In the crypto market, which has been marred by recent price fluctuations, large Bitcoin (BTC) investors, often referred to as “whales,” have shown their confidence by increasing their holdings significantly. XRP and Ethereum whales have also bought in recently. The whales seem to be collecting coins from the bottom as cryptocurrencies have bottomed out locally over the past few weeks. Here are the details…

Bitcoin whales ‘shopped’ $1.5 billion

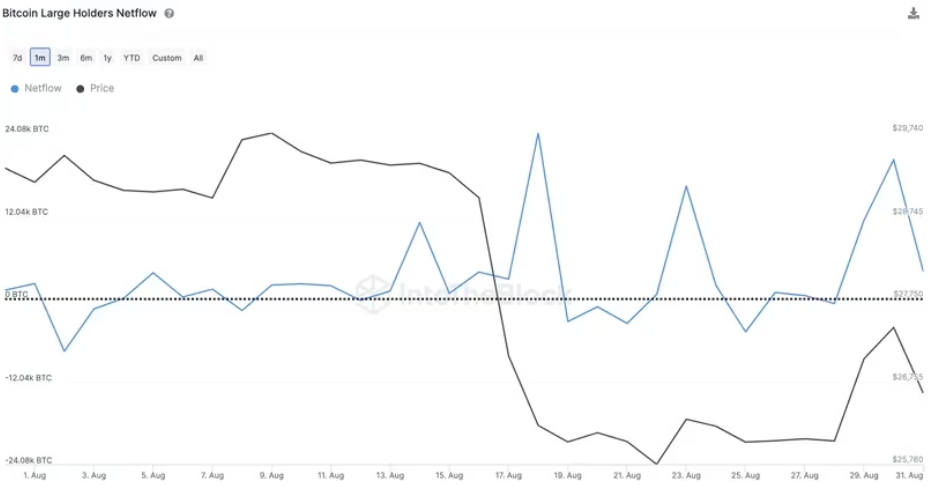

Data from crypto analytics firm IntoTheBlock reveals that these whales, which control at least 0.1% of the Bitcoin supply (equivalent to over $500 million), added a staggering $1.5 billion to their portfolios in the last two weeks of August. . This accumulation is quite significant considering that it coincides with the minimum entry to centralized exchanges. Lucas Outumuro, Research Manager for IntoTheBlock, argues that this refers to “organic purchase demand” rather than fund transfers to exchange addresses.

This surge in whale activity started after the BTC price dropped sharply below $26,000 on August 17, the lowest price since June. Moreover, following the legal victory of asset manager Grayscale against the U.S. Securities and Exchange Commission (SEC), these big holders increased their stakes. The court’s decision to review the rejection of the Grayscale Bitcoin Trust’s conversion into a spot bitcoin ETF was seen as an important step towards making BTC more accessible to a broader class of investors.

XRP and other coins, gains of Grayscale decision wiped

Despite the subsequent market correction that wiped out all gains from the Grayscale decision, the continued accumulation by whales points to growing optimism among institutional investors, especially as ETF decisions approach. In a parallel development, data from whale watching platform Whale Alert reveals significant crypto asset movements totaling over $730 million. High net worth investors transfer Bitcoin (BTC), Ethereum (ETH) and XRP to and from major exchanges such as Binance, Coinbase and Kraken. These processes include:

- 2,881 BTC worth 76,006,587 transferred from an unknown wallet to Coinbase.

- 20,799,168 worth 799 BTC was transferred to Binance from an unknown wallet.

- 2,898 BTC worth $75,364,882 transferred from an unknown wallet to Coinbase.

- 4,000 BTC worth $104,004,357 transferred from an unknown wallet to another unknown wallet.

- 4,000 BTC worth $104,057,443 transferred from an unknown wallet to Bitfinex.

- 1,500 BTC worth $39,022,239 transferred from Bitfinex to Kraken.

- 1,499 BTC worth $39,049,631 transferred from Kraken to an unknown wallet.

- Whale Alert has detected that an ETH whale has suddenly transferred 21,240 ETH worth USD 34,965,976 from an unknown wallet to Coinbase.

There is great activity for XRP

Switching to XRP, the crypto asset associated with Ripple Labs’ payments platform, Whale Alert has found movement worth about $240 million. XRP transactions spotted by the whale watching platform include:

- 29,600,000 XRP worth $15,135,963 was transferred to Bitstamp from an unknown wallet.

- 19,920,318 XRP worth $10,167,904 was transferred to Binance from an unknown wallet.

- 424,354,912 XRP worth 214,293,666 USD was transferred from one unknown wallet to another unknown wallet.

- 66,666,659 XRP (33,065,809 USD) transferred from Binance to unknown wallet.

https://twitter.com/whale_alert/status/1697811704732672203

The cryptocurrency market continues to fluctuate. At the time of writing, Bitcoin is trading at $25,851 and XRP at $0.50. However, significant moves by both large investors and high-net-worth traders reflect continued interest and activity in the crypto space. In addition, the XRP ecosystem has seen significant transfers to secure escrow accounts by Ripple, which coincided with the legal battle with the SEC. Investors are keeping a close eye on these developments as the crypto market hovers between legal actions, significant transfers and market forces. The path to $1 for XRP remains unclear.