Closely followed economist Özgür Demirtaş included cryptocurrencies in his last tweet. He said that the US dollar, which has lost its reserve currency position, will be replaced by a “decentralized currency”.

Özgür Demirtaş says that a decentralized currency will be used in the future

Famous economist Özgür Demirtaş writes that the US dollar may lose its reserve currency status in the long run. The US dollar, a global currency, was hit hard by inflation in the country. “The US dollar is going to die,” finance writer Robert Kiyosaki said last week. Trillions of US dollars are returning to the country. Inflation has peaked,” he wrote.

According to Özgür Demirtaş, when the US dollar loses its reserve currency status, it will not be replaced by the currency of a country ruled by dictators. Instead, the famous economist’s heart was “an ownerless and decentralized currency.”

https://twitter.com/ProfDemirtas/status/1681390403583455232

In his explanations above, Demirtaş implicitly talks about Bitcoin. Unlike fiat currencies, Bitcoin (BTC) is not under the control of an authority such as the Central Bank. Although Demirtaş envisions a decentralized future, he says it will take a very, very long time, not weeks.

Özgür Demirtaş is not alone

Robert Kiyosaki, the author of the bestselling “Rich Dad Poor Dad”, has long been saying that the dollar would collapse. In his recent statements, he said that the first development that will hit the US dollar will be the BRICS meeting of 22 August. On this date, members of the BRICS alliance Brazil, Russia, India, China and South Africa will set a new gold standard. According to Kiyosaki, this development will especially hurt the US dollar. BRICS members are preparing a new currency that they can use among themselves instead of the US dollar.

https://twitter.com/theRealKiyosaki/status/1678652054951317504

Simon Hunt, founder of Simon Hunt Strategic Services, comments on the impact of his meeting as follows:

BRICS’s involvement has been a deliberate, slow move… I think they are now in a position to take the next step. A very serious attack on the dollar world that has existed since World War II…

Bitcoin, the most preferred digital asset

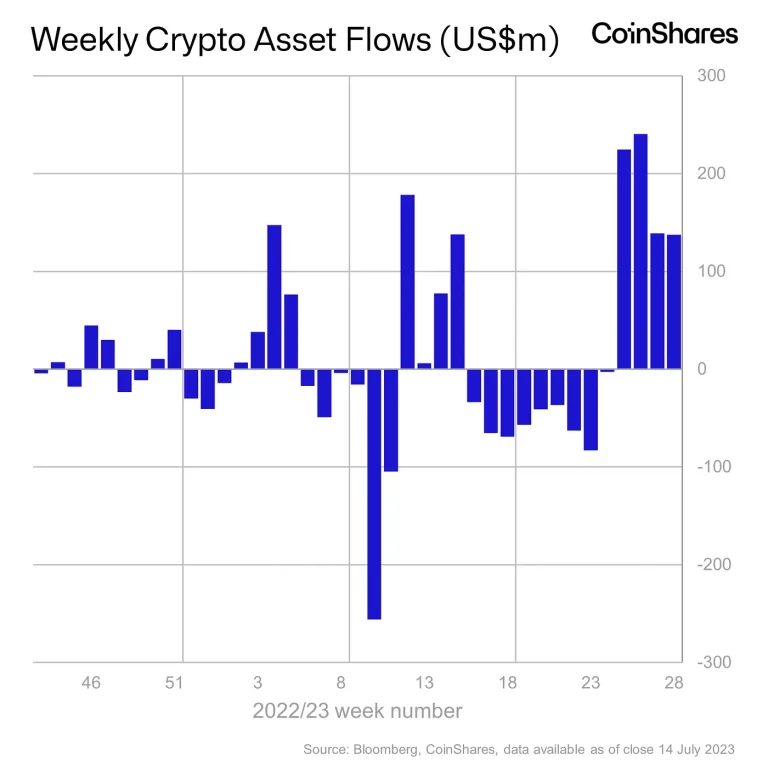

According to CoinShares’ fund flow report, inflows into digital asset investment products totaled $137 million last week. The report also found that entries reached $742 million for the fourth week in a row. As we quoted as Kriptokoin.com, ETH was among the names that saw the exit.

According to the digital asset investment firm, the total inflows recorded last month in particular represent the largest inflows since the last quarter of 2021.

Investor sentiment supports leading cryptocurrency

Also, for the fourth consecutive week, investors are “focusing on Bitcoin,” according to CoinShares. In particular, it recorded the largest inflows of cryptocurrencies, totaling $140 million last week. This accounted for 99% of the total entries registered at that time. Meanwhile, BTC fell from its two-month high of $31,693 on July 13. During this period, he saw his inflows increase by 5%.