Falling Bitcoin (BTC) price targets continue to rise amid concerns over crypto ‘distribution’ by long-term holders. Bitcoin was stuck in a tight range on June 4 as traders continued to demand a new macro low.

Analysts are not talking about Bitcoin at all!

As you can follow from the news of Kriptokoin.com, BTC was stuck between $29,000 and $30,000 by the end of the week. BTC had managed to rebound near $31,000 the previous day, but the last Wall Street trading session of the week paid off for the bulls’ efforts. As out-of-hours markets offer weak volumes but little volatility, eyes are turned to the likely direction of an inevitable breakout. ‘Crypto Tony comments in part of a series of tweets during the day:

Bitcoin’s weekly chart looks terrible and thus the downtrend continues. I think we will consolidate a bit more in this range before finally dropping out.

In another post, the analyst repeats a target between $22,000 and $24,000 for BTC after this predicted drop:

another drop to $24,000 – $22,000 I’m looking for it, but of course deployment takes time. Therefore, we may be navigating around these support zones before any further declines occur.

Others plan to make the most of the incoming weakness, including popular Twitter account Cryptotoad, which announced a ‘low volatility’ accumulation strategy of $27,000 and below for BTC.

Bitcoin long-term holders, started selling

Other sources watching lower lows for Bitcoin range from on-chain analysts to well-known experts such as former BitMEX CEO Arthur Hayes. Adding fuel to the fire is data from on-chain analytics platform CryptoQuant, which signals that long-term holders are starting to pull their BTC out of their stash in a classic bear market move.

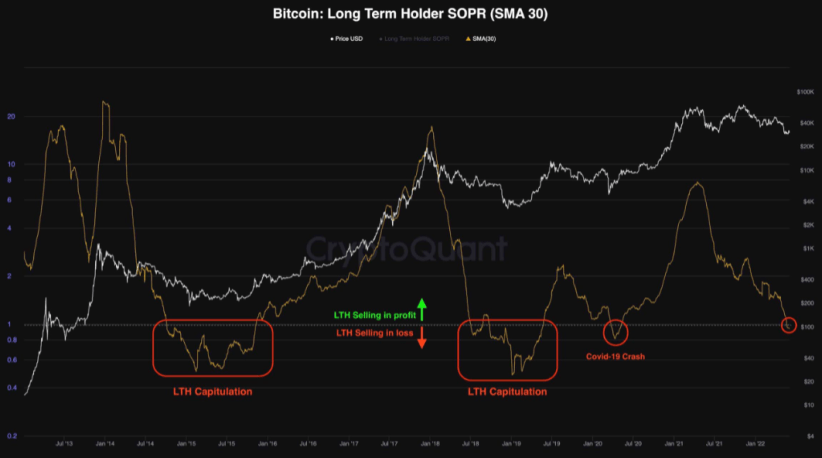

Contributing analyst Edris sums up the current situation in one of the site’s QuickTake market updates released on June 3, as “The long-term holders surrender phase has begun.” Commenting on the Spent Output Profit Ratio (SOPR) chart of long-term holders

, Edris compares conditions that preceded generational bottoms in Bitcoin history. These include the bear markets of 2014 and 2018, as well as the Covid-19 cross-market crash in March 2020, with the result saying:

Currently, long-term holders are entering the capitulation phase and selling at a loss. This indicates that the smart fundraising phase has begun and the next few months will present a great opportunity for long-term investment in the market. Such a capitulation event usually marks a multi-year low.

Bitcoin long-term holder SOPR caption chart / Source: CryptoQuant

Bitcoin long-term holder SOPR caption chart / Source: CryptoQuantExchanges still see big buys

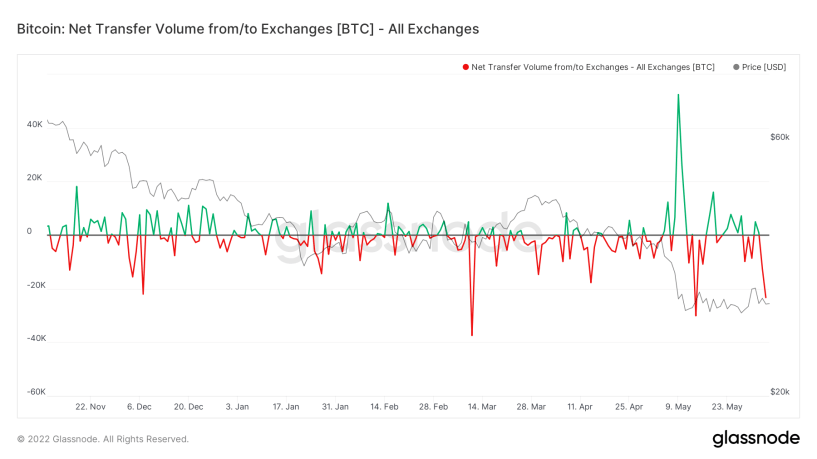

Meanwhile, as a hint that some are already buying the dip, Stock market data shows that the exits have clearly beat the entries in recent days. According to on-chain analytics firm Glassnode, net flows from major exchanges totaled -23,286 BTC on June 3, the highest since May 14.

Bitcoin stock market flows chart / Source: Glassnode

Bitcoin stock market flows chart / Source: GlassnodeGlassnode lead on-chain analyst Checkmate discussing long-term holder behavior earlier in the week in the latest issue of the newsletter ‘The Week On-Chain’ In addition, it identifies the classes of investors currently least interested in selling.

In particular, buyers from areas near November 2021 all-time highs ‘seem to be relatively price insensitive’, adding that the investor profile is increasingly composed of such stubborn hodlers. Finally, the analyst says:

Despite the continued declines in price and a massive +80k BTC spot liquidation, they are reluctant to let go of their cryptocurrencies.