The cryptocurrency fund Grayscale Bitcoin Trust (GBTC), which currently holds 3.12 percent of the total Bitcoin (BTC) supply, or 640,000 BTC, is trading at a record discount compared to the value of its underlying assets. Here are the details…

Institutional interest “dries up”

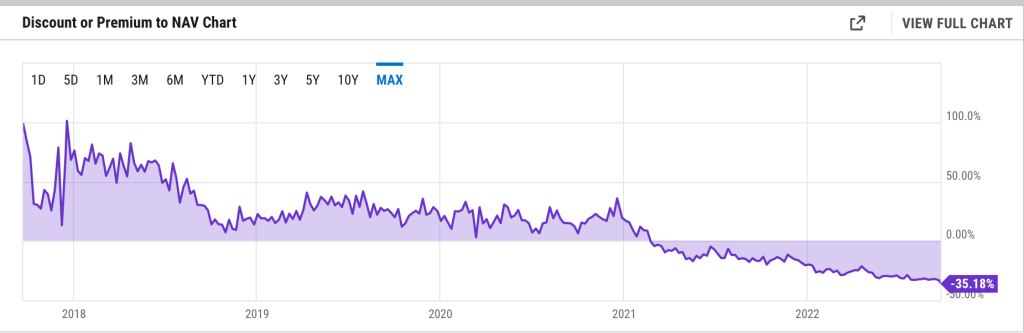

On September 23, $12.55 billion in trust funds (GBTC) were trading at a discount of 35.18 percent, according to the latest data. For investors, GBTC has long served as a great alternative to risk in the Bitcoin market, despite the 2% annual management fee. This is mainly because GBTC is managed through a brokerage account. Therefore, institutional investors got a chance to hold their BTC holdings more easily.

GBTC was generally trading at a high premium against the Bitcoin price. But it started trading at a discount after the launch of the first North American Bitcoin exchange-traded fund (ETF) in Canada in February 2021. Unlike an ETF, Grayscale Bitcoin Trust does not have a redemption mechanism. In other words, GBTC shares cannot be destroyed or created based on volatile demand, at a highly discounted price compared to spot Bitcoin.

Grayscale sued SEC for rejecting ETF application

Grayscale’s efforts to convert its trust fund into an ETF, as we reported on cryptokoin.com, failed after the US SEC rejected the application in June. In theory, the SEC’s approval could have reduced GBTC’s discount to zero from current levels. He could distribute the profits of those who bought the shares cheaper.

Grayscale sued the SEC for the rejection of its ETF application. But for many, it may take years for the court to make a decision. That means investors will be stuck with GBTC stocks, which have lost more than 80 percent from their November 2021 peak. Also, GBTC’s 12-month adjusted Sharpe Ratio fell to -0.78. This indicates that the expected return on the stock is relatively low compared to the significantly high volatility. Namely, it establishes institutional interest in the Grayscale Bitcoin Trust.

Is this a “warning” for spot Bitcoin price?

Grayscale is the world’s largest passive Bitcoin investment vehicle by assets under management. However, it is not expected to have a strong impact on the spot BTC market after the emergence of competing ETF instruments. For example, according to CoinShares’ weekly report, crypto mutual funds attracted a total of about $414 million in 2022. In contrast, Grayscale; Bitcoin faced an outflow of $ 37 million in funds from Ethereum and other coins.

Instead, daily fluctuations in spot Bitcoin price are driven largely by macro factors. A stronger US dollar is also hurting Bitcoin’s upside prospects. The US dollar index (DXY) rose above 113, a 20-year high, on September 23.

However, several on-chain metrics suggest that Bitcoin may soon bottom out based on historical data. However, from a technical standpoint, the price of BTC still risks falling into the $14,000-16,000 area, according to independent analyst il Capo of Crypto. The analyst uses the following statements:

Bitcoin is more likely to be rejected at the initial resistance of 20,300-20,600. Wait for the bounce, then exit all markets.