. He points out that consolidation is important in this area, with several EMAs converging on the daily chart.

However, Sherpa thinks that activities around Bitcoin price may affect what happens with APT. He predicts that a significant drop in BTC price could cause APT to drop into the $9.62 price zone. Otherwise, the $11.72 level remains valid for a bounce.

Binance Coin (BNB)

On the weekly chart, Sherpa is identifying an area of interest that has become a major resistance against BNB price. The $345 price level represents a historically strong area for BNB and Sherpa believes a close above this level will signal a major breakout. He predicts that a confirmed break above this zone could see BNB climb to $450 in its first leg.

In the meantime, let’s note that Binance has announced the BEP2 network update, and BNB deposits and withdrawals will be suspended until this date.

Injective Protocol (INJ)

Sherpa’s selection of INJ is based on a confirmed uptrend that classifies it as one of the most bullish coins in the current Bitcoin market. The analyst expects INJ price to stop around $10.60 and advises everyone to consider taking some profit at this point.

That said, he predicts INJ is in a good position for anyone looking to take a bull run to watch out for the dips and buy them. Sherpa believes there is significant momentum in INJ’s rally that could see it making its way to higher price levels.

XRP, XLM, SHIB and ADA should not be overlooked

XLM is short for Stellar Lumens, a cryptocurrency running on the Stellar Blockchain network. The Stellar network was created in 2014 to provide fast, secure and low-cost cross-border transactions.

Unlike some other cryptocurrencies, Stellar Lumens is not based on mining but instead uses a consensus algorithm called the Stellar Consensus Protocol (SCP). The total supply of XLM is limited to 50 billion and a significant portion is already in circulation.

Shiba Inu (SHIB)

Often referred to as the SHIB, the Shiba Inu was launched in August 2020. It is an ERC-20 that runs on Ethereum and was designed to be a decentralized alternative to existing cryptocurrencies like Bitcoin and Ethereum.

Shiba Inu is about to launch its own network very soon, so investors are eagerly awaiting what happens next for this crypto project.

https://twitter.com/Shibtoken/status/1639347851477274625

Cardano (ADA)

Cardano is a Blockchain platform and cryptocurrency created in 2017 by a team led by Ethereum co-founder Charles Hoskinson. The platform was designed to address some of the limitations of existing Blockchain platforms such as scalability and interoperability using a PoS algorithm called Ouroboros.

One of the reasons Cardano has caught the attention of investors is its strong emphasis on academic research and peer-reviewed scientific principles that set it apart from many other cryptocurrencies. The Cardano team partnered with various universities and research institutions to develop the platform and ensure it is based on sound principles and best practices.

Cardano also offers several features that make it attractive as an investment, including the ability to facilitate fast and low-cost transactions, the ability to run smart contracts and decentralized applications, and a focus on sustainability and environmental friendliness.

Ripple (XRP)

XRP is the cryptocurrency created by Ripple Labs in 2012 and focused on cross-border payments. Unlike other altcoin projects, XRP does not use mining but instead relies on a consensus algorithm called the Ripple Protocol Consensus Algorithm (RPCA) to validate transactions.

Analysts think that even if Ripple loses its SEC case, the company will pay a hefty fee and continue to operate normally. XRP prices may take a hit in the short term, but analysts think it will continue to improve in the long term. As Kriptokoin.com, we have conveyed the statements made by SEC Chairman Gary Gensler recently about XRP.

Polygon (MATIC)

Also known as Polygon, Matic is a layer 2 scaling solution for Ethereum. It was designed to address some of the scalability and transaction speed limitations of the Ethereum network by providing a faster and more efficient alternative to dapps and smart contracts. The Polygon network consists of several interconnected Blockchains, allowing for faster and cheaper transactions while maintaining compatibility with the Ethereum ecosystem.

One of the reasons Matic is considered a good buy is its potential for adoption and growth. The Ethereum network has seen significant growth in recent years with an increasing number of dApps and users. As the Ethereum network continues to expand, the demand for layer 2 scaling solutions like Matic is likely to increase, potentially leading to an increase in value.