South Korean investors prefer to buy Cardano (ADA), Ripple (XRP) and Dogecoin (DOGE), the Bitcoin parody that was born as a joke, along with the leading crypto Bitcoin (BTC) and the leading altcoin Ethereum (ETH) and they are betting on these altcoins.

South Koreans prefer to buy BTC and XRP the most

According to a study conducted by various leading South Korean cryptocurrency trading platforms, residents mostly hold the leading cryptocurrency and are currently in South Korea. A total of 128,828 BTC is held by the Koreans, worth over $5 billion.

The second largest holding of South Koreans is XRP, Ripple’s token, which has not been able to get out of trouble with the SEC. It was a bit of a surprise that an altcoin project dealing with problems took the second place. According to the research, South Korean crypto traders currently hold the equivalent of about $4.8 billion from XRP, which is ranked 7th by market cap. Data from

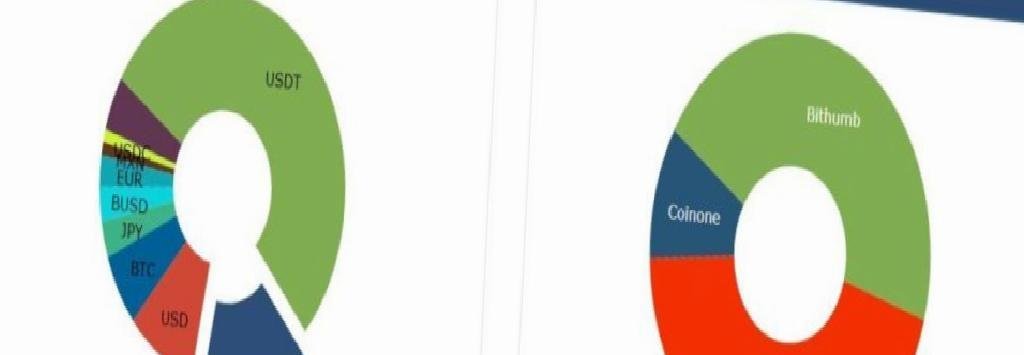

CryptoCompare shows that the country’s fiat currency, the South Korean Won, represents XRP’s second-largest trade volume, behind only Tether’s USDT. is showing. XRP is mostly traded against what was earned on Bithumb and Upbit.

As we reported on Kriptokoin.com, Ripple has announced that it has developed a new standard on top of XRP Legger, called XLS-20, to “help developers build more advanced and innovative NFT applications.” Analysts predict that the price of XRP could take a ‘big run’ as the US dollar weakens.

Other preferred altcoins: ETH, Cardano and DOGE

In particular, South Koreans have Ethereum worth about $4.5 billion and its rival Cardano (which is the fourth largest holding) They hold about $1 billion worth of tokens from the ADA. Behind ADA are South Koreans’ approximately $900 million worth of Dogecoin (DOGE).

The study’s data came from the region’s top four cryptocurrency trading platforms: Bithumb, Coinone, Upbitt and Korbit. The study found that last year, investors in the country traded over $7 trillion in crypto assets.

The amount of BTC held by South Korean investors exceeded the value of their Apple shares to reach $ 5.48 billion. However, Tesla shares held were undervalued, which was close to $17 billion.