Even with Genesis entering bankruptcy court protection, the company’s trading arm outside of Chapter 11 still circulates money on Blockchains. This is a sign that business is still running normally, at least somehow. Here are the details…

Genesis is driving these altcoins

According to blockchain data compiled by Etherscan, a wallet controlled by the Genesis OTC trading desk sent approximately $125 million in ETH, FTM, and USDT to Coinbase, Binance, Bitstamp, and Kraken on Thursday, when the bankruptcy filing was filed. Also, in the last 24 hours, the wallet has made several more transactions, receiving approximately 50 million USDC. During Thursday’s crypto move, the wallet sent 50,000 ETH to Coinbase, 20,000 ETH to Bitstamp, and 5,000 ETH to Kraken.

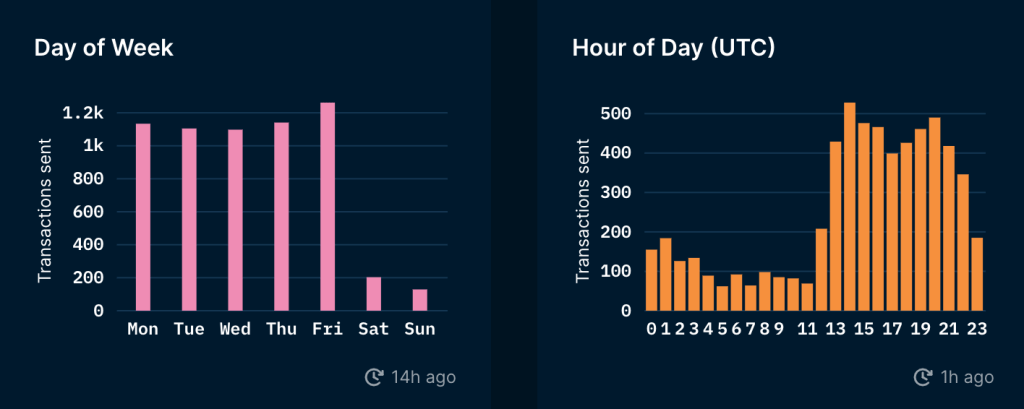

According to Etherscan, it sent approximately $7.7 million of Phantom (FTM) to Binance and $36 million of USDC to another wallet. As Nansen.ai data shows, this particular wallet usually moves coins on weekdays, so many people state that transactions are normal. Genesis’ portfolio of ten chains of at least eight unique addresses has a net worth of $307 million as of now. According to PeckShield’s data, the exchange sent 75,000 Ethereum worth $113.7 million and 4 million Tether (USDT) to Bitstamp and Kraken.

#PeckShieldAlert ~75k $ETH ($113.7M) and3.9M $USDT transferred from Genesis Trading: OTC Desk to crypto-exchanges Coinbase, Bitstamp and Kraken

~36M $USDC transferred from Genesis Trading: OTC Desk to a new address 0x81b3…543 pic.twitter.com/ngKBnBIyCA— PeckShieldAlert (@PeckShieldAlert) January 20, 2023

What had happened?

Crypto lender Genesis Global aims to obtain a resolution from the bankruptcy process within the next four months. In its bankruptcy announcement, the company said it was potentially looking into a sale or equity process to operate under new ownership. The solution from the Chapter 11 process also affects Gemini users. The company said it is evaluating options to achieve the most appropriate outcome for Genesis customers and Gemini Earn users.

CRYPTO LENDER GENESIS PLANS BANKRUPTCY EXIT BY MAY 19

— *Walter Bloomberg (@DeItaone) January 20, 2023

According to Walter Bloomberg on Twitter, Genesis plans a potential bankruptcy exit by May 19. The timeline announcement comes with Gemini co-founder Cameron Winklevoss threatening to file a lawsuit against Barry Silbert and the Digital Currency Group (DCG) if it’s a fair deal. However, Winklevoss acknowledged that the Genesis bankruptcy was a crucial step towards saving Gemini Earn user assets. Gemini’s co-founder said his company will work to hold Silbert and DCG accountable for the situation.

It is not yet clear whether Silbert will take any action regarding DCG’s subsidiaries such as the Grayscale Bitcoin Trust, the world’s largest Bitcoin fund. Meanwhile, Bitcoin (BTC) and Ethereum (ETH) are bullish despite the news of the Genesis episode 11 launch. According to Kriptokoin.com data, the largest cryptocurrency by market capitalization is currently at $ 22,600.