Rumors that the bankrupt cryptocurrency exchange FTX will liquidate its assets with court approval may have the power to drag the market into a new collapse.

The liquidation process of FTX, which announced its bankruptcy in November last year, continues to spread fear in the crypto industry. Various speculations that users on the stock exchange may receive asset liquidation approval from the court on September 13 for compensation have brought Bitcoin (BTC) below $ 25,000, bringing to mind a possible crisis.

FTX has dominated the crypto market!

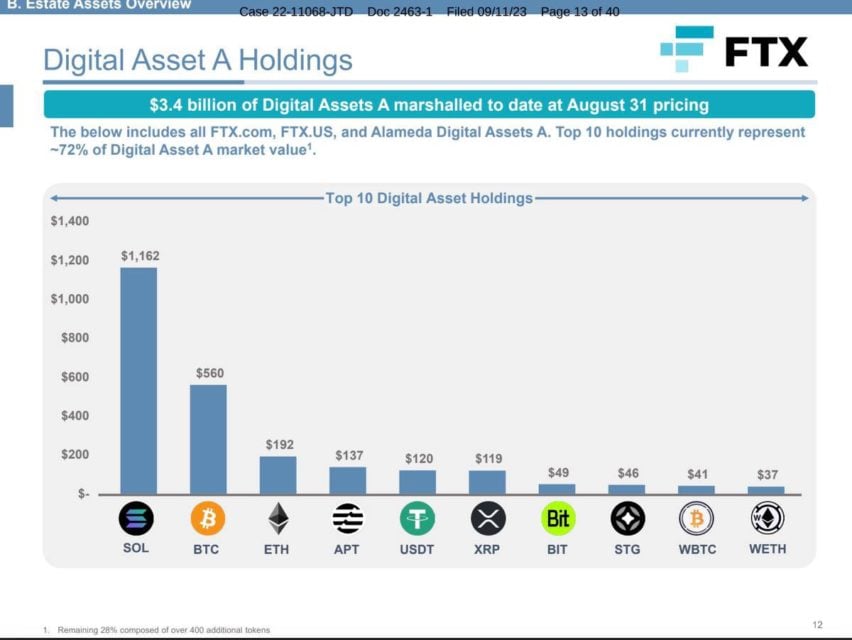

It is noteworthy that the stock market has assets worth $ 3.4 billion, according to the latest published reports. FTX holds over $3 billion in altcoins, excluding Bitcoin (BTC) and Ethereum (ETH). Solana (SOL) with a share of $685 million and FTX Token (FTT) with a share of $520 million are the cryptocurrencies with the largest value in the portfolio.

Other cryptocurrencies among FTX’s assets are stablecoins (USDT, USDC, DAI), Aptos (APT), Dogecoin (DOGE), Polygon (MATIC), Bit DAO (BIT), Toncoin (TON) and Ripple (XRP). shaped. According to the claims made about FTX, apart from crypto assets, the exchange has assets worth $1.27 billion in various fields.

FTX, which wants to pay its creditors in fiat money instead of crypto money, officially stated in its court application that it wanted to stake Bitcoin and Ethereum. In addition, the stock exchange, which wants to prevent the altcoins in its possession from losing value, stated that it does not plan to make direct sales.

FTX, which holds a large amount of crypto money in its portfolio, is currently awaiting approval. The uneasiness that this process created in the market and crypto investors literally took the reins of FTX. It seems that the slightest news from the stock market will change the direction of BTC. The leader of cryptocurrencies, which is testing below $ 25,000 due to this chaotic environment, may create uncertainty for a while longer.

Speaking exclusively to Coinkolik, Volkan Korkmaz, co-founder of Altcointurk, states that the risky atmosphere brought by FTX may first lead to a mini bull rally. Stating that market makers will not dispose of coins that are already at rock bottom prices, Korkmaz says that a small rise will not be a surprise. Making statements based on the assets held by FTX, Altcointurk co-founder said, “The increase in volatility in the market will bring with it high risk. That’s why it would be beneficial for all investors to be careful,” he says and adds:

“FTT appears to have a large amount of SOL, FTT, BTC, ETH, DOGE and APT. Therefore, it would not surprise us to see higher price movements in these coins in the coming period.”

Volkan Korkmaz, co-founder of Altcointurk

Another name that spoke specifically to Coinkolik is Can Özsüer, one of the founding partners of JW3 Community and who stands out with his analyzes on cryptocurrencies. Stating that the events experienced on the FTX side are a good trump card to direct the market, Özsüer points out that they can put the FTX chaos forward at times when the market needs to make a correction: “Market makers have a good opportunity. While there is currently a volatile market, it will become easier to chart the direction of cryptocurrencies with the FTX issue. As for the sale, I do not expect all assets to be sold in a single move. “If such a situation is going to happen, it will happen piece by piece.”

“I do not expect all assets to be sold in one move. “If such a situation is to happen, it will happen piece by piece.”

Can Özsüer, co-founder of JW3 Community

What might happen if the stock exchange’s asset sale request is approved?

In order to understand the magnitude of the issue, it may be necessary to look at the projects that were prioritized within FTX in the past processes. On this side, attention needs to be paid to LEFT and FTT. If approved, this situation, which carries a sales permit worth a total of $ 3.4 billion, could trigger a chain decline in cryptocurrencies.

Small investors in the crypto market will tend to sell transactions due to the domino effect with the FUD environment (the climate of fear and anxiety in the market). Considering that BTC is priced within a critical level range, with a possible decline scenario, the BTC price may reach $ 20,000. In fact, it is possible that this level will not only remain at $ 20,000, but will drag it to lower levels.

There is also a second option: BTC, which fell below $ 25,000 last night, actually clearly reflects the anxiety created by FTX on its price structure. If the FTX process progresses in favor of the crypto sector, these experiences may remain as a short-term decline, followed by sharp increases.

What happened with the altcoins that came to the fore with FTX?

Many assets on the balance sheet of the exchange, especially Solana (SOL) and FTXToken (FTT), were negatively affected by liquidation speculations.

According to CoinGecko’s data, with the onset of chaos, SOL dropped by more than 10 percent from $ 19.43 to $ 17.65. In this process, SOL market value decreased from 8.3 billion dollars to 7.2 billion dollars.

The cryptocurrency most clearly affected by speculations is FTT. The native token of the FTX exchange has decreased by over 16 percent, falling from $1.18 to $0.98 in the last week. Apart from SOL and FTT, other cryptocurrencies in the portfolio have their share of this chaos environment.

Sales may not start immediately as expected

Experts state that the sales panic in the market is unfounded. Even if FTX receives approval as of tomorrow, sell-side transactions may not start directly. Court documents released in previous proceedings show that FTX wants to dispose of $100 million a week of tokens if it begins sales. It is stated that this figure can reach a maximum of 200 million dollars.

FTX 2.0 may come: More than 75 investors bid!

FTX, which went bankrupt in the past period and caused a collapse in the crypto industry, is now seeing an incredible demand for its new formation. New details emerge from court documents regarding FTX. In light of these documents, it is known that more than 75 investors have been contacted for “FTX 2.0” since May.

While negotiations with investors continue, the deadline for clarification on the issue has been set as September 24. The newly launched FTX 2.0 exchange is planned to consist of FTXcom and FTX US.

New details emerged about the rescued assets

FTX has $7 billion worth of recovered assets at stake, including cryptocurrency holdings and properties in the Bahamas. The exchange holds approximately $3.4 billion worth of crypto assets. He also owns 38 properties in the Bahamas with a total value of $199 million. In addition, there is $2.6 billion in cash, brokerage firm assets and assets seized by the US government.