Miners seem to be taking action for the popular altcoin project Litecoin (LTC). The coin has lost 15% as miners sell the LTCs they have mined. Here are the details…

Miner sales begin for altcoin project LTC

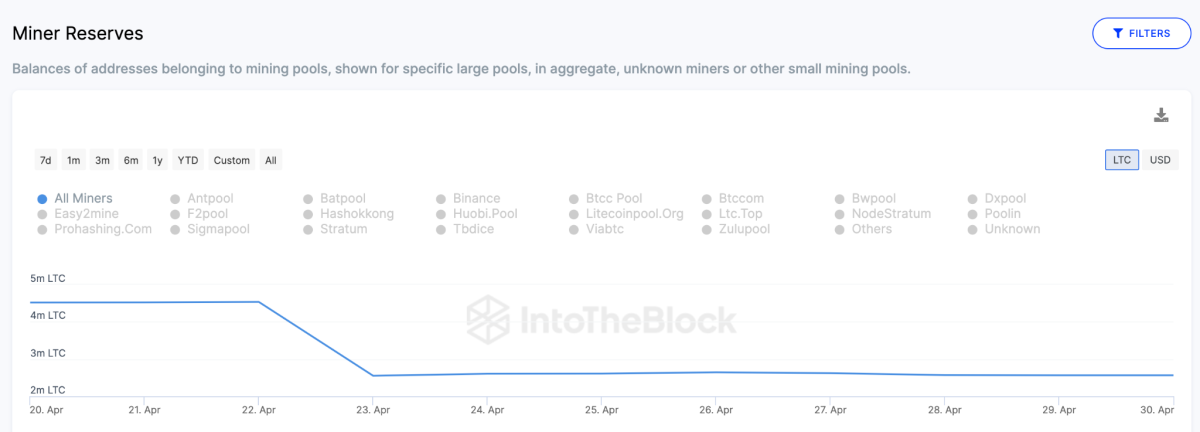

Litecoin (LTC) price is down 14 percent from the last high of $101 recorded on April 18. The miner sale has sparked bearish concerns in the Litecoin ecosystem. As the Litecoin (LTC) community started the 100-day countdown to the next halving event, bullish speculators were expecting an accumulation trend among miners. But instead, on-chain data currently paints the opposite picture. Onchain data compiled by IntoTheBlock shows that Litecoin miners significantly depleted their reserves in a shocking move at the end of April.

As of May 1, the reserves of LTC miners stood at 2.56 million coins. However, the chart below shows how miners reduced their balance from 4.53 million LTC to 2.55 million LTC from April 22 to 23. Miner reserves refer to the amount of cryptocurrencies that miners hold and have not yet sold. Investors often interpret the sharp drop in miner reserves as a bearish signal because it indicates that miners are selling more of their block rewards.

At current market prices of $88, the coins disposed by miners are worth approximately $174 million. If the demand for LTC fails to keep up with the increasing market supply of miners, owners can expect an impending price drop. Interestingly, Litecoin whales holding between 1,000 and 100,000 coins seem to be taking a hawkish position as miners flock to the market. The chart below shows how whales started selling as miners flocked to the market on April 23. Between April 23 and April 28, they reduced their balance by 340,000 coins, worth approximately $30 million, based on the current market capitalization of $88.

How is LTC coping with selling pressure?

Whales are big investors and usually hold at least $100,000 worth of assets in a crypto. Because of their enormous financial power, their buying/selling patterns can significantly affect the price of an asset. As of May 1, the whales, as mentioned above, have not made any significant moves. Instead, they kept their balance close to 22.37 million LTC over the last 5 trading days. In a nutshell, investors can expect the LTC price to drop in the coming days unless whales move to buy some of the excess supply exported by miners.

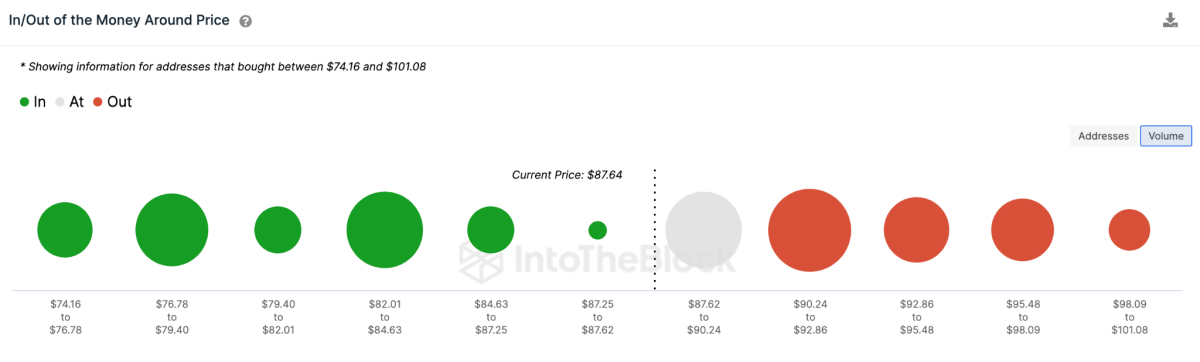

Looking at the Global Money In/Out data around Price, Litecoin price seems likely to drop below $80. Although a cluster of 116,000 wallets holding 370 million could offer significant support around $83. However, if the bearish outlook turns out to be as expected, LTC price could decline until it reaches a more important support level at $77.

Still, if the bulls push LTC price above $90, they could invalidate this bearish discourse. But first, they will have to overcome potential selling pressure from 255,000 addresses holding 3.7 million Litecoins. If they successfully break the $90 resistance, LTC holders can expect a price rally towards the recent local top of $101.

LTC-20 NFT standard introduced

Looking at other news, the Litecoin community decided to propose a test standard for the LTC-20 and then launched a test token for this purpose. They came up with a fork from the standard, the BRC-20 standard. The community describes it as “a fun experimental standard”. The standard is being developed on Litecoin Ordinals Protocols, which has a supply of 84 million. On Twitter, Litecoin Punks stated that the first LTC-20 was minted by about 20 percent. 4,000 were issued for each of the punk owners.