Seven popular cryptocurrencies have been listed as currently “oversold” altcoin projects by a leading crypto analytics firm. These coins have lost more than 50% from their ATH levels and are showing the first signs of bullishness…

In the recession of Bitcoin these 7 altcoins are giving bullish signals

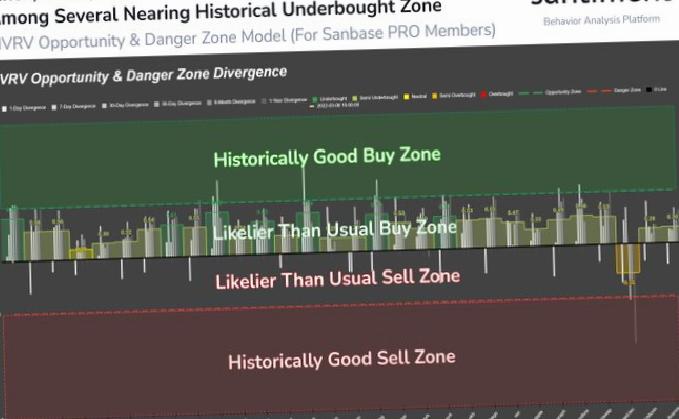

In a recent tweet, Santiment, the following crypto He shared that currencies are in “historically perfect buying territory”:

Phantom (FTM), Curve DAO Token (CRV), 1inch (1INCH), Enjin (ENJ), Chiliz (CHZ), Loopring (LRC) ) and Skale (SKL) are all in “historically perfect buying territory.

However, altcoin prices are likely to fall further, according to Santimen:

As crypto prices continued to fluctuate, cryptocurrencies took distinctly different trajectories and averaged produced markedly different results based on investor returns. We see the vast majority of cryptocurrencies as oversold using different timeframes in the results, but some additional dips are quite plausible.

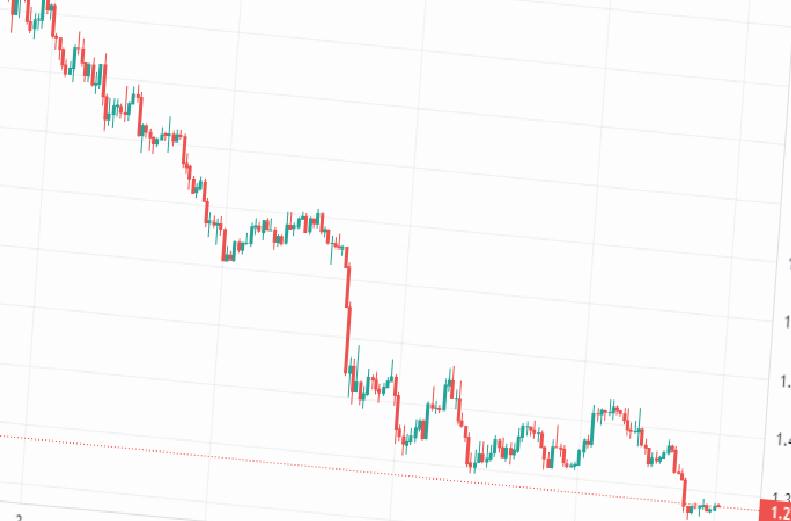

FTM, CHZ, ENJ and LRC significantly moved away from their peak prices

Phantom (FTM), a scalable smart contract-enabled Blockchain, exchange and payment protocol Loopring (LPC), fan token and platform Chiliz (CHZ), gaming-focused NFT hub Enjin Coin (ENJ), is down between 60% and 80% from its peak prices. You can reach the developments regarding the separation of Andre Cronje, the developer who dropped Fantom in double digits, which we have quoted as Kriptokoin.com.

Decentralized exchange platform 1inch (1INCH), Tier-2 scaling solution Skale (SKL), and Curve DAO Token (CRV) designed for trading stablecoins, % off ATH prices Redboard leaders who lost value between 84 and 96. According to analytics firm

, privacy altcoins Monero (XMR) and Zcash (ZEC), file storage system Aweave (AR), and micropayments network Toncoin (TON) are cryptocurrencies that put Bitcoin above $39,000. market is making “significant gains” after recovery. Bitcoin (BTC) is trading in the $39,300 region, down 6.5% at the time of writing. Since March 9, when it touched over $42, there have been $200 million in liquidations.