Blockchain analytics platform Santiment is bullish on these 5 altcoins amid the recent market-wide correction.

Santiment says LTC, SRM, RAD and these 2 altcoins are in the zone of opportunity

Bitcoin price continues its downward momentum today due to network congestion. The price is bearish again as the continued “congestion” disappoints investors and depresses market sentiment. As Kriptokoin.com, we have mentioned that the traffic is dependent on Ordinal usage on a large scale.

Santiment says that the recent Bitcoin-induced correction burns a bullish signal for 5 altcoins. In their May 9 analysis, he reported that LTC, SRM, RAD, VIDT, and HIGH are trading in the opportunity zone…

https://twitter.com/santimentfeed/status/1655817422765699072

According to the tweet, “We see tons of people starting to seep into opportunity zones as altcoins continue to sway while Bitcoin and Ethereum manage to stay afloat in their respective ranges.” LTC, SRM, RAD, VIDT, HIGH are among the coins that investors can hit the bottom, especially in the near future.

Santiment’s analysis says that selected altcoins are in heavy buy territory at current prices. According to the data, traders generally went overbought from these levels. Litecoin (LTC), Serum (SRM), Radicle (RAD), VIDT Datalink (VIDT), and Highstreet (HIGH) are altcoins that require tracking throughout the week at this point.

“Bitcoin shows an uptrend”

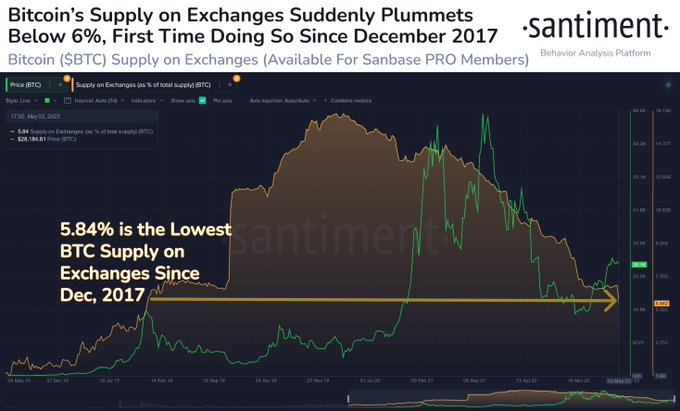

Returning to Bitcoin later, Santiment reports that the supply of Bitcoin on exchanges has been at the bottom of the last 5.5 years. This is interpreted as a potential bullish signal for Bitcoin. According to Santiment, this low level of supply indicates that users tend to keep it to themselves and have a lower risk of being withdrawn from wallets on exchanges. According to the analysis:

The amount of Bitcoin on exchanges is currently at its lowest rate since December 2017. The five-and-a-half-year low is a good sign for investors that there is increased interest in self-holding and a lower risk of being sold back into exchange wallets.

It is also stated that approximately $2 billion worth of Bitcoin was withdrawn from Binance cold wallet. With this transaction, the supply of Bitcoin on exchanges has dropped from 6.78% to 5.84%.

According to the analysis, “Binance’s cold wallet, one of Bitcoin’s biggest whales, is extremely active today. In 4 transactions, this wallet disposed of $2.26 billion worth of BTC. Bitcoin’s supply on exchanges has dropped from 6.78% to 5.84%.”

According to Santiment’s other tweets, BTC’s BitMEX funding rate has fallen sharply since heavy bets on prices in mid-March, just before prices rose. The odds of price increases increase when there is consensus that generally predicts prices will fall. Therefore, as the funding rate is low it means there is less demand in the futures market, while the possibility of BTC price increase cannot be ruled out.