Bitcoin (BTC) may show more pain in the future. At least, that’s the message from the weekly chart momentum indicator, which is about to signal bearish for the first time in three years. Here are the details…

A development that has not been seen in Bitcoin for 3 years is about to happen.

Last week, Bitcoin briefly climbed above $25,000. However, it lost momentum towards the end of the week. This week, it is busy consolidating around $21,000. This raises curiosity as to which direction is next for BTC. Investors, therefore, listen to the opinions of experts. Some analysts, on the other hand, make various predictions based on previous price situations.

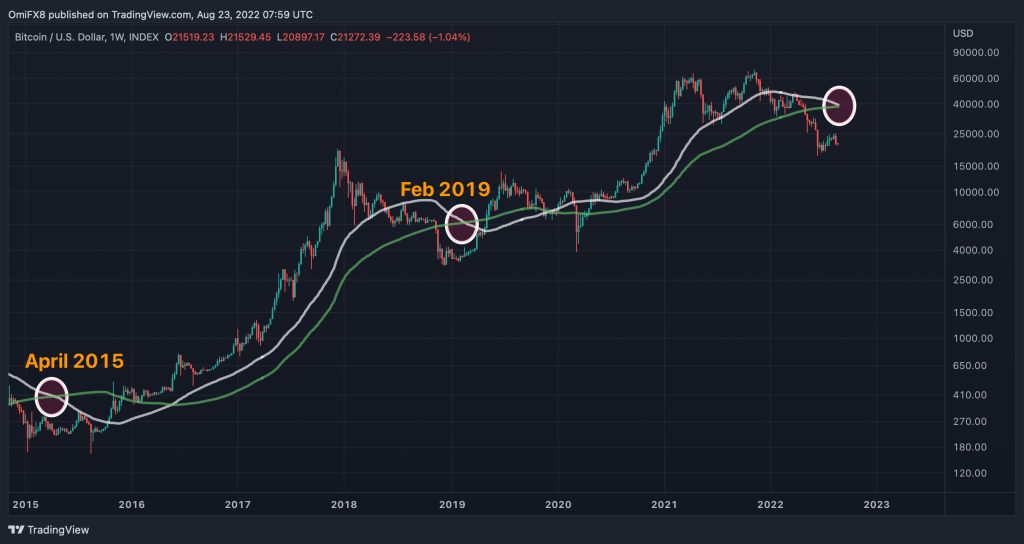

Bitcoin’s 50-week simple moving average (SMA) is heading down. According to experts, it looks like it will drop below the 100-week SMA in a week or two. It confirms the bearish crossover, the first since February 2019. While in theory the impending bearish bias would mean strengthening bearish momentum, the indicator has an excellent record of catching sellers on the wrong side of the market, similar to the negative SMA crossover confirmed on the three-day chart last month.

Expert predicted bottom and top levels for Bitcoin

The bearish crossovers of April 2015 and February 2019 proved to be opposite indicators telling you to bet against common sense. It is not yet clear whether the upcoming crossover will mark the highest sales. According to Delphi Digital, the cryptocurrency risks bottoming out in November. Andrew Krohn of Delphi Digital used the following statements:

From the previous two cycles, BTC bottomed out in the 59 and 53 weeks following the cycle peak. Based on this, we may see a bottom at the end of November 2022 and a new cycle high in August 2025.

But over the past two years, crypto has become sensitive to macro factors such as central bank policies and the traditional market. Previously, it was not so correlated with traditional factors. Therefore, past performance is no guarantee of future results.

What is the latest situation in the market?

In the meantime, Bitcoin and most of the market remained calm, as we reported on Kriptokoin.com. However, Bitcoin Cash was hacked and jumped to $135. The extreme volatility of last week that pushed Bitcoin up as much as $4,000 in a few days has not been repeated this week for now. The last significant price came on the weekend, when BTC dropped to a three-week low of $20,800. It reacted well to this drop and quickly reclaimed the $21,000 level. Since then, the asset has been relatively dormant along this line with a few minor price increases and decreases. It’s just over $21,000 as of now. Its market capitalization is still over $400 billion.