Crypto analyst Filip L states that SHIB price is set to burst upwards this weekend as a major event neutralizes. Also, the analyst says that Ripple price has definitively declined against the technical indicator level this week. According to the analyst, Solana price is defending the bulls with a technical handle at $90 as an anchor point. We have prepared Filip L’s analysis of SHIB, Solana and XRP for our readers.

“Shiba Inu sees bulls waiting for key risk event”

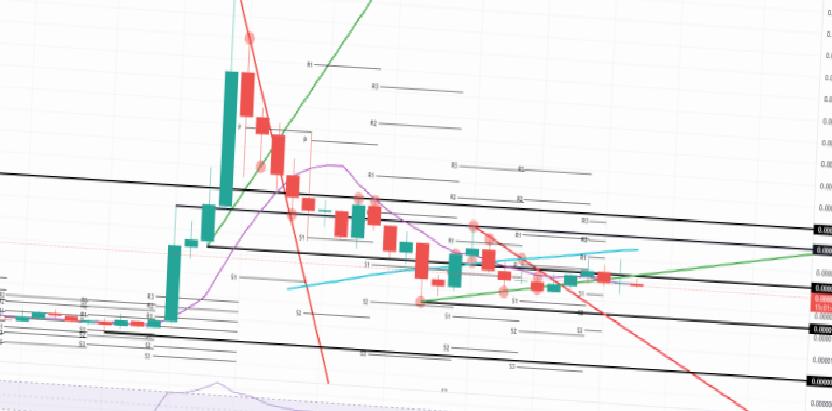

Shiba Inu (SHIB) price 55 as anchor point for a week that saw only 8% price change versus 27% It trades as a pendulum with the daily Simple Moving Average (SMA). With this significant drop in price action and the fact that the 55-day SMA is used as an anchor point, a consolidation appears to be in place. We expect a bullish boom next week as markets are ready to jump into risky trades after Macron is confirmed for another term as French president.

Shiba Inu price was trading relatively quietly against the backdrop of the previous week. It offered more than threefold variation in the previous week, with a narrow trading range of around 8%, a 27% swing from high to low during the trading week. The convergence of buyers and sellers indicates that the distribution phase is almost over and there will be a breakout transaction.

Therefore, SHIB price is in a good mood and looks set for another rally as markets in Europe’s second largest economy hold their breath with the weekend’s elections. In recent polls, the current ruling president will remain in his seat; therefore, there could be a bounce in the euro, a drop in the dollar and a surge in cryptocurrencies at the ASIA PAC on Monday morning with the tailwind of the weaker dollar. SHIB price could rally above $0.00002640 early next week and from there to $0.00003535 over the course of the week as Fed officials are in the blackout period and traders can briefly forget about central bank problems and interest rate hikes.

Consolidation could still be downside in a pure technical game as the bulls receive a rejection at $0.00002640, opening room for the bears to fill the gap and push price action back to last week’s low around $0.00002100. The mood can be adjusted to drop to $0.00001708 in total. That means a nearly 30% drop with rising headwinds and more dollar strength in the markets.

“XRP needs a cure to rebound”

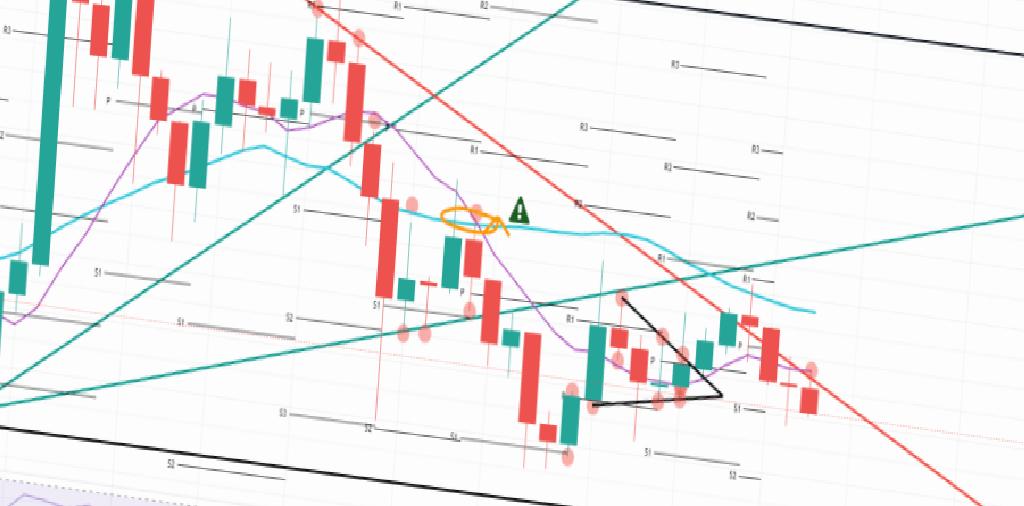

Ripple (XRP) price is unlikely to gain from dollar weakness and positive headwinds supporting price action in cryptocurrencies in general, as most other an outlier against the major cryptocurrency. XRP price seems to be hanging by a thread and looks set to form a massive 35% warehouse going into next week. With the Relative Strength Index (RSI) just below 50, the bears are holding the RSI in their favor for further downside.

Ripple price is this week, so it is not following the bullish scenario that applies to most other cryptocurrencies. Even if the risk of more tails is neutralized or reduced and the room created is filled with tailwinds, XRP cannot count on it. Instead, price action looks very heavy as the bulls rejected a break of the 55-day Simple Moving Average (SMA) at $0.7823 this week.

XRP price is plagued by continued volatility along with the earnings season, and more hawkish comments from Fed officials are scaring XRP price investors for further rate hikes, so Ripple is capping any rise for now. We expect to see another drop into the next week as XRP price seeks support near the March low of $0.6232. If that doesn’t happen, a drop towards $0.50 could be seen, where bulls should generally be concerned with getting some price action for a slowing trade and by then the RSI would have crossed the oversold area.

If the bulls come out the door and hit every possible bid in risk assets on Monday, this could be a 180 turn in XRP price with a quick retest against the 55-day SMA. Once above, the way is clear for a quick 12% bounce to the 200-day SMA at 0.8743. If this breaks, the 55-day SMA could drag and XRP could eventually break out of the death cross keeping it in bearish mode.

“Solana adjusted towards $150”

As you can follow from Kriptokoin.com news, Solana (SOL) price has decreased for two weeks in a row. While the earnings season is rocking the boat quite a bit, SOL looks set to gain ground this week, where a weekly close above the 55-day Simple Moving Average would be ideal. If traders can sit on their hands, Solana price could rally towards $146, gaining 50%.

Solana price saw its rise in March and was almost fully matched in the first weeks of April. However, the bulls plan not to let it get that far. The 55-day SMA at $100, eagerly defending $90.23, is used as a connecting point where buyers and sellers are in the distribution phase, the bulls get their hands on it later, and the bears are desperate to sell, seeing the price action move higher. It is looking for the highest price that some bulls are willing to sell at the end.

So Solana price is in a scenario that supports bulls in this technical game. Even jumping in for this trade now still makes sense, with a stop below $0.90, a trader only needs to give up roughly $10, and when the SOL price rises to $150, your trading book will have a return of $1 to $50. The 5 risk-reward ratio isn’t bad at all. If the rally has many more legs above $150, it is doubtful that the death cross and the 200-day SMA at $146 will drag the rally in the short term.

Solana bulls could settle at this $90.23 and bears could shorten the price action further. This could cause a long squeeze as the bulls stop, sell-side volume explodes and creates a nose dive towards $75.34 or even $61.44 depending on volume. Fortunately, the Relative Strength Index is already below 40, so there isn’t much room for another drop as the RSI will be ‘oversold’ until then.