The cryptocurrency market has been experiencing significant fluctuations lately and several tokens are attracting the attention of investors around the world. In this analysis, we will examine some cryptocurrencies and explore the factors that affect their prices. These coins are making headlines for a variety of reasons, from the recent decision on XRP’s security status to the strategic moves of investors in the PEPE coin and the growth of Optimism’s network. Here are the details…

What’s next for PEPE and these coins?

What does the price prediction for XRP point to?

As we reported on cryptokoin.com, XRP, the Ripple-related token, witnessed a spike in price after a summary judgment declared it not a security. While the token’s price has fallen slightly since then, PricePredictions, a machine learning tool, predicts an uptrend, expecting a gain of around 1.5 percent from its current price of $0.7. Investors are cautiously optimistic and forecasts suggest that XRP could reach $0.71 by August 26, 2023. This resurgence comes after the impressive market trend of XRP, making it the fourth largest cryptocurrency by market cap.

Whale activity rises on Chainlink

Chainlink (LINK) experienced a brief price increase, attracting whale activity and substantial accumulation. However, the daily chart soon turned red and the token’s transaction count and network growth plummeted. Despite this decline, dwindling stock market reserves and supply signals indicate that buying pressure remains high. Investors are keeping a close eye on future growth potential as LINK’s funding rate reflects demand in the derivatives market.

https://twitter.com/santimentfeed/status/1684583144891224064

Interesting developments for PEPE

Meme coin PEPE witnessed a massive listing on Binance earlier this year, sparking a price explosion. However, the token took a dip last week, causing concern among traders. However, on-chain data reveals that a smart money investor made significant moves by removing 677 billion PEPE tokens from the exchange at a purchase price of $0.000001385. This move keeps investors on alert, signaling a potential big move for PEPE in the future. Data from Santiment support the above findings. Most of the big PEPE holders took advantage of the drop in prices to add to their holdings last week. Supply held by over-the-counter addresses diverged sharply from price action.

https://twitter.com/lookonchain/status/1684557347451293696

SHIB continues to perform well

Despite the low volatility of the overall market, the Shiba Inu (SHIB) has managed to maintain its healthy visibility. It achieved a positive LunarCrush ranking. The price action of the token has turned bullish, reaching a high of $0.00000845. Despite a slowdown in activity in the crypto market, SHIB’s investor confidence and network performance remain positive indicators for potential future growth.

https://twitter.com/LunarCrush/status/1685073406557904896

Evaluating the supply distribution of the Shiba Inu also reveals something worth noting. There has been an increase in demand over the past four weeks. Most of the whales are increasing their balances, but the pace of accumulation has slowed in the last two days.

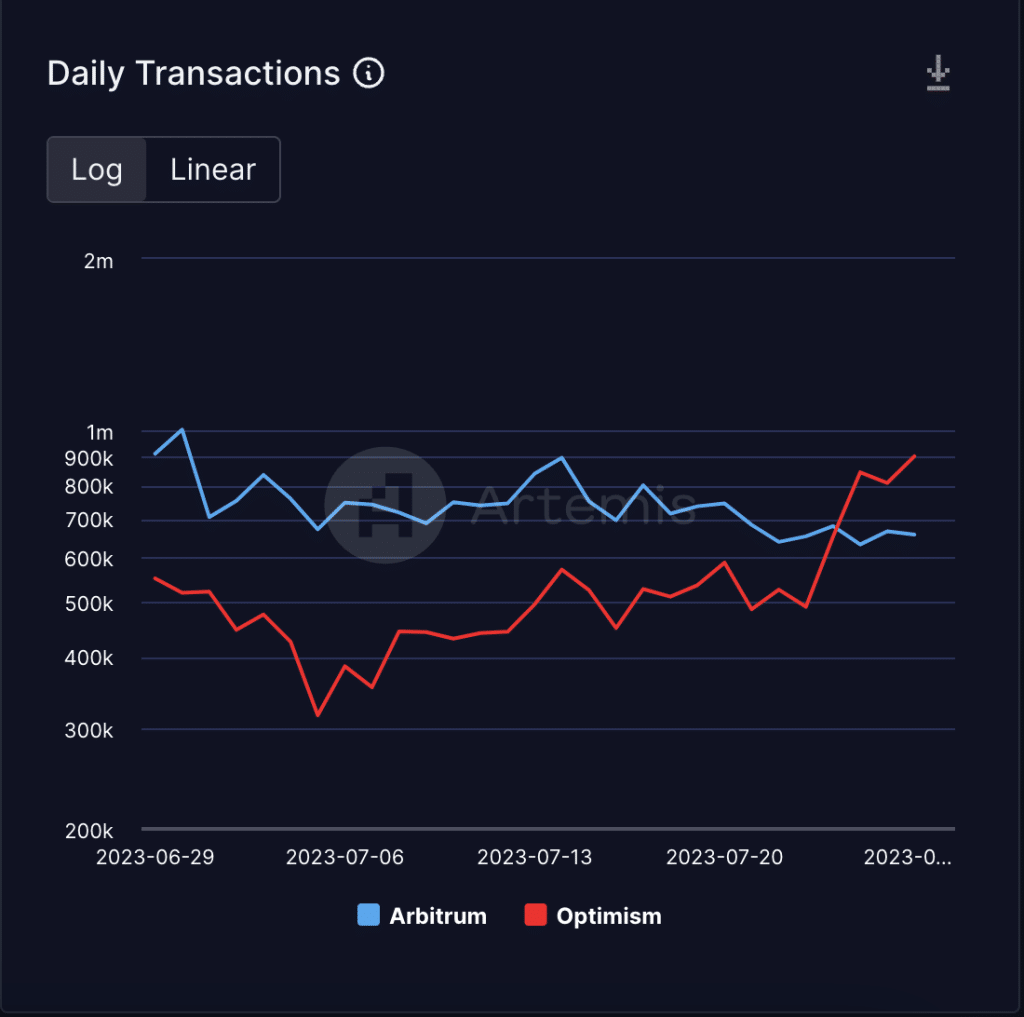

Optimism (OP) TVL has bounce

Optimism (OP) experienced a surge in network activity following the launch of Worldcoin (WLD) on its platform. The move from Polygon to Optimism marks a strategic move to explore new opportunities. On May 11, Worldcoin announced its decision to move the launch of the World App, originally scheduled to run on Polygon Network, to Optimism. Daily trades on Optimism surpassed those on Arbitrum for the first time since January. Moreover, the total value of locked assets (TVL) of the L2 network has increased, attracting the attention of investors. Although the OP token price has experienced a slight drop, the potential of the project continues to attract the attention of the crypto community.

https://twitter.com/worldcoin/status/1656653379903586304

According to data from Artemis, daily active addresses on the blockchain have been climbing since the launch of Worldcoin, with increased activity in Optimism. Since the project went live on OP’s mainnet on July 24, daily active addresses on the blockchain network have increased by 22 percent. The number of unique addresses in Arbitrum has also increased, rising only 2 percent over the same period.

The cryptocurrency market remains highly volatile and subject to a variety of influencing factors. While XRP, LINK, PEPE, SHIB, and OP have shown impressive performances from different angles, it is essential to approach these estimates with caution. The global crypto landscape is constantly evolving, and investors should conduct extensive research and consult reliable sources before making investment decisions. Due to the unpredictability of the market, it is always wise to be cautious and apply risk management when trading cryptocurrencies.