The gold price continued to fluctuate within its three-week range as investors refrain from taking large positions ahead of next week’s highly anticipated macroeconomic events. May US Consumer Price Index (CPI) data to be released on Tuesday and the US Federal Reserve’s (Fed) policy statements on Wednesday could help XAU/USD find its next direction. So what’s next for gold and Bitcoin?

What happened this week?

Gold fell below $1,950 earlier in the week as investors continue to digest the impressive May jobs report from the US and nonfarm payrolls increased by 339,000, beating market expectations of 190,000 by a large margin. However, in the second half of the day, the US Dollar (USD) came under selling pressure after the ISM Services PMI survey revealed a loss of momentum in service sector activities. In addition, the Price Paid Index fell from 59.6 to 56.2, while the Employment Index fell from 50.8 to 49.2, indicating a softer input inflation and a decline in the sector’s payrolls. Negative data helped XAU/USD gain value again and gold closed the day in positive territory.

In the absence of data releases, the gold price traded in a very narrow range on Tuesday before turning south on Wednesday. The Bank of Canada (BoC) unexpectedly raised the policy rate by 25 basis points to 4.75%, triggering a rally in global bond yields. The benchmark 10-year U.S. Treasury bond yield rose nearly 4% in the middle of the week, while the inversely correlated XAU/USD fell below $1,950 once again.

After the quiet European session on Thursday, Gold price gained bullish momentum and moved towards $1,970. Initial Jobless Claims in the US rose to 261,000 from 233,000 a week ago in the week ended June 3, emphasizing looser labor market conditions and the dovish Fed pulled its bets. Signs of rising unemployment levels mean a reduction in the labor gap, a key factor behind recent wage increases fueling inflation, particularly in the services sector. Trading stagnated ahead of the weekend, with XAU/USD moving up and down in a narrow channel around $1,960 on Friday.

What will happen next week?

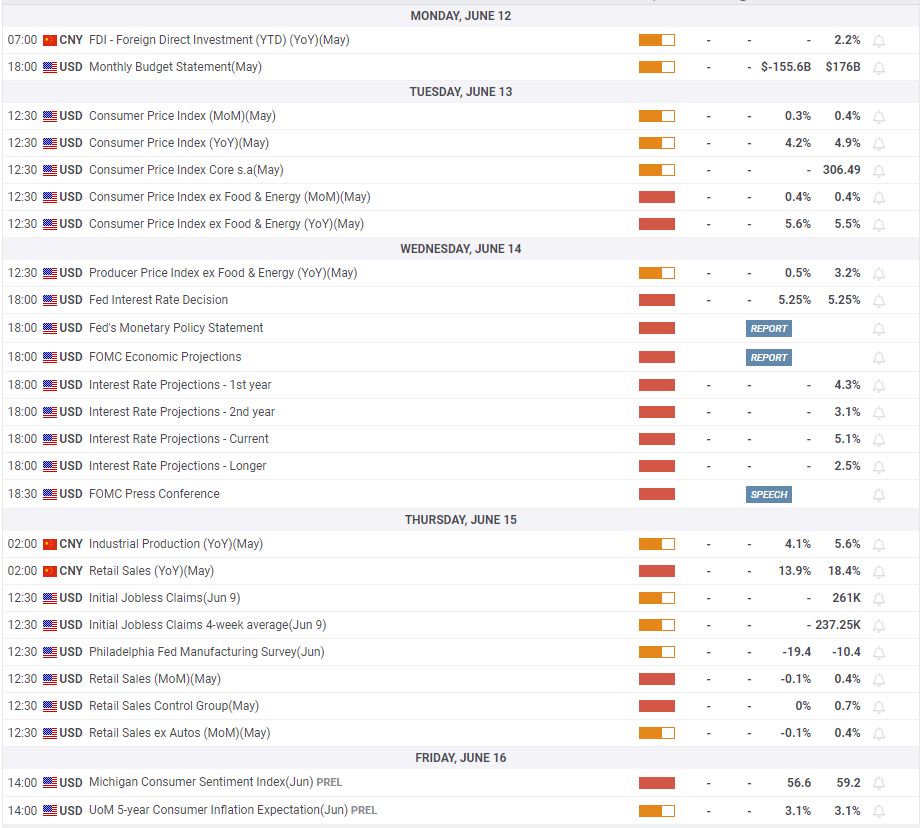

In the US, the Consumer Price Index (CPI) is expected to decrease by 4.2% year-on-year in May, compared to the 4.9% increase recorded in April. Core CPI, which excludes volatile food and energy prices, increased by 5.6% in the same period, following a monthly increase of 0.4%. Markets are likely to react to the monthly Core CPI figure, as it has not been distorted by the base effect from energy prices. More importantly, the Fed is most concerned about inflation in core services excluding housing, and that measure has yet to soften significantly.

The current market position indicates that a substantial increase in the Core CPI will be required for investors to change their minds about the Fed not changing the policy rate on Wednesday. Since January 2022, the monthly Core CPI has increased by 0.6% three times, with the last in September 2022. A bounce of 0.6 or higher could open the door for another 25 basis point Fed increase, triggering a rally in the USD and putting heavy pressure on XAU/USD. On the other hand, a smaller-than-anticipated increase should confirm a pause in the Fed’s tightening cycle and help the Gold price rise.

It is difficult to assess the potential impact of the Fed’s interest rate decision on the price of gold without seeing how May inflation data will affect market pricing. At this point, the CME Group FedWatch Tool indicates that the markets have a greater than 75% probability of keeping the Fed’s policy rate constant in the 5-5.25% range. In the absence of a change in interest rates in inflation data, an increase of 25 basis points will come as a surprise and will support USD and US bond yields, leading to a sharp decline in XAU/USD. On the other hand, despite the strong CPI figures in May, the gold price seems likely to rise if the Fed does not touch the interest rates.

For gold, this development could lead to a rise

In the March Projection Summary (SEP), called the Fed’s dot chart, the public opinion on the policy rate at the end of 2023 was 5.1%. If the Fed keeps the policy rate unchanged but revises the final projection rate higher, it will show that policymakers are not done with the rate hikes and will make it difficult for the gold price to rise. An unchanged final interest rate forecast will have the opposite effect and cause XAU/USD to rise.

Market participants will also closely follow FOMC Chairman Jerome Powell’s comments on the policy outlook. After the May meeting, Powell reiterated that it would not be appropriate to cut the policy rate this year, explaining that it is difficult to predict how much credit tightening will replace the need for further rate hikes. If Powell continues to defy rate cut expectations, the USD could remain resilient and limit XAU/USD’s potential gains. Similarly, any statement that the credit tightening is not as severe as initially expected should have a positive impact on the USD’s valuation.

On the other hand, if Powell opens the door to the possibility of a rate cut in late 2023 or early 2024, the gold price is likely to turn higher. Still, increased volatility in financial markets during Fed activity will make it more difficult to determine the next direction of XAU/USD. Therefore, it may be wise to wait for the situation to calm down before taking a position.

How is Bitcoin affected?

In addition to gold, the price movement in Bitcoin is also curious. If gold goes up, BTC could go up as well, as BTC is currently highly correlated with gold. However, the recent regulatory pressure of Bitcoin and altcoins has been plaguing investors. Because the SEC has labeled many altcoins as securities, it has lowered the price of many of them. In the upcoming period, the movements of the SEC will be watched with interest rather than the macroeconomic developments.

Gold technical view

According to analyst Eren Şengezer, the gold price has been moving between the 50-day and 100-day Simple Moving Averages (SMA) since mid-May, reflecting the indecision of the yellow metal. Also, the Relative Strength Index (RSI) indicator on the daily chart fluctuates around 50, emphasizing the neutral stance. On the upside, $1,990 (50-day SMA) is aligned as the first hurdle. With a daily close above this level, XAU/USD could face resistance at $2,000 (psychological level, static level) before targeting $2,025 (static level).

$1,950/$1,945 (23.6% Fibonacci retracement of the last uptrend, 100-day SMA) is forming significant support. If the gold price drops below this zone and starts using it as resistance, sellers may show interest. It could open the door for a long decline towards $1,925 (static level) and $1,900 (Fibonacci 38.2% retracement, psychological level).

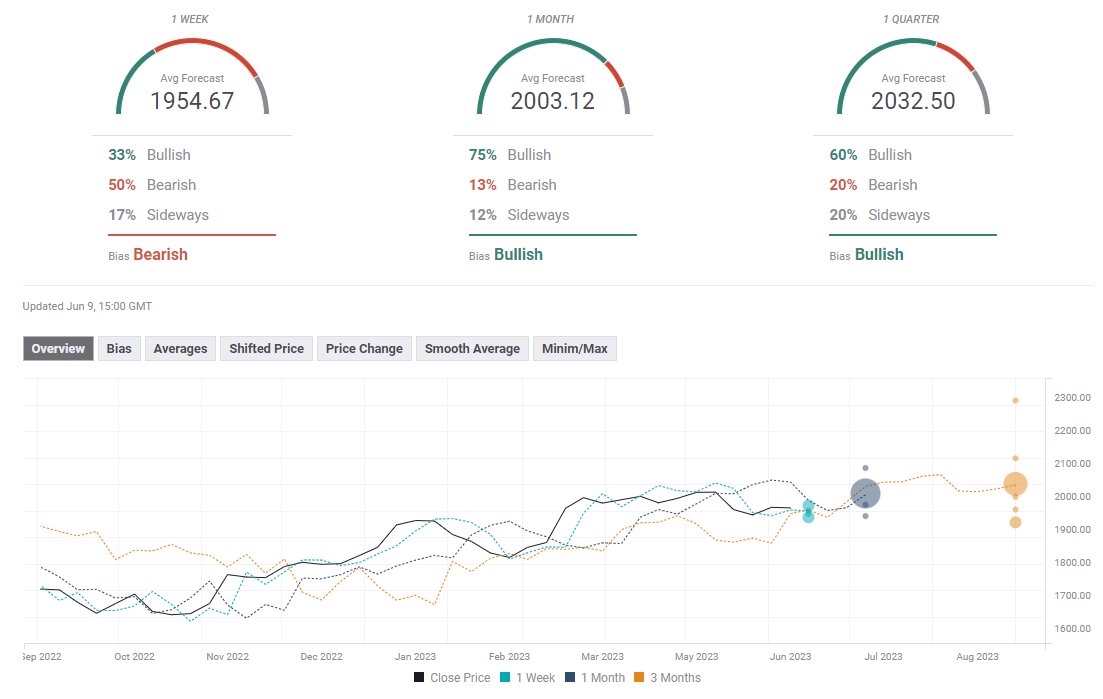

gold forecast survey

While the FXStreet Forecast Survey highlights the bullish trend in the one-month outlook, the majority of experts expect XAU/USD to rise to at least $2,000 in this timeframe.