Bitcoin and Ethereum are trading in the oversold zone after losing more than 10% in the last three days.

Current buy signals for Bitcoin and Ethereum

You can take a look at the accurate predictions of The Tom DeMark (TD), an accurate indicator with more than 25 signals, here. Bitcoin and Ethereum started this week on a negative stance. However, momentum is poised for a significant recovery, according to the indicator.

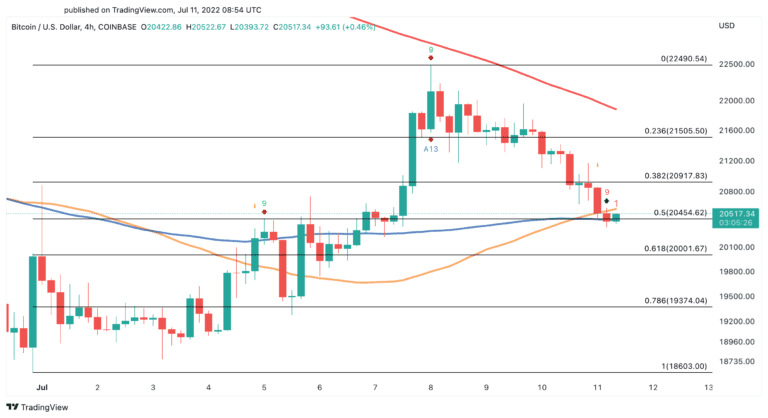

Bitcoin price analysis

The leading cryptocurrency faced the 200-hour MA barrier on the four-hour chart. It later saw around 10% correction from this region. It was trading at $22,490 on July 8 and dropped to $20,350 early Monday morning. Bitcoin’s 100 hourly MA is now acting as a stable support that could prevent it from falling any further.

The formation of the buy signal according to The Tom DeMark (TD) Sequential indicator supports this optimistic view. The bullish pattern developed as a red nine candlestick, which is an indicator of one to four candlestick bullishness. If bitcoin can hold above $20,450, it could gain strength to bounce back to $20,900 or even $21,500.

The indicator pointed to these levels for Ethereum

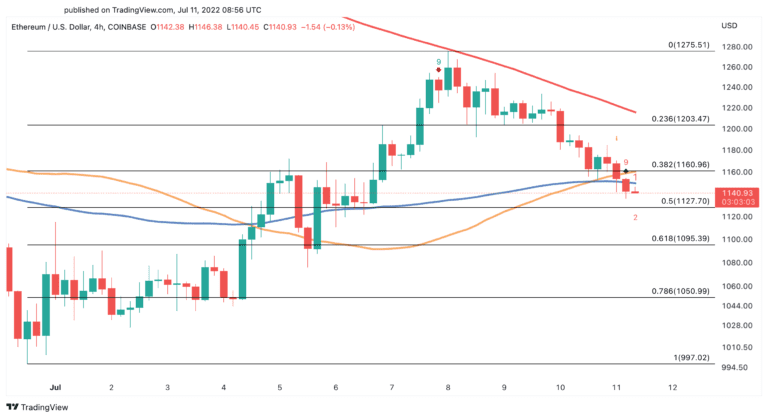

Similarly, Ethereum is in the oversold region after experiencing an 11% correction over the same period. The second-largest cryptocurrency by market cap has seen its price drop from $1,275 to $1,135 in the past three days. However, like Bitcoin, there are some signs that a recovery is underway.

TD Sequential has also given a buy signal in the form of red nine candles on the four-hour chart of ETH. A sustained candlestick above $1,160 is helping to confirm this bullish formation. If this happens, Ethereum will rise to its 200 hourly moving average at around $1,200.

The odds are currently supporting the bulls. However, trading volumes continue to drop. Meanwhile, we have to watch Bitcoin and Ethereum price closely. BTC’s breach of the $20,450 support level threatens the leading crypto at $20,000 or $19,375. Meanwhile, if ETH loses $1,127 as support, the bears will target $1,050.

What levels are analysts expecting in Bitcoin and Ethereum?

According to FXStreet analyst Akash Girimath, while BTC is trading in the demand zone of 19,284 -20,726, the bulls could press for $25,000. For this to happen, Bitcoin price must exceed $22,629. $1,284 will be critical for Ethereum. Breaking this level will open the way for a retest of $1,543 and $1,697. As we covered in the cryptokoin.com analysis, BTC and ETH are trading below these levels at the time of writing.