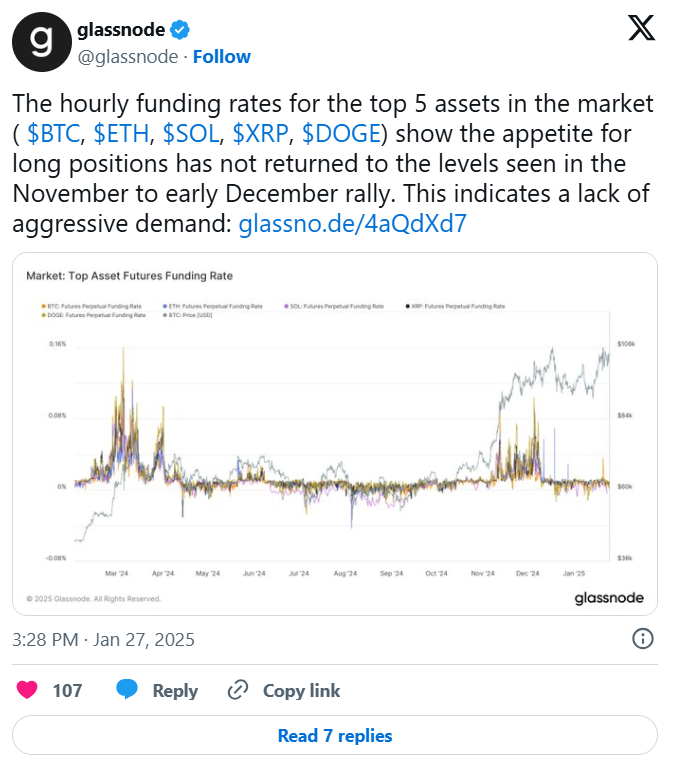

The stagnation seen in the crypto money market in recent weeks reveals that investors’ interest in the market has decreased and has a cautious approach. The latest data of Glassnode, the On-Chain Analysis Platform, shows a significant decrease in the funding rates for Bitcoin (BTC), Ethereum (ETH), Solana (left), XRP and Dogecoin (Dogge), especially leading crypto beings.

Glassnode warned for Dogecoin and four crypto currencies

In a recent analysis on the X platform, Glassnode, the five largest assets on the market, Bitcoin (BTC), Ethereum (ETH), Solana (Left), XRP and Dogecoin (Doge), the hourly funding rates from November to December He stated that he did not return to the levels seen. This shows that there is an aggressive lack of demand in the markets. The funding rates are considered as an important indicator directly connected to market sensitivity.

High funding rates often indicate that investors are optimistic and expect price increases in the future, so the market may be “overheated”. On the other hand, low funding rates often reflect decrease expectations and indicate that prices may fall. Glassnode said that Bitcoin showed a positive momentum, especially at the beginning of last week, according to the 168 -hour moving average funding rates. On the other hand, Solana’s funding rates have been ongoing decrease since December. The lack of aggressive demand for long positions shows that investors may have adopted a cautious attitude, that the market will follow a horizontal course or may experience slight retreats in the coming days.

What’s next?

So, what’s next? The Crypto Money Market is preparing for a critical week with investors waiting for the next meeting of the US Federal Reserve (FED) and significant inflation data. With the Fed’s preparation for the next monetary policy decision at the January meeting on Wednesday, the markets are on the alert for possible impacts. In addition to the FED meeting, the new inflation data to be announced on Friday will be closely monitored.

Crypto money market is currently under sales pressure; Investors realize the profit before the first Federal Open Market Committee (FOMC) meeting of this year. Bitcoin decreased by 3.83 %in the last 24 hours to $ 100.954 in the last 24 hours, while fell to $ 97.715 during the day. Solana’s (left) and Dogecoin (Dogge) prices decreased by 8.46 %and 10.46 %, respectively in the last 24 hours, while losses of up to 6 %in Ethereum (ETH) and XRP.