NYDIG, one of the leading companies in the crypto money industry, conducted a research on the spot Bitcoin ETF fund. NYDIG has determined that if the spot funds are approved, there will be $30 billion in BTC demand.

Spot Bitcoin ETF applications, which the SEC has long rejected, have recently come to the fore again. The application of the world’s largest asset manager BlackRock to the SEC caught everyone’s attention. NYDIG commented that if known companies list BTC funds in its report, confidence in cryptocurrencies will increase.

Similarity Between Bitcoin and Gold

Researchers compared Bitcoin, which crypto fans describe as “digital gold,” with the precious metal. Wanting to measure the demand for a possible ETF, NYDIG made an analysis on asset distribution and volatility.

According to the report, Bitcoin’s volatility level is 3.6 times higher than gold. This means that an investor who wants equal risk exposure will demand 3.6 times less Bitcoin compared to gold. Despite this data, NYDIG expects an additional demand of 30 billion dollars, since the awareness of cryptocurrencies is not as much as gold.

Gold ETFs, which found their place in the market in the early 2000s, are of great importance. Investors, who were difficult to reach precious metals, had the opportunity to trade gold with mutual funds. Experts expect similar demand if spot Bitcoin funds are listed.

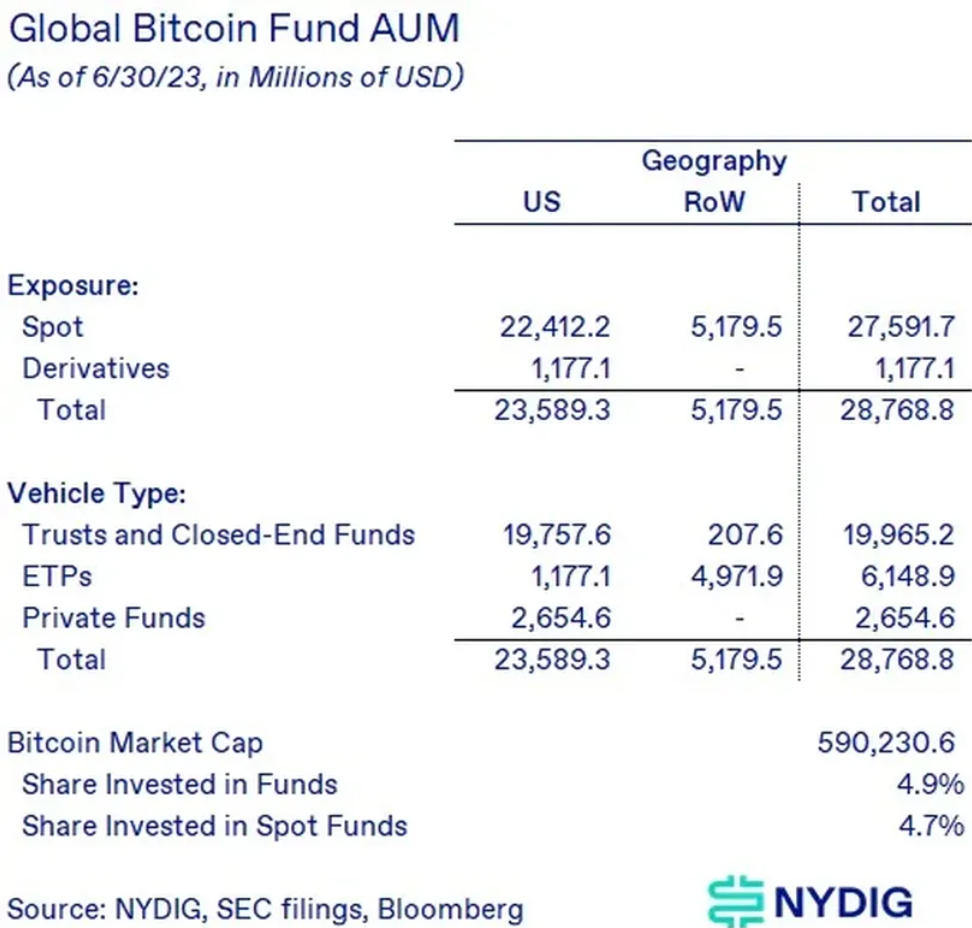

NYDIG, the leading company in the crypto money industry, has a large amount of BTC. NYDIG owns $28.8 billion worth of Bitcoin as of the end of June.