Ethereum investment products rose 2.36 percent in assets under management (AUM) to $6.81 billion during the month of August. It outperformed Bitcoin products, which fell 7.16% to $17.4 billion. The figures appeared in a new report shared by CryptoCompare. Here are the details…

CryptoCompare report pointed to interesting data on Bitcoin and altcoins

The decrease in smart money going to BTC and the increase of ETH was also reflected in Bitcoin (BTC) and Ethereum (ETH) product transaction volumes. Grayscale’s most notable Bitcoin product, GBTC, has experienced a 24.4 drop in volume. Ethereum product GETH rose 23.2 percent. CryptoCompare’s report suggested that the reason behind the change in trading volumes is the highly anticipated Ethereum Merge. The following statements were used in the report:

In fact, even on a more granular level, none of the Bitcoin products featured in this report saw AUM or volume growth in August. We may see interest move away from Bitcoin in the short-term as Ethereum-based products take notice with the much-anticipated Merge on the horizon.

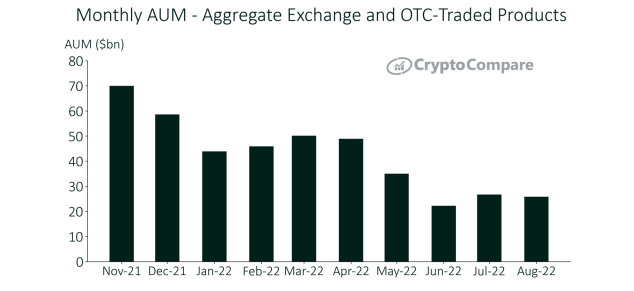

Monthly AUM figures for cryptocurrency investment products fell 4% overall. This was largely attributed to the 6% drop in Grayscale’s GBTC product. Because of the total 25.8 billion dollars of crypto money under the management of the company, 13.4 billion dollars is BTC, with 53.4%.

Other products increased

According to the report, the largest entries came from products under the umbrella of “Other”, which represents Bitcoin and non-ETH products, which reached $1.13 billion, up 12.3% in the first three weeks. Despite the bear market, a number of reputable financial institutions launched crypto investment products during the month of August. These products came in the form of exchange-traded funds (ETFs), exchange-traded certificates (ETC), exchange-traded notes (ETN), and trust products.

Among the most notable was BlackRock’s Bitcoin Trust, which prompted the “here comes Wall Street” response from former Grayscale CEO Barry Silbert. As we reported on Kriptokoin.com, the launch of Bitcoin Trust from the world’s largest asset manager follows its partnership with Coinbase to provide institutional trading services to its clients.

Charles Schwab was another financial institution entering the space this month, launching its own “Schwab Crypto Thematic ETF” labeled STCE on the New York Stock Exchange. Thus, it provides exposure to several Blockchain-based companies as well as mining and staking companies. BetaShares has launched Australia’s first Metaverse-focused ETF on the Australian Securities Exchange (ASX) and the new Metaverse and nonfungible token (NFT)-focused ETF launched by financial firm SoFi.